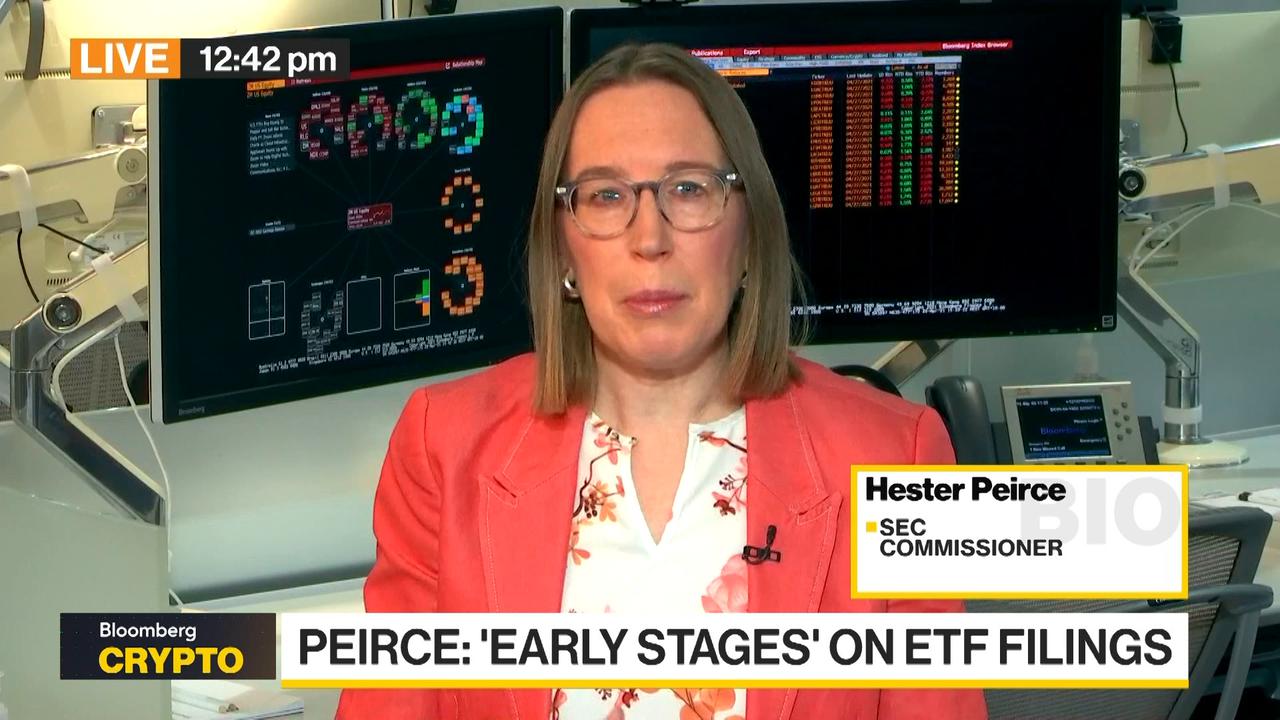

Most coins not under the jurisdiction of the dry: peirce

The head of the dry crypto Task Force and the commissioner of the dry, Hester Peirce, gives him the vision of the pieces even and says that the dry will examine the facts and the circumstances, but says that most of the pieces even have of house on the current whole of regulations.

Bloomberg

The launch of the new Bitcoin spot (Crypto: BTC) The ETF last January was one of the most successful ETF product launches of all time. In a period of only 12 months, these Bitcoin FNB spot Attracted more than $ 100 billion in investors and have become one of the most popular means for individuals, hedge funds and institutional investors to expose themselves to the cryptographic asset class.

It is therefore quite understandable that fund managers have flooded the dry with applications for new Crypto-Spot ETF, including some this feature Corners. Consequently, it becomes more and more likely that an ETF same corner will make its debut in 2025. Perhaps you will be tempted to invest, but here are several reasons why it would be a colossal error.

The false promise of three -digit yields

Let’s be honest here. The main reason why many people would be tempted to invest in an ETF even corner is to have access to three -digit yields. The coins are known for their frog potential in value, and indeed, if you look at how some of these memes parts work for very short periods, it is difficult not to be impressed.

