Ethereum (ETH) has become optimistic after weeks of negotiations less than $ 3,000, a level which he has not broken since February 2. Change occurs while capital seems to flow from Solara And in Ethereum, with stable Hops and climbing TVL supporting its momentum.

Meanwhile, Ethereum’s price graph shows that short -term EMA increases, signaling a potential golden cross that could push ETH to $ 3,020. If this trend continues, the ETH could see a rally of 22%, while a unsuccessful rupture can lead to another retaining of key support levels.

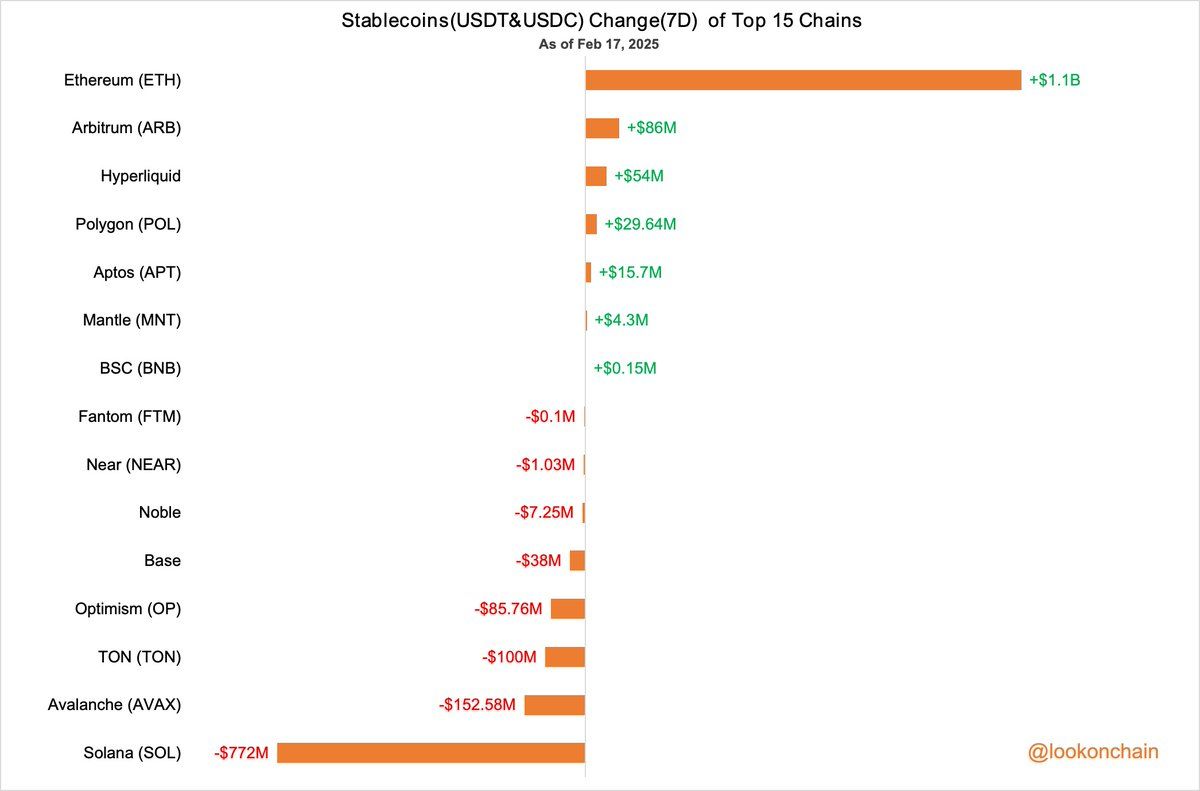

Stablecoin active ingredients flow from Solana to Ethereum

In the middle of the controversy surrounding Solana Even corners, Lookonchain’s data suggest that capital moves to Ethereum. In the past seven days, Stablecoin Holdings on Ethereum (USDC and USDT) increased by $ 1.1 billion, while $ 772 million in Stablecoins have left Solana.

It comes after the launch of Balance same cornerwhich has accumulated many users and has aroused concerns about the sustainability of the Solana ecosystem. With questions about the main players such as Jupiter, Pumpfun and Meteora, investors seem to run funds in Ethereum.

The data suggest that traders can reduce exposure to Solana due to uncertainty around its memet’s currency scene and the main protocols.

In the meantime, Ethereum seems to benefitattracting fresh liquidity that could feed Challenge Activity, trading or token launches. If this trend continues, Ethereum could see other entries, while Solana may need to restore confidence to reverse the current outings.

Ethereum Network TVL is increasing

This trend is also reflected in the total value of the two locked channels (TVL). Solana’s TVL culminated at $ 14.2 billion on January 18, but has never stopped lowering since then.

In the past four days only, it has increased from $ 10.95 billion to $ 10.5 billion, indicating capital outlets Solana projects.

TVL measures the total assets locked in the protocols of a blockchain, representing liquidity and global activity. A growing TVL suggests increasing confidence and participation, while a decline indicates capital leaving the ecosystem.

In the meantime, Ethereum TVL increased, from $ 59.66 billion on February 2 to 63.7 billion dollars before February 16.

This change suggests that investors promote Ethereum compared to Solana, strengthening Stablecoin data showing the rotation of capital.

If this trend continues, Ethereum could strengthen its position, while Solana may have trouble resuming loss of liquidity.

ETH price prediction: a potential increase of 22%

Ethereum Prize The graph shows that its EMA lines are always lowering, with short -term EMA lower than long -term. However, short -term lines move upwards and a golden cross could be formed soon.

If this happens, the ETH could test the resistance at $ 3,020, exceeding $ 3,000 for the first time since February 2. Continuous momentum could push ETH up to $ 3,442, marking a potential increase of 22% compared to current levels.

Additional short -term external factors, such as Modification of the next upgradecould also support this upward trend.

Lower down, if the downward trend is strengthening, Ethereum could relaunch support for $ 2,551.

The loss of this level could trigger a deeper drop to $ 2,160. Bears must break the key support areas, while the bulls must maintain the momentum for a rupture above the resistance.

Non-liability clause

Online with the Project of confidence Guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our Terms and Conditions,, Privacy PolicyAnd Warning have been updated.