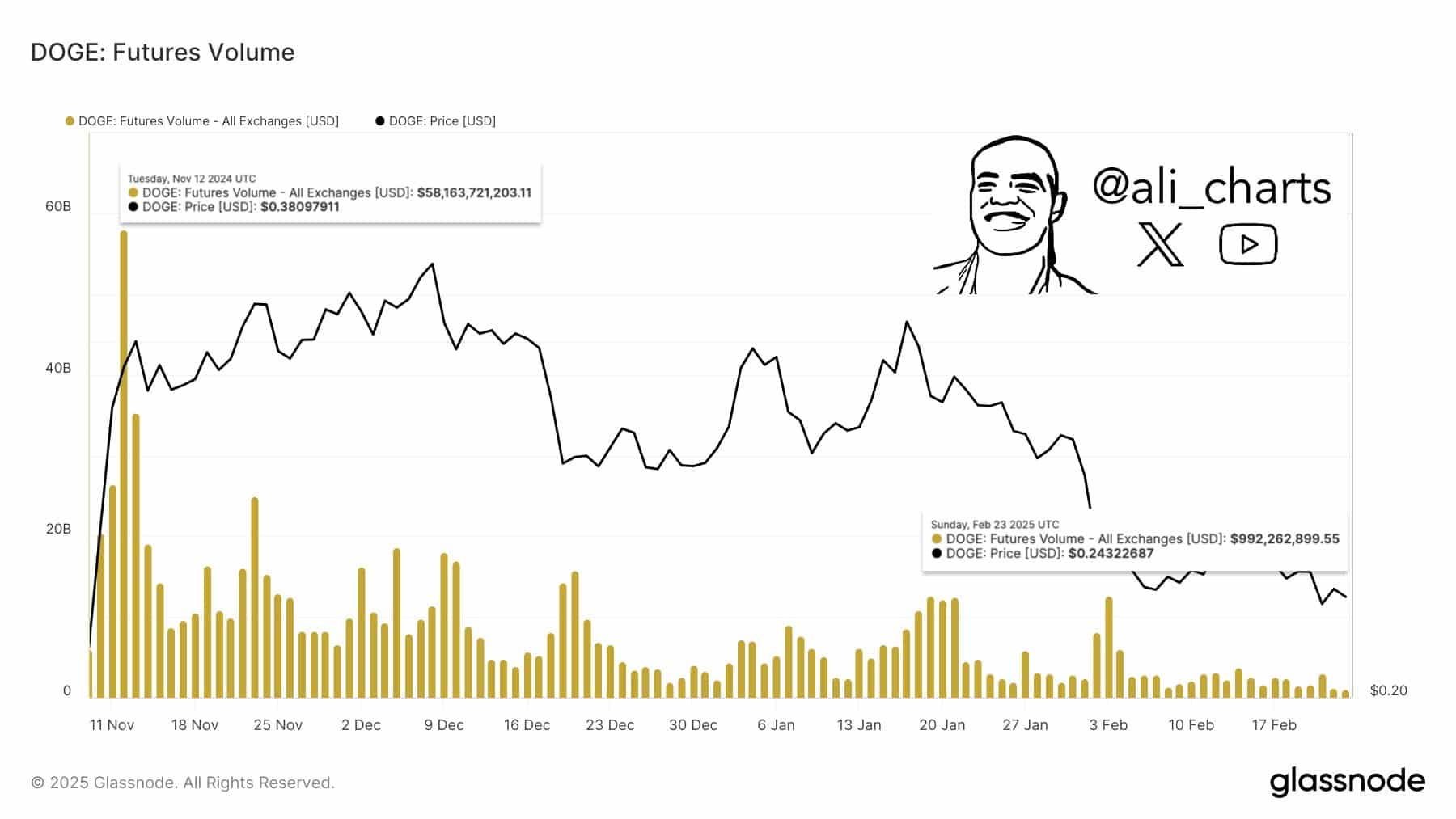

- DOGE’s long -term trading volume increased from $ 58.2 billion in November to only $ 992 million.

- The activity of the Dogecoin network has decreased considerably despite the bull signals of the action of DOGE prices.

DOGECOIN (DOGE) The long -term market has experienced a contraction in the volume of negotiation in recent months, the figures of a summit of $ 58.2 billion in November to a modest $ 992 million. This sharp decline confirmed a significant reduction in market speculation.

From mid-November, the volume culminated impressively, coinciding with a price of $ 0.308, suggesting a frenzy of commercial activity.

However, the following weeks saw a gradual but persistent drop in volumes, indicating a cooling of the interest and the momentum of investors.