But here is the thing: these yields can rarely be reproduced on a long -term time horizon. The coins, by their very nature, are supposed to be ephemeral and transient. They try to capitalize on new viral trends and are not supposed to be long -term investments.

In addition, since the viral trends are entering and getting out of the traffic very quickly, it is almost impossible to predict which parts of memes will work well at any time. A quarter, it can be parts of memes on the theme of dogs. The next quarter, it could be on the theme of the cat or on the theme of the frogs.

As a prudence tale, consider the case of dogecoin (Crypto: Doge). After a brief momentary point of value during the Haussier market rally of the cryptography market in 2020-2010, this was a huge disappointment. This year, for example, Dogecoin is down 20% – and it is even with “DOGE” to make the headlines literally every day. Thus, even if some analysts now give an ETF of Dogecoin 74% to be approved this year, it is an ETF that I would certainly avoid.

The hidden risks of coins

Although the ETFs are highly regulated, the parts even are not. And this creates the potential of many bad behaviors on the cryptography market. A lot of money even, unfortunately, are Pump and smoke diagrams. Some are scams. And even the pieces even launched by high -level celebrities and public figures can collapse in value overnight, which led to many difficult questions later.

Make things even more difficult, there are literally thousands of new coins during creation every day, so it is almost impossible to examine them all. It is really easy to start a new cryptocurrency, but much more difficult to find a really precious new piece.

If you are optimistic, this is a problem that the ETF application process must solve. In theory, only the safest, most reliable and liquid pieces of memes will even be taken into account for an ETF. And only the best of the best will get a seal of dry approval.

But do you remember what I told you about the pieces even being ephemeral and transient? As an ETF same corner is finally starting to exchange, it will be almost impossible to earn serious money. The time of virality will probably have already passed the first day, and it will be too late for the investors who were blinking and missed it.

We already see a version of this phenomenon now, while the pieces even migrate decentralized cryptography exchanges towards centralized crypto exchanges such as global cornerbase. As this process occurs, investors have already missed a huge amount of increase.

Graphic Pepe / Tatherus by tradingView

Take a look at this table for Pepe (Crypto: pepe)The popular memes on the theme of frogs with a market capitalization of $ 4 billion. The play was launched in mid-2023, but Coinbase only listed this coin for trade in November of last year. At that time, it was already too late. You have already missed the remarkable ascending trajectory of Pepe which made him so popular with investors. If an ETF based on Pepe is sort of approved this year, I would not touch it with a ten -foot pole.

99% of people lose money with coins

As a result, is it really surprising that 99% of people lose money with coins? It is quite difficult to choose the right piece of memes. But you also have to enter early to earn real money. And you have to go out quickly enough to avoid being transformed into exit liquidity by unscrupulous initiates.

So, if you hope that a corner ETF on the dog’s theme will transform you into an cryptographic millionaire, you may barked the bad tree. Investing in coins is sufficiently speculative, and investing in FNB even corner would only worsen these problems.

Dominic Basulto has positions in Bitcoin. The Motley Fool has positions and recommends Bitcoin. The Word’s madman has a Disclosure policy.

The Motley Fool is a USA Today content partner offering financial news, analyzes and comments designed to help people take control of their financial life. Its content is produced independently of USA Today.

Do not miss this second chance for a potentially lucrative opportunity

Motley Fool offer: Have you ever had the impression of having missed the boat to buy the most successful actions? So you will want to hear this.

On rare occasions, our team of analysts experts issues a The “Double Down” stock Recommendation for the companies they think are about to burst. If you are afraid, you have already missed your chance to invest, it’s the best time to buy before it is too late. And the figures speak for themselves:

- NVIDIA: If you have invested $ 1,000 when we doubled in 2009, you would have $ 363,307! *

- Apple: If you have invested $ 1,000 when we doubled in 2008, you would have $ 46,607! *

- Netflix: If you have invested $ 1,000 when we doubled in 2004, you would have $ 552,526! *

Currently, we are issuing “double” alerts for three incredible companies, and there may be no luck like this as soon as it is.