Analysts and traders are focus On the price level of $ 0.35, which could trigger an explosive increase.

The crucial threshold of $ 0.35 for Doge

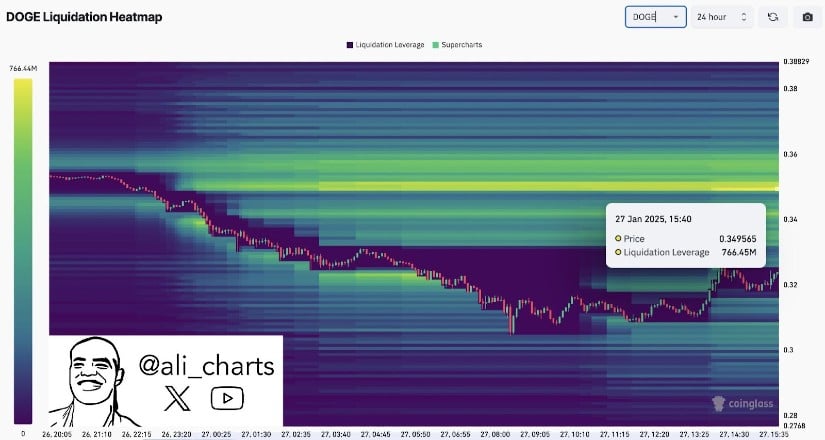

DOGECOIN (DOGE), known for its presence on the market focused on the memes, attracts attention while it vacillates near a critical price level. Market data reveal that short positions worth around $ 766.45 million is concentrated in a range of $ 0.32 to $ 0.35.

An increase of $ 0.35 for Dogecoin ($ DOGE) could trigger a short pressure, destroying more than $ 766.45 million in short positions. Source: Ali Martinez via x

If the price Doge would take up $ 0.35, it could trigger forced liquidations, forcing the sellers uncovered to cover their positions by buying the assets, thus creating a cascade effect which increases prices.

“The market dynamics are ready for short pressure,” said analyst Ali Martinez on January 27 via X. “If Doge bounces $ 0.35, $ 766.45 million in short positions could be liquidated.”

This potential chain reaction comes from an overwhelming accumulation of short positions, as the thermal liquidation card of Corglass points out. The thermal card indicates dense lever bunches around $ 0.339 to $ 0.343, highlighting the precarious position of lower traders.

Short pressure mechanisms and historical context of Dogecoin

Short pressure occurs when the price increase in traders prices occupying short positions to buy the assets to avoid other losses. This sudden purchasing pressure often accelerates ominous momentum, creating pointed price peaks. For Dogecoin, a successful rally greater than $ 0.35 could release this phenomenon.

DOGE Liquidation Heatmap. Source: Ali Martinez via x

The historical models of the action of Dogecoin prices suggest similar scenarios. During the overvoltage of detail in 2021, DOGE recorded a rally of 800%, while the Bull Run 2017 experienced an increase of 1,000%. In both cases, speculative trade and social media buzz played an important role in the amplification of price movements.

In particular, figures like Elon Musk have historically fueled Dogecoin gatherings with tweets that have triggered fast price peaks. While Musk’s influence has decreased slightly, his occasional commitment with Dogecoin always has weight in speculative circles.

The Bromance in progress between Elon and Dogecoin is back under the spotlight after the social media platform of Elon Musk, X, announced a partnership With Visa – marking the first step towards its ambitious digital payments and its banking expansion. According to the New York TimesX joined forces with Visa Tuesday to launch a new digital payments feature, an important step in Musk’s vision to transform the X platform into an “all application”, an objective he described for the first time In 2022, and was from the Paypal for the first time as the Paypal Days, a Musk company co -founded. Dogecoin enthusiasts are buzzing because Musk has been a vocal supporter of the memes play for years. Last week, he invited the co-founder of Dogecoin, Billy Markus, to join the X-efficiency Ministry of X as an advisor.

These developments feed speculation according to which Dogecoin could always play a role in the emerging financial ecosystem of X. In fact, we think it is likelyBut patience is necessary.

