This report was written by Tiger Research, analyzing how Memecoins reshaped the dynamics of the trading of cryptocurrencies and challenged the domination of the CEX.

-

The same has transformed speculative assets into a dominant commercial force, attracting massive liquidity and reshaping the way in which capital moves on the cryptography market.

-

The rise of Dex, driven by platforms like Pump.fun, diverts both the liquidity and the active traders of CEX. This reduces the risk of price discovery at an early stage.

-

The exchanges of rapid adaptation such as Mexc which adopt the same trading are prosperous, while slower platforms like Binance have trouble preserving the liquidity and the influence of the market.

Evencoins transformed the cryptocurrency market. They started as speculative trends but are now leading significant trading volumes on the main exchanges.

Exchanges have moved their strategies to adopt this trend. Gate.io and Mexc captured the market share thanks to rapid memecoin lists. Binance created “Binance Alpha” to list the same at an early stage and provide soft landings. On the Dex market, Raydium, based in Solana, exceeded the UNISWAP market share, based in Ethereum. This stage proves the power of the same as a market catalyst.

As even even plays a more important role in exchanges, wider implications are at stake. Will trading focused on the same same lead to a lasting evolution of the market, or will it ultimately prove to be a cyclic phase? In addition, how will regulatory developments influence the sustainability of mecoins as a class of dominant assets? These are the questions that will determine the future of retail and exchange growth.

