Even Dogwifhat Coin (WIF), based in Solana, experienced a net slowdown in last week. He lost 33% of his value during this period and is currently negotiating at a hollow of February 2024.

The chain and technical indicators confirm that the weakening of the request for money of the same, which suggests that its decline could continue in the short term.

Application signals declining wif

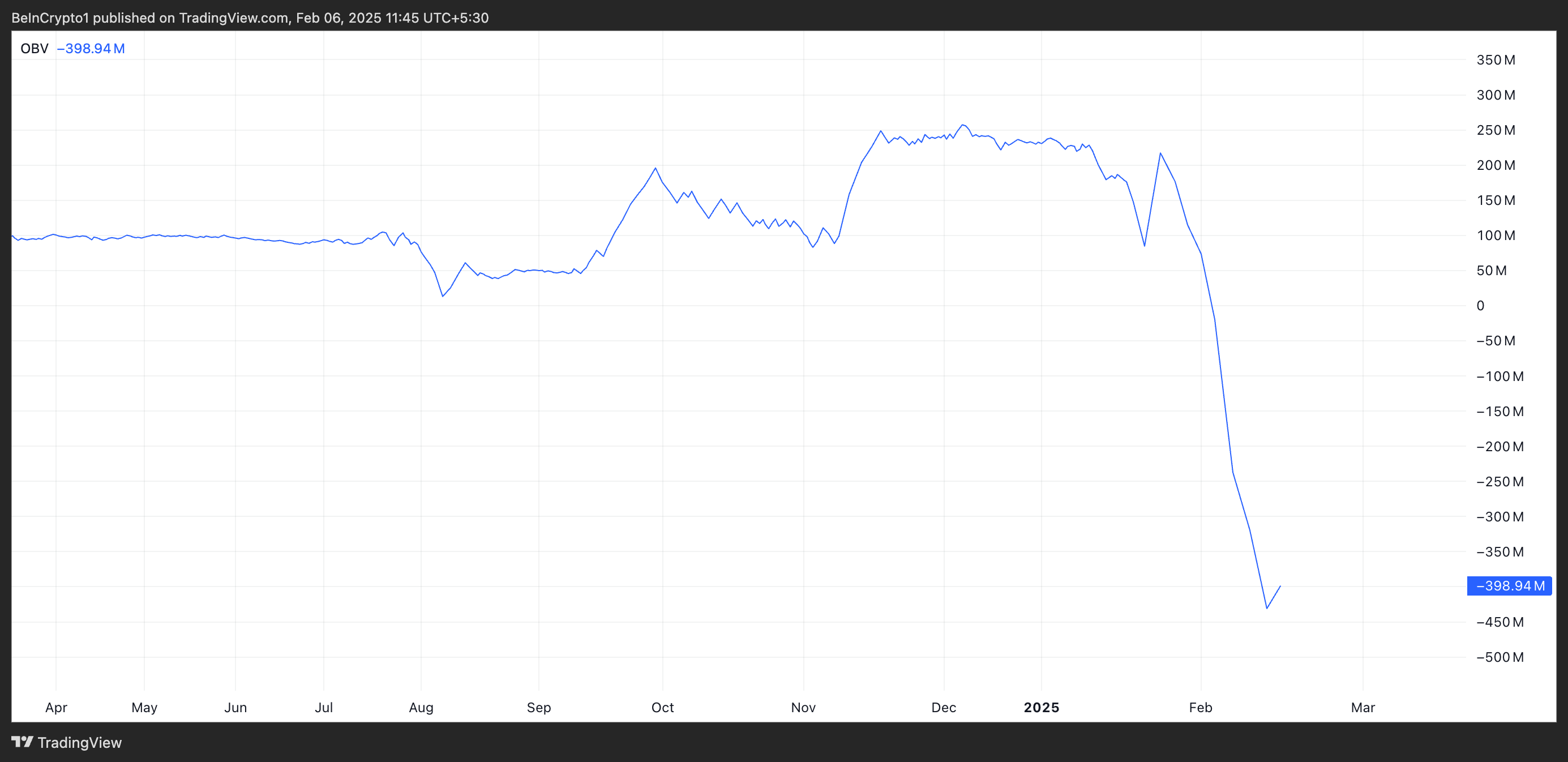

An assessment of the WIF / USD The graph of a day reveals that the volume of the token balance (OBV), a key indicator of the purchase and sale pressure, continued to decrease, reflecting the decreasing demand For the same piece. At the time of the press, it was -398.94 million, down 285% in just seven days.

