- On Friday, Dogecon prices are negotiated by 6% and the solana memes parts are 9% of the market capitalization, after the DSA directives.

- The dry affirms that the pieces even are generally not titles under federal law but fail to catalyze recovery in the category.

- Bitcoin recovers slightly after a drop of less than $ 80,000 to the market -scale correction, causing extreme fear among merchants.

Friday, the prices of the coin and the Doges) and memes in the middle of a correction on the scale of the cryptography market on Friday. Two key market movers for sale are the drop in Bitcoin below the assistance of $ 80,000 and the directives of the Securities and Exchange Commission (SEC) of the United States Commission, published Thursday.

DOGECONE and same corners CRASH PRICE FACE

Dogecoin coins and even like Shiba Inu (Shib), Pepe (Pepe) and official Trump (Trump) are struck by prices in response to the cryptography market. Coingecko data show a drop of almost 4% in the market capitalization of parts even based in Solana, to $ 8.7 billion at the time of writing this document.

Doge / USDT daily price board

The two main engines of the price accident in the even parts could be the decline of Bitcoin below the level of $ 80,000 early Friday and the recent statement hack, or 1.4 billion dollars.

The American financial regulator Advice issued on the pieces evenWhere the corporate finance division explained that the transactions involving documents even “do not imply the offer and the sale of securities under federal securities laws”.

Despite the advice of the dry, the pieces even have trouble recovering. The effects of correction of cryptography on a market scale are felt in feeling among traders.

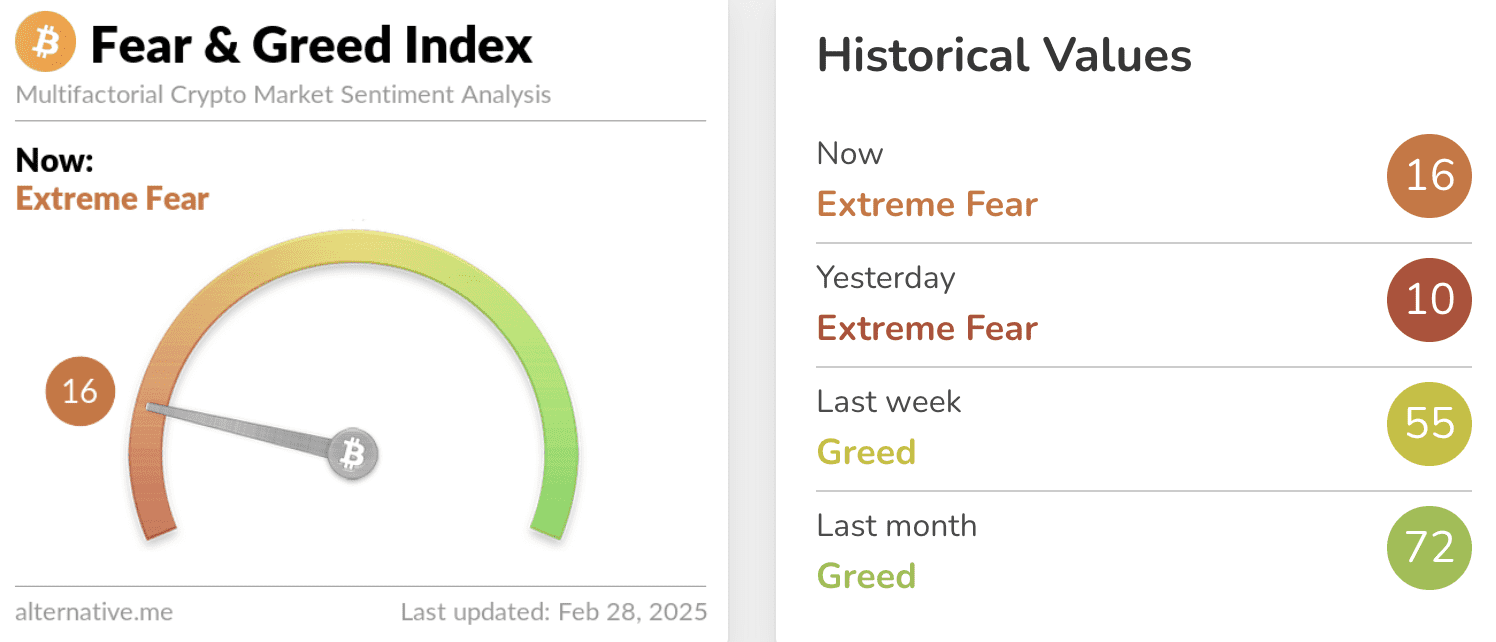

The Crypto Fear & Greed index reads 16 on a scale of 0 to 100, indicating an “extreme fear”, for the first time in three years. This indicates an increased feeling of risks among crypto traders.

Index of fear and greed | Source: alternative.me

In their February 10 report, “$ Trump killed the cryptographic pump?” 10x research analysts mentioned that the dynamics of the cryptography market moved after the launch of the Trump room. Analysts have stressed that the market will probably remain in a consolidation state with continuous short -term pressure pressure.

10x Research identified the launches of Trump and the Pump peak.

In their report, analysts say:

“The problem is not only the drop in prices – it is awareness that initiates could accumulate important amounts early, take advantage of major cryptography exchanges for liquidity, then sell to retail investors at more than $ 60 per token, only for it to exchange less than $ 16. This growing consciousness can discourage more in -depth speculative frenzy. »»