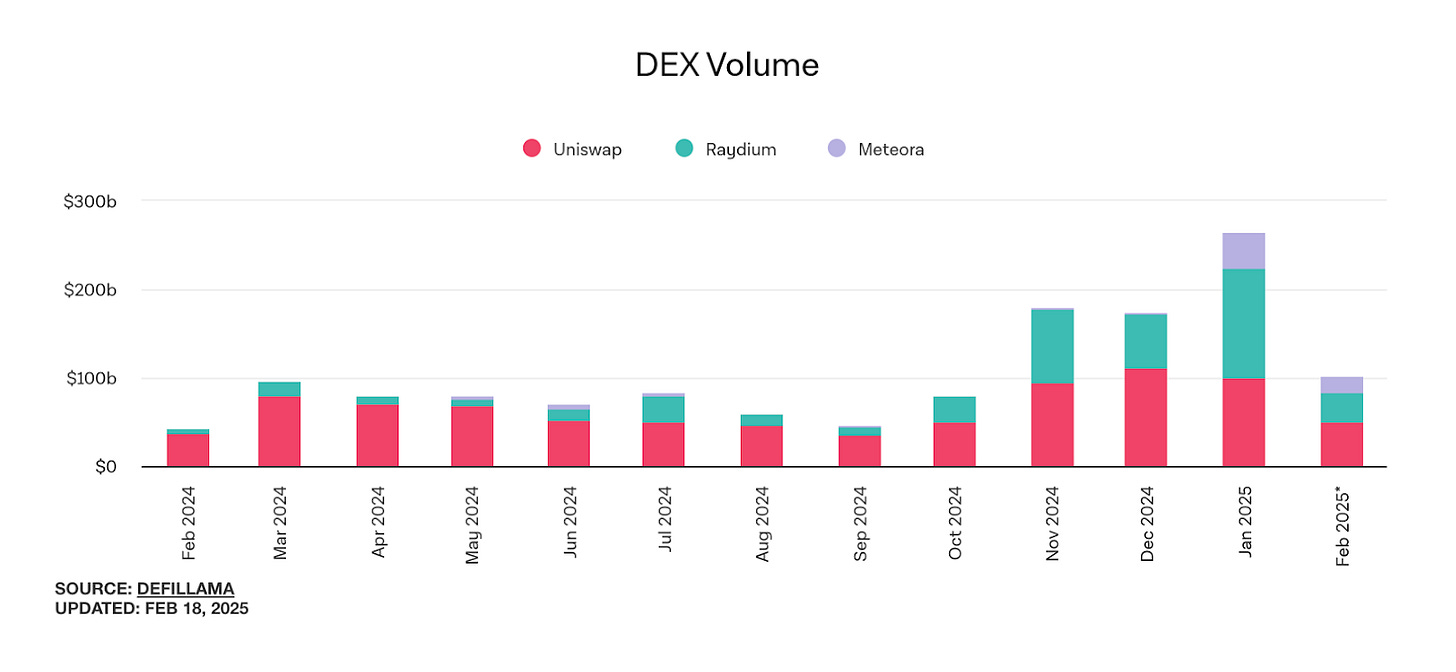

Samecoins stimulates explosive Raydium growth. Captured Raydium 27% of the DEX market share In January 2025, which proves that retail investors prefer its platform. The advantages of Solana Chain feed the success of Raydium. The platform offers lower costs and faster transactions than exchanges based on Ethereum. These characteristics have made Raydium the dominant center for the same trades.

UNISWAP has lost its position of leadership Dex. Its market share increased from 34.5% to 22% between December 2024 and January 2025. High Ethereum gas fees created barriers for memecoin traders. These costs repel the cost -sensitive retail investors. Dex based on Ethereum must innovate as liquidity passes to new channels.

Samecoins clearly stimulates Raydium growth, but experts must carefully monitor this trend. Some experts predict that the so -called trading wave ends as speculative demand is falling. However, Raydium has already become a familiar platform for users via same trading. By taking advantage of this trend as an opportunity, Raydium can strengthen his liquidity pools, improve the user experience and create effective trading systems to become a trusted trading platform. These developments will guarantee its long -term competitive advantage on Dex and CEX.

