- The Dogecoin price continued to decrease on Monday after correcting more than 6% the previous week.

- The Shiba Inu price is negotiated in the red on Monday after decreasing almost 7% last week.

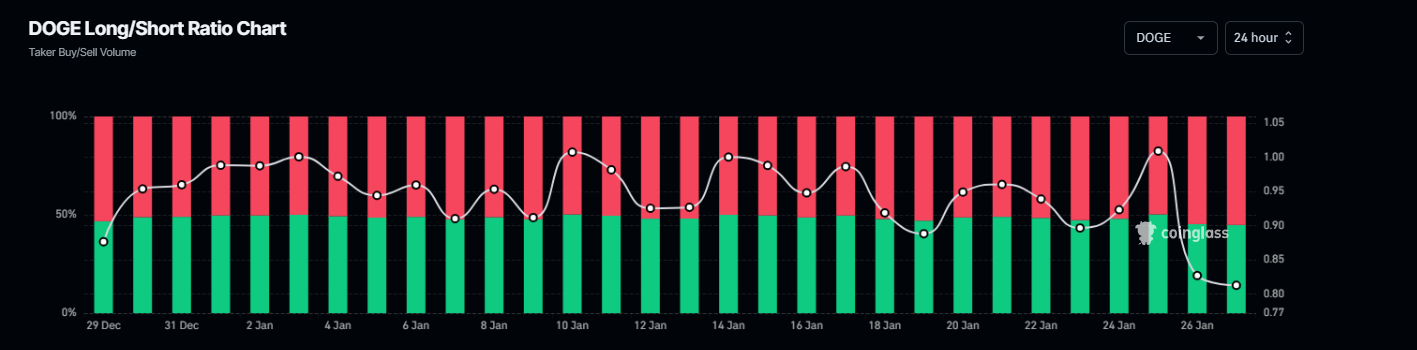

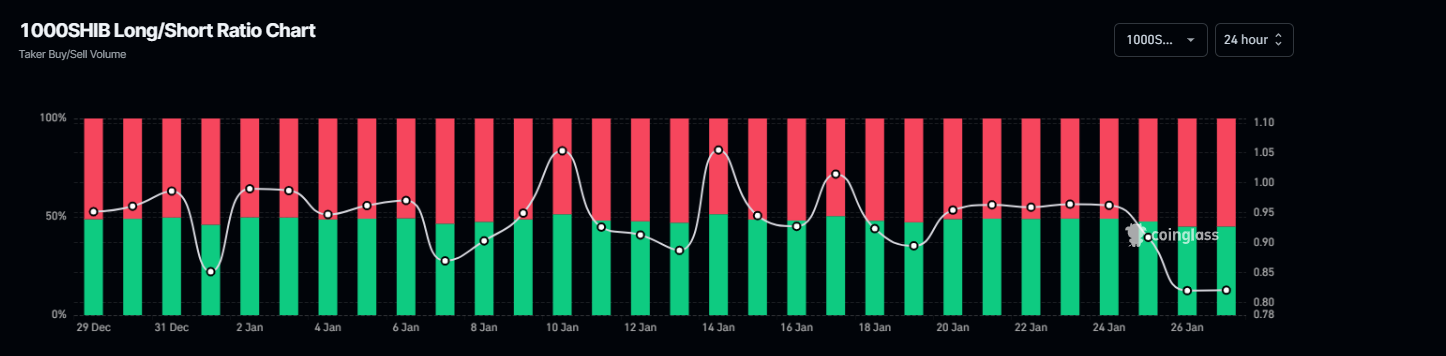

- Long -to -short and shib ratio transactions are lower than one, indicating that more traders are betting so that dogs based on dogs fall.

The prices of Dogecoin (DOGE) and Shiba Inu (SHIB) continue to drop Monday after having corrected more than 6% the previous week. Long -to -short and shib ratio transactions are lower than one, indicating that more traders are betting so that dogs based on dogs fall.

The same on the theme of dogs are facing stake stockings

According to Coringlass data, the Long Harvesting of Ménecoins report on the theme of dogs and Shib is read 0.79 and 0.82, respectively. This ratio lower than one reflects the lowering feeling in the markets because more and more traders are betting so that the same fall.

DOGE Table of long -standing reports. Source: Coringlass

Sch’s long -standing ratio table. Source: Coringlass

Dogecoin price forecasts: Doge shows signs of weakness

Dogecoin price rejection facing Around its 61.8% Fibonacci Travel level on January 21 (from December 8 level from $ 0.48 to the lowest of December 20 of $ 0.26) to $ 0.40, which decreased by 16.78% until Sunday. When writing the editorial’s moment on Monday, he continues to exchange around $ 0.32.

If Doge continues its correction, it could prolong its drop in retester its lower December 20 by $ 0.26.

The indicator of the relative resistance index (RSI) on the daily graphic rates 40, below its neutral level of 50, pointing down, indicating a lower momentum. The MOBILE Average Convergence Divergence Indicator (MACD) also shows a lowered crossroads on Thursday, indicating a downward trend.

DOGE / USDT daily graphics

Shiba Inu Prévisions: owned for a two -digit crash

The price of Shiba Inu has broken and closed below its ascending trend (drawn from the connection of several low levels since August 5) on Friday and decreased by 4.36% until Sunday. At the time of the editorial staff on Monday, he continues to to exchange About $ 0.000018.

If Shib continues its decline, it could prolong its 12% drop to retest its lower November 3 of $ 0.0000,16.

The RSI indicator on the daily graph is read 34, below its neutral level of 50, pointing down, indicating a lower momentum. The MacD indicator also shows a lowered crossroads on January 20, indicating a downward trend.

Shib / Usdt Daily Chartred News