The most recent collapse of the prices in Dogecoin (DOGE) has seen whales loaded massively with their bags before which could happen.

In a tweet today, Market Watcher Ali Martinez disclosed That the whales took advantage of the recent drop and bought 750 million Doge tokens. He stressed that this decision is a clear indication of strong confidence in the market.

Whales pick up the dip

For the context, Tuesday, the price of Mastiff Tuncoted at $ 0.2017, dangerously getting closer to losing the psychological level of $ 0.2, which he has exchanged above November 2024.

In particular, this downward trend started three weeks ago when Dogecoin reached a new summit in 2025 of $ 0.4335. He continued with coherent lower stockings until the trend gets worse on February 4.

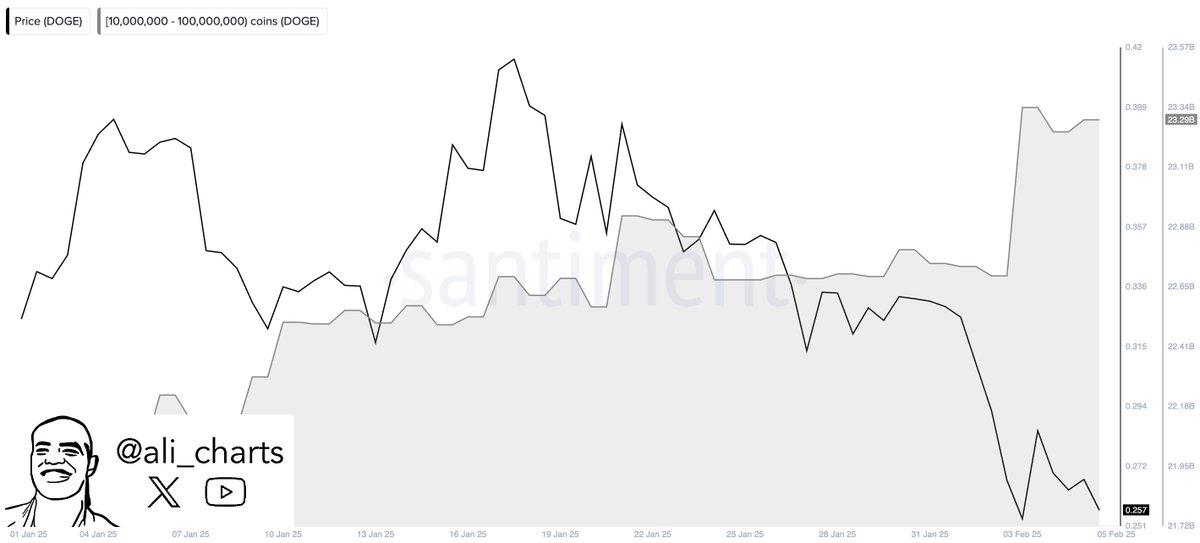

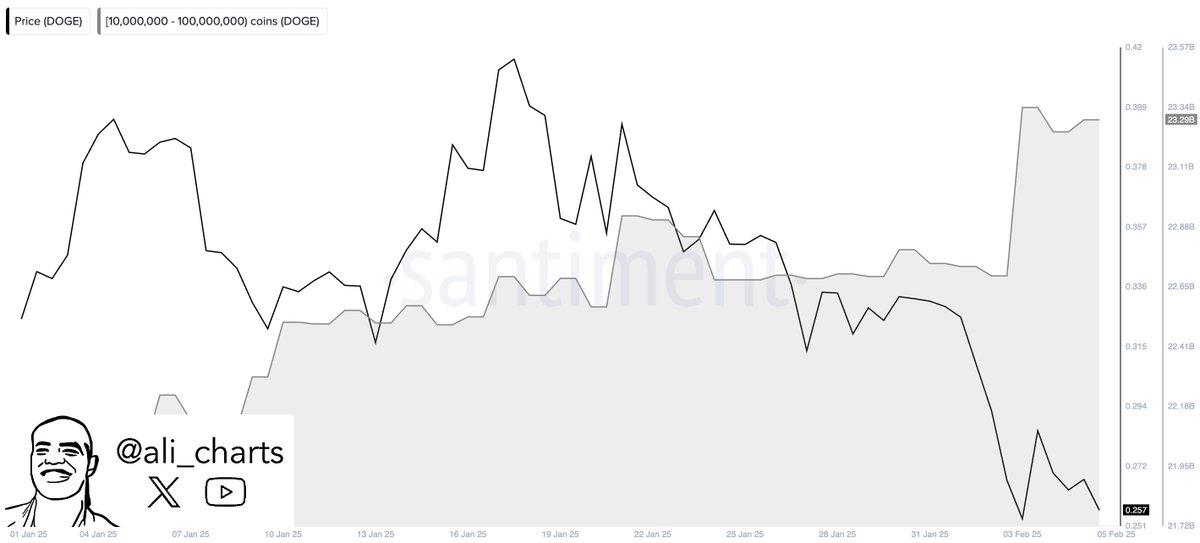

Meanwhile, whales holding between 10 million and 100 million Doges increased their assets. More specifically, their portfolios increased from around 22.5 billion to 23.34 billion Doge, adding around 750 million tokens.

This accumulation took place in a single day, immediately after Dogecoin retests the hollows of $ 0.2 on February 4. Essentially, whales saw the drop to $ 0.2 as an ideal entry point, positioning itself for the next major rebound.

The immediate impact of the purchase pressure has seen Dogecoin bounce briefly at $ 0.2885 on the same day before the retracement.

Remember that the Dogine whales of higher level, those holding 100 to 1 billion tokens, had liquid 270 million tokens two days before the landslide accident. Their perfectly timed outing went well because they sold Dogecoin when it was negotiated in the range of $ 0.3.

Now they buy back around $ 0.2, which suggests that a trend reversal could be imminent.

Doge always selling

Meanwhile, at the time of the press, Dogecoin has not yet completely recovered from Tuesday’s decline. At $ 0.2597, Dogecoin sells for a 22% discount compared to the highest threshold he reached last week. In addition, the current price reflects a larger discount of 33% compared to its monthly summit.

How long will Dogecoin rebound?

While Martinez is convinced that the accumulation of whales implies confidence in a turnaround, he did not offer any overview of the place where Dogecoin could target in the short term.

Meanwhile, the abbot case analyst suggested that the current model looked very much like 2014, where a big accident was followed by a few weeks of consolidation.

He suggested that the current service scheme could last a few weeks before a parabolic rally, where Mastiff could pump 300% on a window of 4 to 6 weeks, as we saw at the end of last year.

“I think this time, it will not be different,” he said.

Difles: This content is informative and should not be considered financial advice. The opinions expressed in this article may include the author’s personal opinions and do not reflect the basic opinion of cryptography. Readers are encouraged to do in -depth research before making investment decisions. The Crypto Basic is not responsible for financial losses.