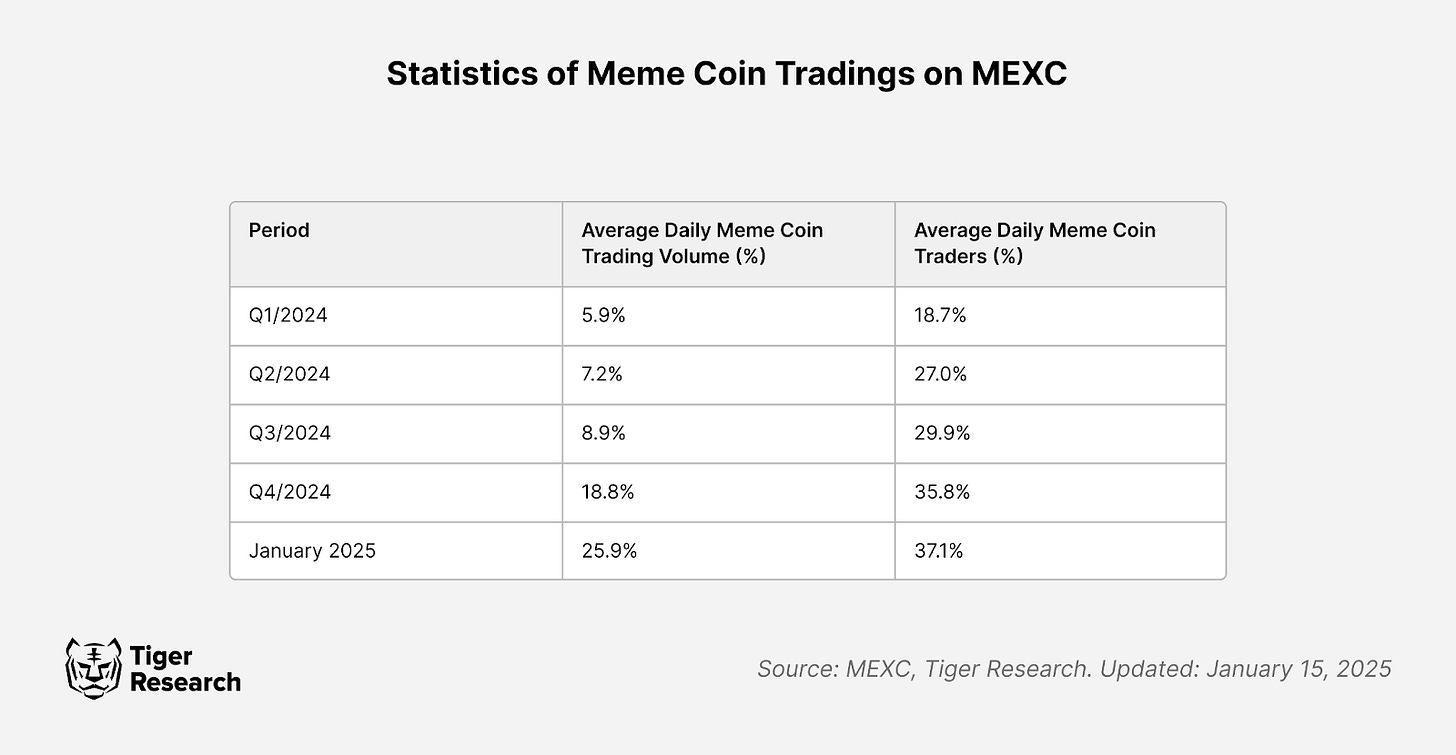

Gate.io and Mexc have targeted retail investors interested in speculative assets thanks to their same -law registration strategy. Mexc led the same trend with its rapid registration policy. They listed the Trump ($ Trump) official on the day of its launch, which led to record negotiation volumes and an expansion of the user base. These strategies have produced tangible results. The daily volume of Mexc Memecoin rose from 5.9% to T1 2024 to 25.9% in January 2025. During the same period, the proportion of samecoin traders rose from 18.7% to 37.1% .

