- Shiba Inu price is hovering around $0.000021 on Tuesday after retesting and bouncing off key support from the previous day.

- Secondary investors looking to accumulate SHIB can do so in the range of $0.000019 to $0.000021.

- A daily candlestick closing below $0.000019 would invalidate the bullish thesis.

Shiba Inu (SHIB) price is hovering around $0.000021 on Tuesday after retesting and bouncing off key support from the previous day. Secondary investors looking to accumulate SHIB can do so at support levels ranging from $0.000019 to $0.000021.

Shiba Inu price shows promise for recovery

Shiba Inu price declined to retest its daily support level at $0.000019 on Monday. This support level coincides with its 61.8% Fibonacci retracement (taken from the August 5 low of $0.000010 to the December 8 high of $0.000033), making it a reversal zone key. At the time of writing on Tuesday, it is trading slightly higher, above its 200-day exponential moving average (EMA) at $0.000021.

Secondary investors looking to accumulate SHIB tokens can do so around $0.000019.

If the $0.000019 level remains as support and SHIB closes above the weekly resistance at $0.000022, it could extend the rally to retest its next weekly resistance at $0.000028.

The Relative Strength Index (RSI) reads 44 on the daily chart, below its neutral level of 50, indicating slight bearish momentum. However, the Moving Average Convergence Divergence (MACD) indicator is flattening around its neutral level of zero, suggesting indecision among traders.

SHIB/INU USDT daily chart

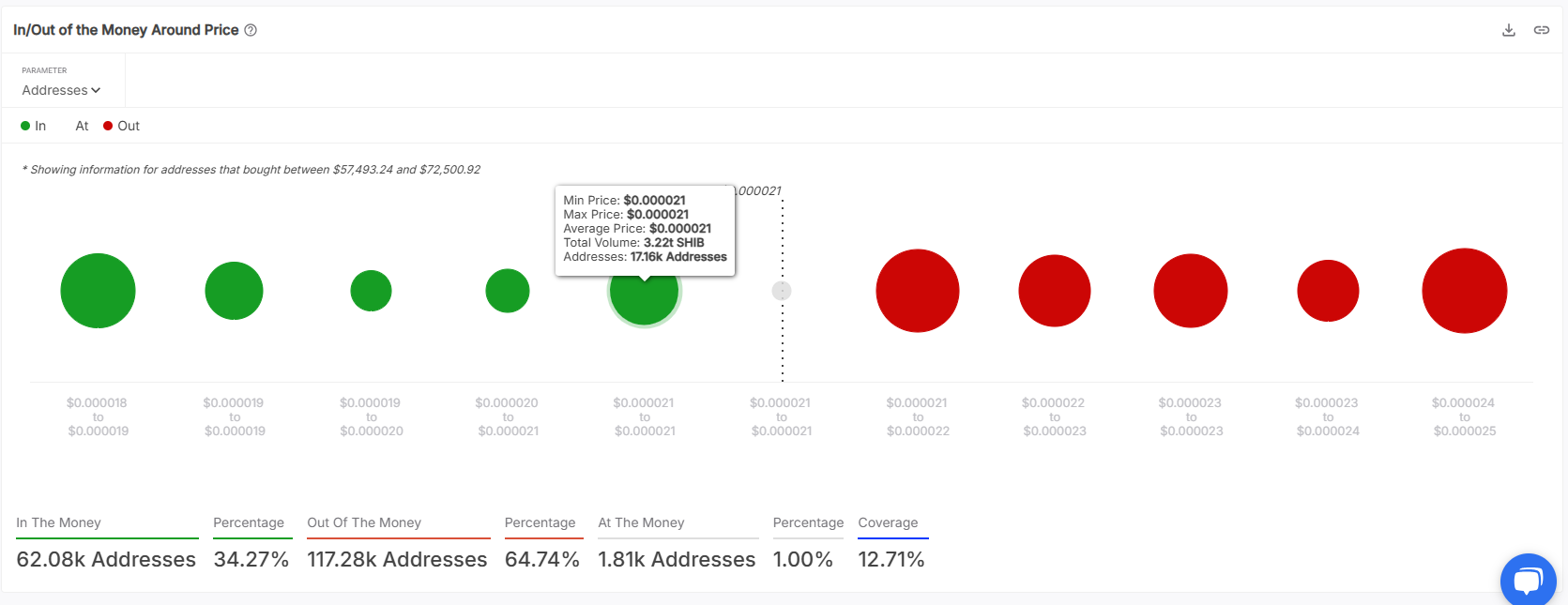

However, on-chain data indicates a bullish outlook for Shiba Inu price. According to IntoTheBlock’s In/Out of the Money Map (IOMAP), approximately 17,160 addresses purchased 3.22 trillion SHIB tokens at an average price of $0.000021. If the price falls to this level, many investors could strengthen their positions further, making it a key reversal level to watch.

From a technical analysis perspective, the support level at $0.000019 to $0.000021 aligns with the IOMAP results, marking this area as a crucial reversal point to watch.

SHIB IOMAP card. Source: In the block

According to Coinglass OI-weighted funding rate data, more traders are betting on a rise in the price of SHIB than those anticipating a fall in price.

This index is based on futures contract returns, which are weighted by their open interest rate. prices. Generally, a positive rate (long positions pay short positions) indicates bullish sentiment, while negative numbers (short positions pay long positions) indicate bearish sentiment.

In the case of SHIB, this measure amounts to 0.0103%, reflecting a positive rate. This scenario often signifies bullish sentiment in the market, suggesting potential upward pressure on the Shiba Inu price.

SHIB OI Weighted Financing Rate Table. Source: Coinglass

Even though on-chain metrics support the uptrend outlookIf Shiba Inu closes below $0.000019 on the daily chart, the bullish thesis would be invalidated by creating a lower low. This development could see SHIB price fall by another 15% to retest its November 3 low of $0.000016.