- The price of Pepe decreases on Monday after correcting more than 12% the previous week.

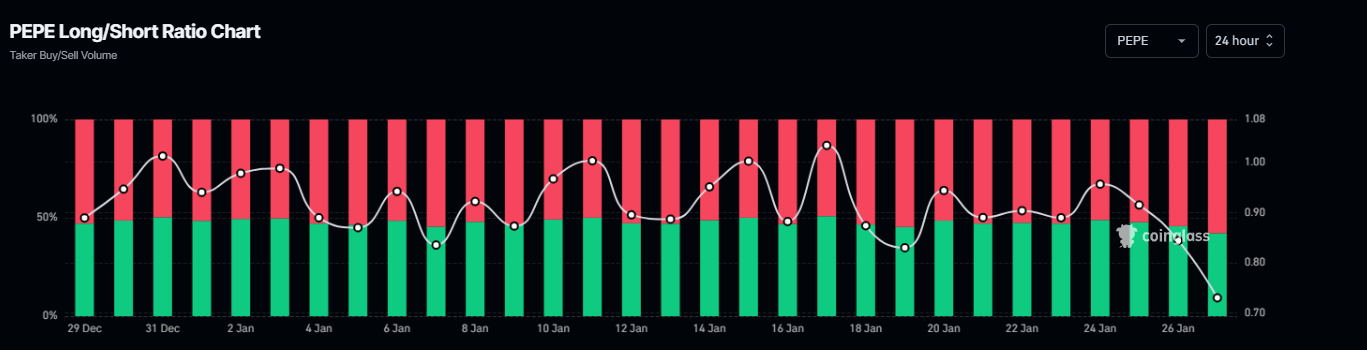

- PEPE’s long-to-short ratio trades below one, indicating more traders are betting for the frog-based meme coin to fall.

- The technical outlook suggests further correction as momentum indicators show signs of weakness.

Pepe (Pepe) continues its decline, trading around $0.000012 and plunging almost 10% at the time of writing on Monday after correcting more than 12% the previous week. PEPE’s long-to-short ratio trades below one, indicating more traders are betting on the frog-based meme coin to fall. Additionally, the technical outlook suggests another correction as momentum indicators Show weakness, projecting a 20% crash ahead.

Pepe Bears aim for 20% crush

Pepe Price Rejected in the face of a descending trendline (drawn by connecting multiple highs since early December) on January 18 and declined more than 30% through Sunday, ending below its 200-day exponential moving average at $0.000014. At the time of writing on Monday, it continues to decline around $0.000012.

If Pepe continues its correction and closes below $0.000013 daily, it could extend the decline by almost 20% from current levels and retest its November 8 low of $0.000010.

The relative resistance index (RSI) on the daily chart reads 31 and is pointing downward, indicating strong bearish momentum not yet in oversold conditions, leaving more room to extend the decline.

The Moving Average Convergence Divergence (MACD) indicator also shows a bearish crossover, suggesting a sell signal. The rising red histogram bars below the neutral zero line suggest that Pepe price may continue its downward momentum.

Pepe/USDT Daily Chart

Another bearish sign is Coinglass’ long-to-short PEPE ratio, which reads 0.72, the lowest level in a month. This sub-one ratio reflects bearish sentiment in the markets as more traders bet for the frog-based memecoin to fall.

PEPE’s long-standing ratio chart. Source: Coinglass