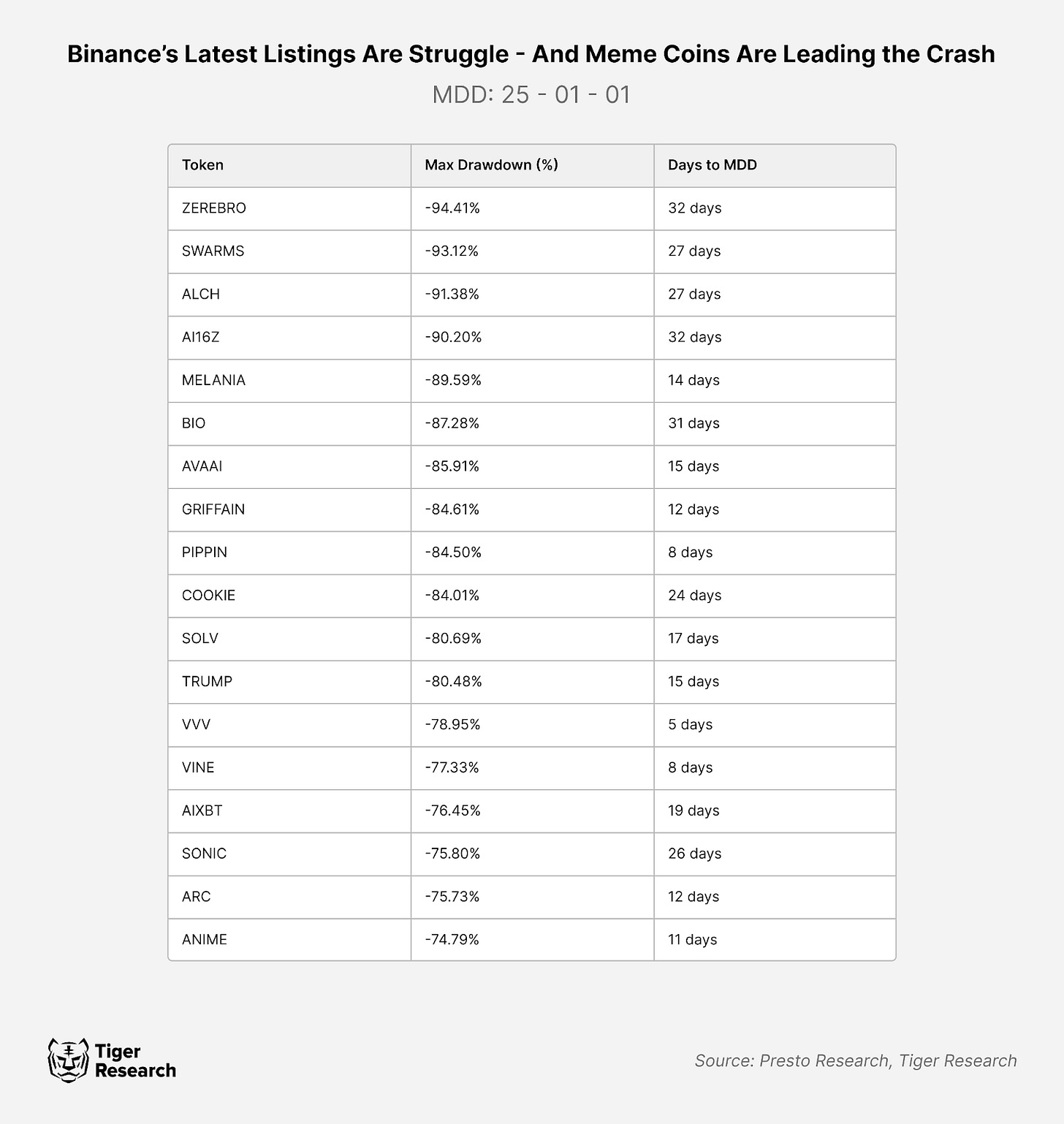

Even the largest crypto exchange in the world, Binance has considerably widened its same lists to guarantee the liquidity of retail. Their recent strategy focuses more on speculative assets, which targets “attention economics”. However, as a centralized exchange (CEX), Binance faces inevitable delays due to internal procedures such as list opinions. These delays often cause the memecoins when the market cycle has already decreased or has moved to more recent trends.

Although the change provides sufficient liquidity to protect investors, this paradoxically serves as a liquidity exit for the first unloading holders of large quantities with an impact on minimum prices. Most of the same newly listed on Binance have dropped more than 75% prices in a short period of time, causing significant losses to many investors. These results not only affect the long -term credibility of the exchange, but also raise questions about the reliability of their list examination process.