An obv falls as this indicates that the sales pressure prevails over the purchase pressure. This means that more traders unload the assets than to accumulate it.

When the OBR of an asset decreases while its price decreases, it strengthens the lowering feeling and the probability of new losses. This suggests weakening WIF demand and reporting a potential decline tendency or continuation of its existing price drop.

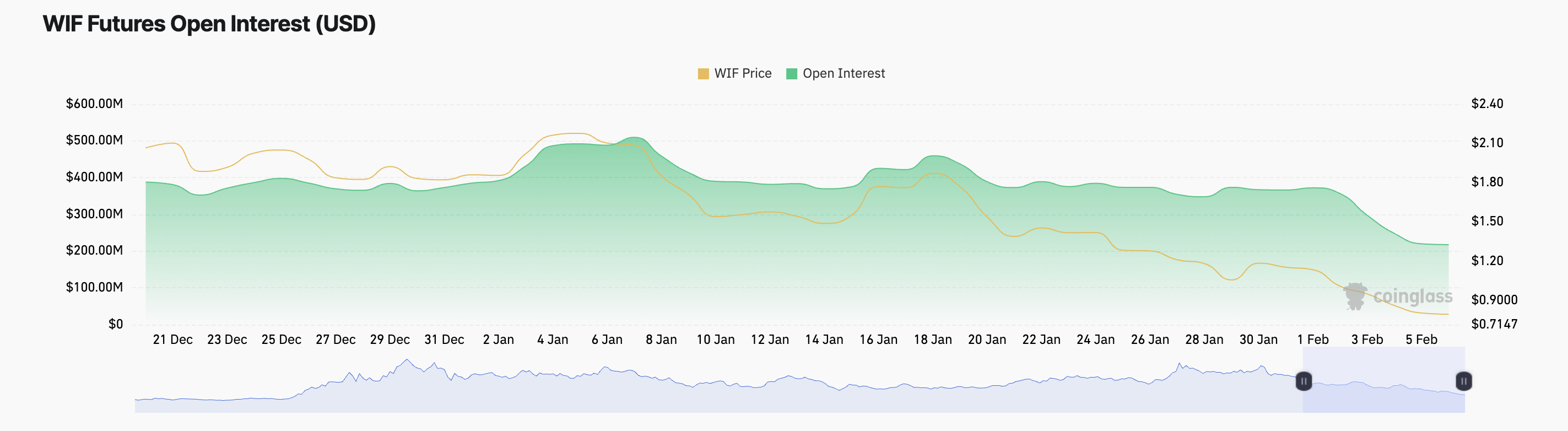

In addition, WIF’s open interest is strengthening this downward perspective. He has regularly decreased since the beginning of February, diving by 42%.

Open interest refers to the total number of future or options of options that have not been settled. When he falls alongside the drop in prices of an asset, traders close their positions rather than opening new ones. This reflects a weakening of market participation and can point out that the downward trend can continue unless new interest emerges.

WIF prices prediction: more drops to come?

The readings of the impressive oscillator of WIF (AO) confirm the decreasing request for Altcoin. This indicator displays histogram bars oriented down red to date, reflecting the high sales pressure. Its value is -0.60.

The impressive oscillator indicator measures the momentum by comparing the recent mobile average at 5 periods on the mobile average at 34 periods longer. When it displays histogram bars oriented down red, it indicates a weakening of the bullish momentum or a strengthening of the down pressure, suggesting a potential continuation of a downward trend.

If the downward tendency of WIF continues, its price could drop to $ 0.55, which represents a drop of 30% compared to its current value.

However, if the same piece sees a resurgence of demand, it could propel its price After the resistance to $ 0.92 and to $ 1.89.

Non-liability clause

Online with the Project of confidence Guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our Terms and Conditions,, Privacy PolicyAnd Warning have been updated.