In December and in the new year, daily time volumes have constantly oscillated below $ 5 billion, which was the decrease in previous heights.

This downward trend in the term volume could imply a decrease in confidence or a speculative interest in DOGE. This may be due to broader conditions or a decrease in yields of speculative trades.

If this trend continues, Dogecoin could potentially see new price reductions. Conversely, a volume resurgence could indicate a renewed interest and potentially strengthen prices, signaling a recovery.

Will the activity of the DOGE network decrease, but will the price follow?

As the volume fell, the creation of new addresses which went from a peak of 1.29 million new addresses in November to only 30,815 as recently as Ali noted on x. This change indicated a significant reduction in network activity.

In November, the wave of new addresses of addresses coincided with higher Doge prices. However, the following months show a sharp drop in new addresses and the Doge price, which has dropped accordingly.

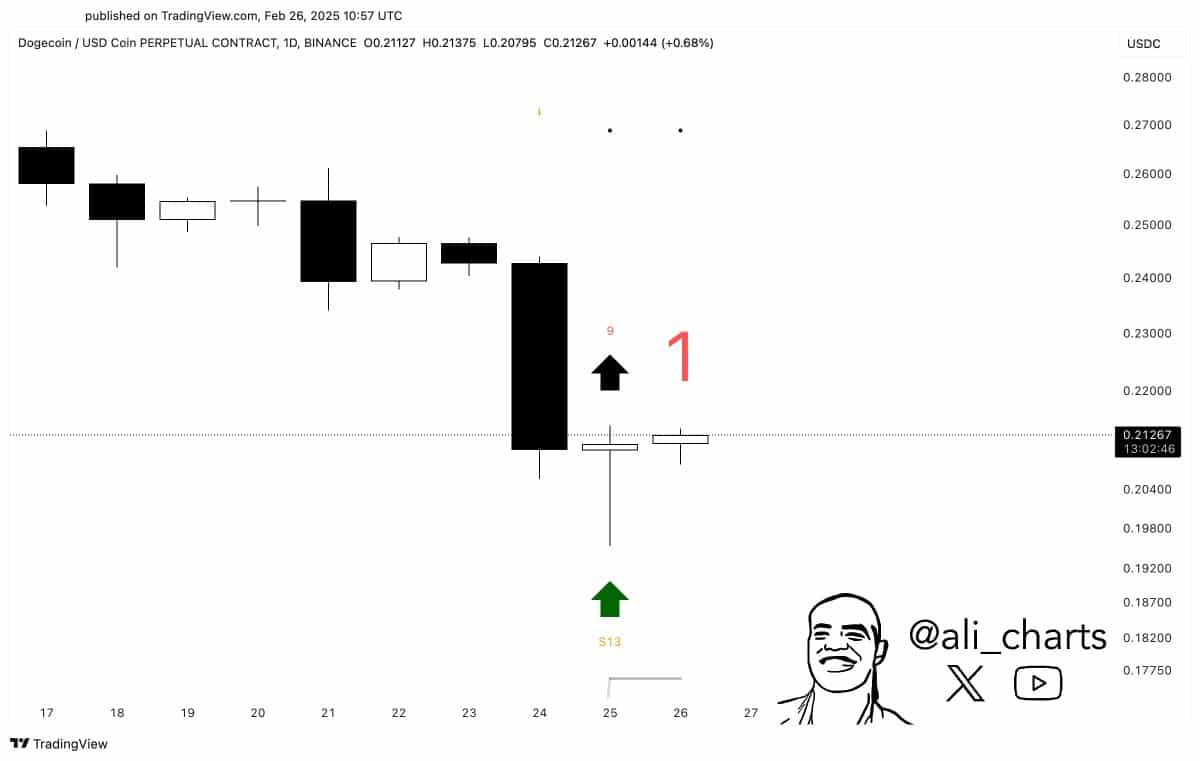

After these drops, another drop is expected in price, but there is a potential turning point for Dogecoin. The TD sequential indicator has flashed a purchase signal.

This signal suggests that the current downward trend could conclude, preparing the ground for a possible rebound. Currently, DOGE stabilizes around $ 0.21267.

This stabilization, associated with the indicator signal, suggests that buyers can regain control, which has potentially conducted the price increased if the bullish momentum comes into play.

Historically, such signals have often been followed by price increases, in particular with the feeling of market support. If the market does not support this signal, Doge could continue the recent downward trend.

If DOGE maintains a support greater than 0.21267 and bursts current levels, it could reach higher resistances and review higher price levels.

Conversely, a failure to maintain the support could lead to new decreases, the prices being possibly lowered below recent stockings and testing lower support limits.