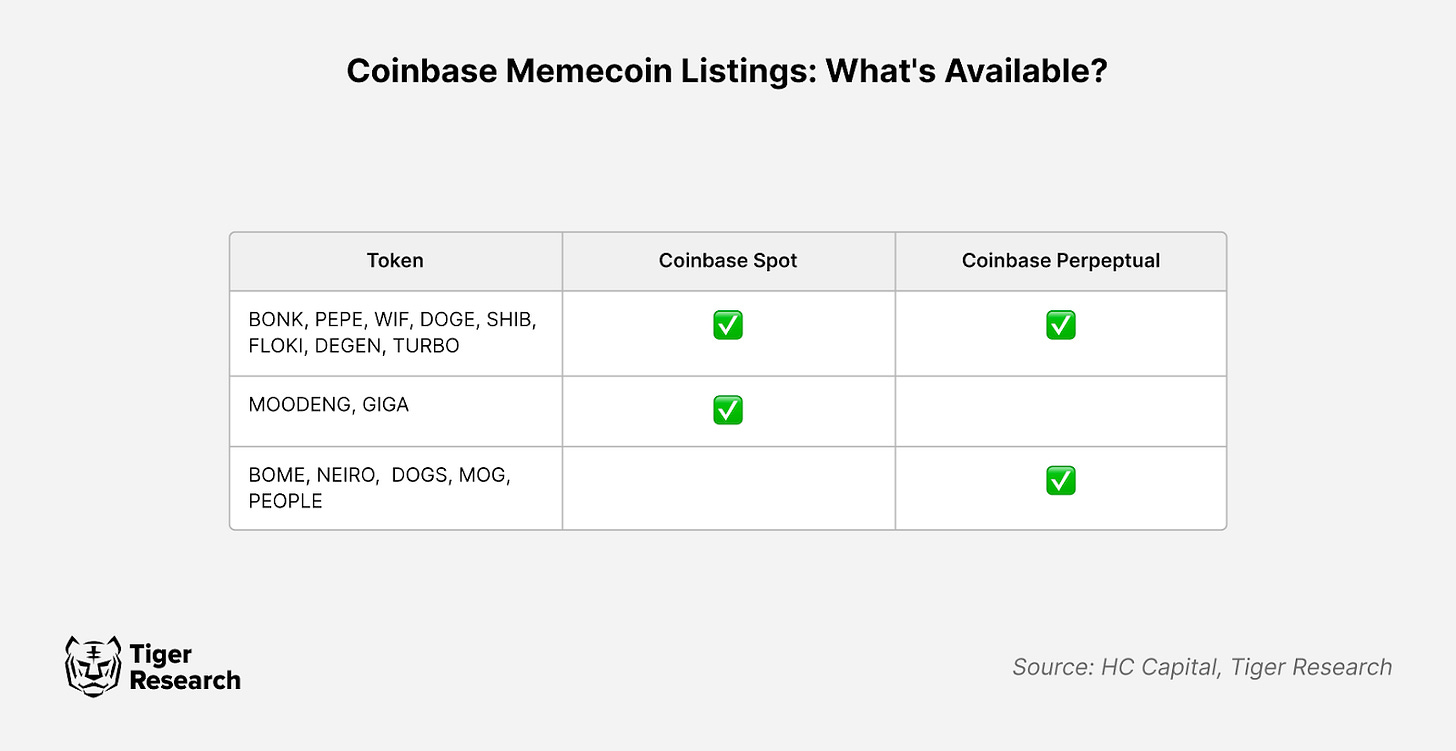

The main CEXs like Coinbase, Kraken and Upbit maintain a prudent strategy by focusing on verified cryptocurrencies rather than mecoins. Although this approach cannot take advantage of very profitable short -term market opportunities, it helps to guarantee the stability of platforms and manage regulatory risks.

However, recent clear trends show that funds from CEX to Dex, revealing that the CEX no longer has absolute domination in the market. CEX must now review their existing strategies. They can continue various strategic approaches: screening for assets at an early stage and the supply of transparent information such as Binance Alpha, risk management through selective lists of the same or the introduction of hybrid trading models that incorporate command books and current challenge elements.

The basic challenge for CEX is to develop solutions that balance the short -term negotiation activity with the long -term stability of platforms, while maintaining the confidence of institutional investors and effectively attracting retail investors.

Evencoins has transformed speculative tools into main trading assets on the cryptocurrency market. The Dex Memecoin professions have increased to create new opportunities and challenges for the cryptographic industry.

The same on Dexs upset the assets listed in the CEX during the recent bull markets, which pushes investors to Dex. Plates-form like Pump. This allows new tokens to develop explosively without lists of CEX.

Market manufacturers, liquidity suppliers and project teams have adapted their strategies to correspond to these changes. They concentrated previously only on the CEX lists, but now also consider the DEX environments. They build liquidity pools on several platforms to extend trading accessibility.

Ethics practices threaten the market for the same. Carpet prints, cabals and malicious trades harm investors. The market lacks appropriate surveillance. The Argentina Scandal Balance ($ balance) exposed these risks. He sparked generalized skepticism and lowered Solana Dex’s trading volumes.

Despite these challenges, even demonstrates a new potential in crypto. They now serve as proxy assets for specific entities and groups. Cases like Elon Musk with Dogecoin, Trump with an official Trump token and various startups and the same national show how cryptocurrencies capture real value. This trend reflects traditional securities markets and could become a new cultural standard.

CEX must respond to these changes. Investors are no longer waiting for CEX lists to exchange promising assets. Exchanges must integrate chain features and DEFI while maintaining stability and conformity to maintain the interest of retail. This strategy will stimulate the next market growth phase.

Read more reports related to this research.This report was prepared on the basis of materials that would be reliable. However, we do not expressly or implicit the accuracy, completeness and relevance of information. We decline any responsibility for any loss resulting from the use of this report or its content. The conclusions and recommendations of this report are based on the information available at the time of preparation and are likely to change without notice. All projects, estimates, forecasts, objectives, opinions and opinions expressed in this report are likely to change without notice and may differ or be contrary to the opinions of others or other organizations.

This document is for information purposes only and should not be considered as legal, commercial, investment or tax advice. Any reference to securities or digital assets is for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment consulting services. This equipment is not intended for investors or potential investors.

Tiger Research allows equitable use of its reports. “Equitable use” is a principle that largely allows the use of specific content for purposes of public interest, as long as it does not harm the commercial value of the equipment. If use aligns with the purpose of fair use, the reports can be used without prior authorization. However, when quoting Tiger Research reports, it is compulsory 1) clearly indicates “research on tigers” as a source, 2) include the Tiger research logo (Black/ /White). If the equipment should be restructured and published, separate negotiations are necessary. Unauthorized use of reports can lead to legal action.