Speculation, social media and feeling surrounding the DOGE price and the FNB of DOGECOIN

The unique positioning of Dogecoin as a play of meme has made it strongly dependent on speculative trade and feeling focused on social media. According to Lunarcrush data, the majority of the social mentions of Dogecoin – 58% – are neutral, while 34% of the mentions present a positive tone. This cautious optimism could quickly move if viral content or high -level endorsements renewed interest.

The accumulation of whales, the job offer of Elon and a high short -term interest make heard for a compression of $ 766 million. Source: AA Crypto via x

Platforms like Tiktok and X are key engines of speculative activity, often amplifying the volatility of the Dogecoin market. As analysts have underlined, an increased commitment to these platforms can cause self-reinforced purchase pressure, especially in ripe scenarios for short pressure.

Meanwhile, Bitwise postulated with the dry for a place DOGECOIN ETFIt is extremely optimistic for the price.

Bitwise postulated for an ETF Dogecoin Spot, Source: X

DOGE TRADERS Potential ocular risks to reward the opportunity

Although the gains potential is significant, the configuration of the Dogecoin market also has substantial risks. Short compressions are notoriously volatile, often followed by net corrections. Merchants considering short -term opportunities must remain agile, while long -term investors should approach caution, evaluating wider market conditions and the sustainability of Dogecoin.

According to the Elliott Wave analysis, Dogecoin (Doge) looks at $ 0.50 as a potential target. Source: Wave on tradingView

A recent trading view by Behdark suggests that Dogecoin could experience a temporary drop to $ 0.26 before bounceing at higher levels. Depending on the analysis, this drop could provide a springboard for a Rally at $ 0.50 Or beyond, fueled by speculative purchase and liquidity hunting.

Broader trends and perspectives for Dogecoin

The potential of Dogecoin rally It also depends on broader trends on the market. For example, recent bitcoin gains and post-electoral overvoltages in the feeling of crypto have been ripe for altcoins. If this continues, then Dogecoin could, in fact, be for the benefit of higher capital entries, in particular motivated by speculators.

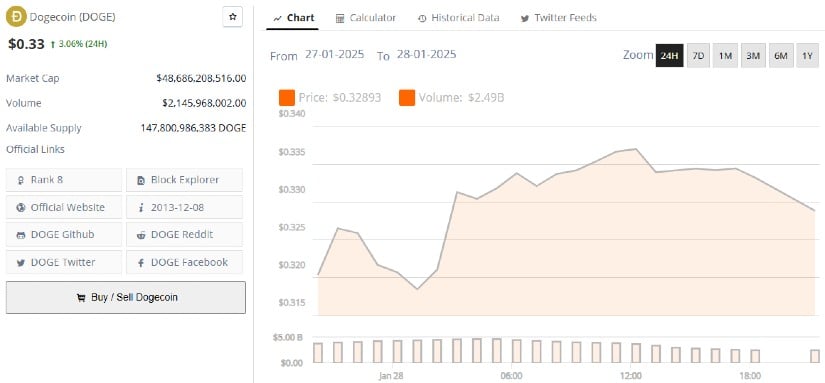

Dogecoin (DOGE) was negotiated at $ 0.33, up 3.06% in the last 24 hours from press time. Source: Brave new room

The Crypto analyst, Master Kenobi, highlighted the historic price models of Dogecoin, noting similarities in its current configuration with the 2023 gathering. If the piece even had to increase the price, it could pass through the Psychological brand at $ 1According to this configuration.

Will $ 0.35 arouse the Doge rally?

While Dogecoin hovers almost $ 0.315, the level of $ 0.35 remains a critical battlefield for merchants. A breach could trigger short dramatic pressure, which led the price to Higher resistance levels. However, the result depends on bullish Overcoming dense liquidity barriers and the alignment of market feelings in favor of the memes play.

For the moment, the community and the traders of Dogecoin look closely, waiting to see if this pivotal moment will open the way for a historic rally. Whether it is a break or a ventilation, one thing is certain: the Dogecoin market remains like unpredictable and volatile as always. Doge to a dollar!