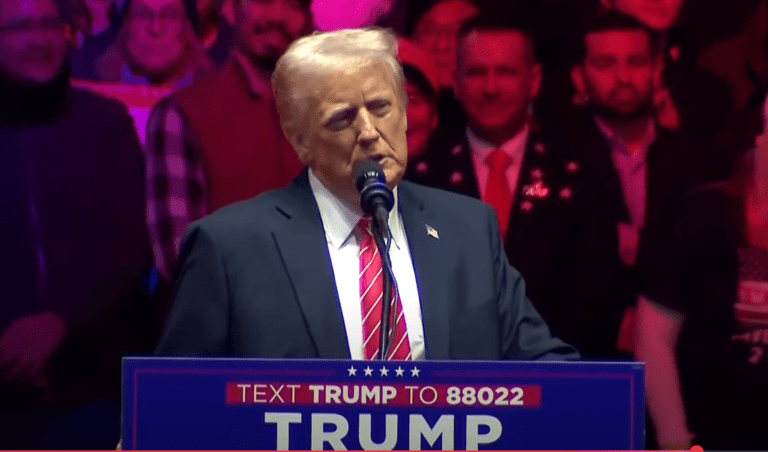

Donald Trump’s recent foray into the world of cryptocurrency with the launch of his coin, TRUMP, has raised questions about its legality, sparking widespread debate. A complete analysis by Anonwassielawyer (@wassielawyer), a prominent crypto and finance lawyer, shed light on the matter, explaining why Trump’s launch, while unconventional, adheres to existing US securities laws.

Memecoins: Did Trump Use a Loophole in Securities Law?

Anonwassielawyer begins with a provocative summary: “Trump launched a memecoin worth over $70 billion from the United States of America. Is the crime legal now? According to his analysis, the legal basis for such launches has always existed, rooted in the distinction between securities and non-securities in American law. Memecoins, which lack inherent utility or revenue sharing mechanisms, generally do not meet the criteria for an “investment contract” as described in the document. Howey test.

For a token to be considered a security, it must meet specific criteria, including an investment of money in a joint enterprise with a reasonable expectation of profits from the efforts of others. In the case of memecoins like TRUMP, these elements are conspicuously absent. The analysis details this with an example: If a token is sold with the promise that the proceeds will fund a project expected to generate profits shared with investors, the token would be considered a security.

However, if a token is sold solely as a speculative asset, with no underlying project or economic value, it does not fall under this classification. TRUMP clearly belongs to the latter category. As Anonwassielawyer explains: “If I asked you to buy a memecoin, we wouldn’t expect the profits to go to any project. The money simply goes to the seller who sells it because he thinks the price will go down. You simply buy it because you think there is a next marginal buyer who will take it from you at a higher price. There is no investment contract. There is no underlying value. This is pure speculation about attention. It is therefore not a security.

Although the legal status of memecoins is relatively straightforward, the broader implications for the crypto industry are more complex. Projects designed to create real value often face much higher regulatory hurdles. Tokens that generate revenue, offer governance rights, or otherwise resemble traditional financial instruments are much more likely to fall within the scope of securities law. This reality has led to growing frustration within the industry, particularly regarding the enforcement policies of regulators like SEC Chairman Gary Gensler. As Anonwassielawyer notes: “Much of the hatred toward Gary Gensler is not because he enforced the securities laws; it’s because he pretended everything was a failsafe even though it might not be.

The contrasting approaches taken by TRUMP and other Trump crypto initiatives, World Liberty Finance (WLFI)illustrate this regulatory divide. While TRUMP operates as a speculative memecoin, WLFI adheres to a strict compliance framework designed to satisfy U.S. securities laws. The WLFI token, for example, is explicitly structured to be non-transferable for at least 12 months, a safeguard to ensure compliance with Regulations D and S. These regulations govern sales to U.S. accredited investors and non-U.S. persons, respectively.

The terms of the WLFI explicitly state: “If seeking to unlock the transferability of the WLFI in the future through protocol governance procedures, such unlocking would only be permitted if it is determined that it does not infringe not to applicable law. »

Another level of complexity concerns the use of offshore structures, often wrongly considered as tools for regulatory avoidance. Anonwassielawyer specifies that these entities serve legitimate objectives, mainly governance and tax optimization. Securities laws are territorial, meaning that operating in offshore jurisdictions like the Cayman Islands does not exempt projects from compliance if their tokens are sold to U.S. persons. However, offshore structures can provide tax advantages, including deferring taxable events associated with the generation and disposition of tokens until the assets are onshore.

For the crypto industry, the lessons from Trump’s initiatives are clear but sobering. Memecoins may represent the lowest common denominator in the market, but their simplicity protects them from regulatory scrutiny. Meanwhile, projects that strive to provide real utility must adapt to an increasingly complex and inconsistent regulatory environment. Anonwassielawyer emphasizes this point, advising caution and respect: “Memecoins are very cool but no fraud please. Stock analysis should be reasonable but can be a little more relaxed. We should always be careful when selling tokens with security features and follow the usual frameworks for this.

At press time, TRUMP was trading at $39.26.

Featured image created with DALL.E, chart from TradingView.com