Cryptocurrencies fell over the weekend and today as investors grappled with a potentially more hawkish Federal Reserve, which could lead to smaller rate cuts than hoped for in 2025.

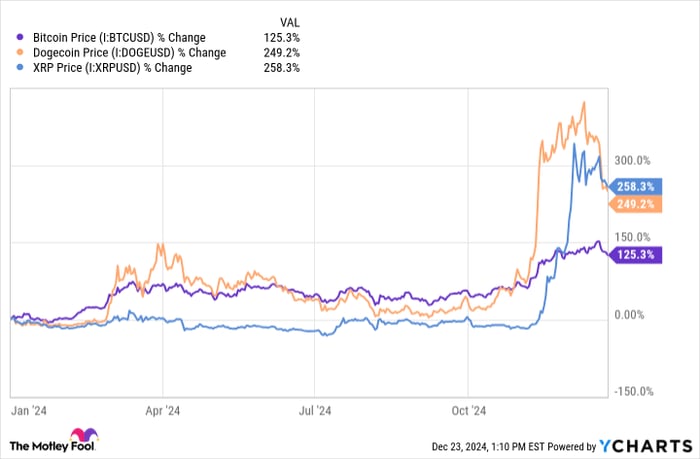

The price of Bitcoin (CRYPTO:BTC)the world’s largest cryptocurrency, was trading down about 4% from late afternoon trading, but also fell significantly over the weekend. At 1:29 p.m. ET Monday, Bitcoin was trading around $93,260 after surpassing $102,000 last Thursday. The price of Dogecoin (CRYPTO:DOGE) is trading down 3.2%, while XRP (CRYPTO:XRP) had fallen by 3.1%.

Start your mornings smarter! Wake up with Breakfast News in your mailbox every market day. Register for free »

The macroeconomic outlook is important right now

The Federal Reserve sent the market lower after concluding its final meeting of the year last week. The Fed also revealed that it only expects two rate cuts next year, instead of the four planned at its September meeting. While many investors and market experts seemed to be expecting this in the run-up to the Fed meeting, the news surprised the entire market.

Crypto players received more good news this morning after President-elect Donald Trump named Stephen Miran, an economist and former US Treasury Department official, to chair the influential President’s Council of Economic Advisers. Moran is pro-crypto.

However, investors appeared more focused on the broader macroeconomic outlook. Although durable goods orders in November were lower than expected, Treasury yields rose, normally a bearish indicator for Bitcoin and crypto in general.

Many believe that Bitcoin can protect against inflation. However, cryptocurrency is not only affected by Treasury yields, and gold also fell today. The dollar has continued to strengthen and Bitcoin, as an alternative currency, tends to have an inverse relationship with the dollar.

Bitcoin Price data by Y charts.

Traders betting on future 30-day federal funds prices are increasingly counting on the agency cutting rates less often than expected in 2025. More than 91% of traders believe it is about to suspend rates. rate cuts at its January meeting, and 37.5% of traders the Fed would only make one rate cut next year.

Just a week ago, most traders were expecting two Fed cuts next year, but keep in mind that those odds can change quickly.

I haven’t seen much token-specific news this morning, although Michael Saylor’s company, MicroStrategy, keep buying Bitcoin. Last week, the company purchased an additional 5,262 tokens for $561 million, at an average price of $106,662. Saylor has publicly predicted that Bitcoin could reach $13 million by 2045.

Expect some turbulence as the new year approaches

Bitcoin has risen significantly this year, so it is more sensitive to pullbacks. I expect the token to remain volatile as the market searches for clues about inflation and the trajectory of interest rates.

Most traders now believe inflation will be persistent and remain above the Fed’s preferred 2% target. Investors and the Fed are also bracing for the potential inflationary impact of Trump’s proposed tax cuts and tariffs.

Still, this could all change direction in no time with a weak reading in December’s jobs report or the Consumer Price Index in early January, which is why I expect an early volatility next year. XRP and Dogecoin are more volatile than Bitcoin, so both tokens are expected to experience higher gains and worse losses than Bitcoin.

I like Bitcoin and think XRP warrants a smaller speculative position. I currently have no interest in Dogecoin.

Don’t miss this second chance and a potentially lucrative opportunity

Have you ever felt like you missed the boat by buying the best performing stocks? Then you will want to hear this.

On rare occasions, our team of expert analysts issues a “Doubled” actions recommendation for businesses that they believe are on the verge of collapse. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Nvidia: If you invested $1,000 when we doubled down in 2009, you would have $349,279!*

-

Apple: If you invested $1,000 when we doubled down in 2008, you would have $48,196!*

-

Netflix: If you invested $1,000 when we doubled down in 2004, you would have $490,243!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns December 23, 2024

Bram Berkowitz has positions in Bitcoin and XRP. The Motley Fool holds positions and recommends Bitcoin and XRP. The Mad Motley has a disclosure policy.