- The price of Shiba Inu has increased up to 11% in the last 24 hours, recovering the territory greater than 0.000014 despite a wider market turbulence.

- Chain data reveal that sand whales have increased by more than 300% since the start of the week.

- Large investors capitalize on the decline, which suggests that bears can find it difficult to regain short -term domination.

Shiba Inu Price has jumped more than 11% in the last 24 hours, defying disorders on the wider market of cryptography to recover the territories greater than $ 0.000014. Whale investors have spotted the purchase of the decline, Shib Price could be underway for an extended rebound phase.

Shiba Inu Price extends the rebound while the Ethereum ecosystem recovers by Bybit Hack

Shiba Inu (Shib) shows the early signs of a sustained recovery like Ethereum ecosystem The tokens are starting to bounce back after the recent relay hack, which saw more than 400,000 ETH stolen by pirates linked to the Lazare group in North Korea.

Bybit has since assured customers that all losses will be covered using the company’s reserve capital. The exchange has also reimbursed more than 100,000 ETH to key partners, including Bitget, who provided an emergency liquidity To stabilize withdrawals. These efforts have contributed to restoring confidence in assets based on Ethereum with Shib leading.

Analysis of Shiba Inu Prix

The daily trading graph shows that Shib increased by 11% during the day, exceeding the level of $ 0.000014.

This marks a lively reversal of its local background of $ 0.000013 recorded on Monday, after the confirmation of US President Donald Trump price on Mexico and Canada.

Despite the initial concerns concerning the impact of protectionist policies on the world markets, Shib has demonstrated strong resilience. The bullish momentum suggests that its recent price action is largely motivated by internal market forces rather than broader macroeconomic trends.

Large shib transactions increase 300% while whales challenge Trump prices fears

While Trump’s pricing announcement has reduced the feeling of investors in the global markets, the rapid rebound in the price of Inu Shiba indicates strong internal demand. The latest chain data reveal that institutional investors take advantage of the decline to accumulate Shib.

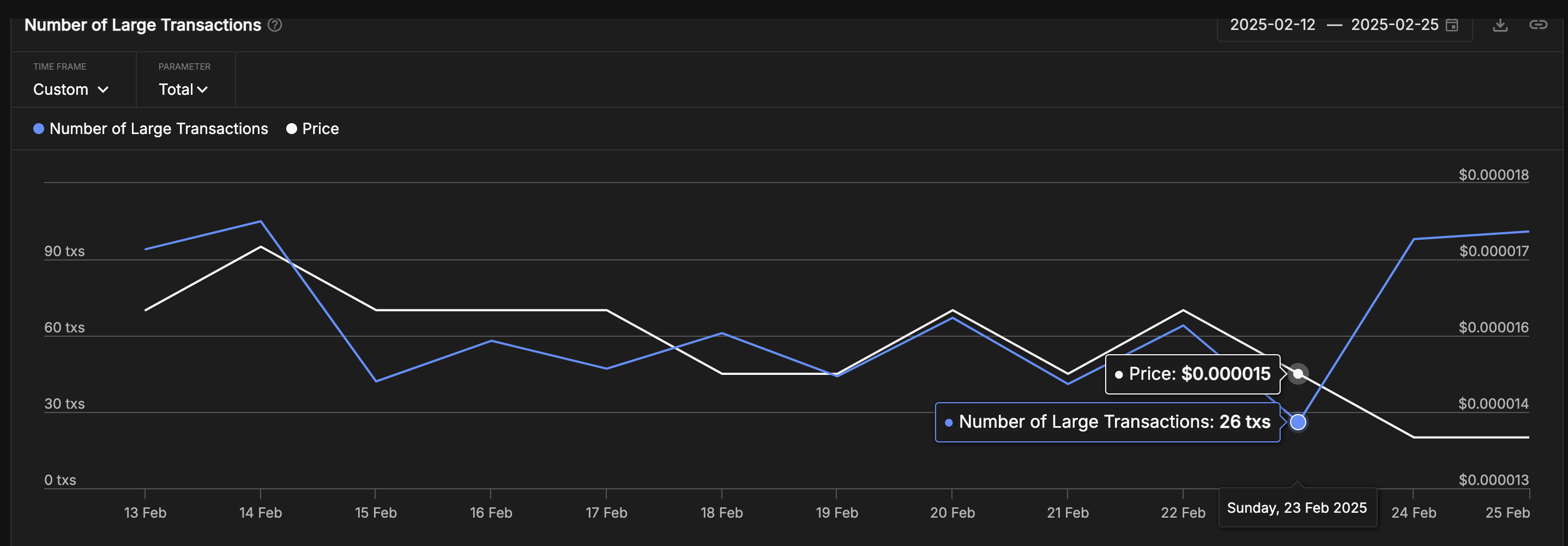

According to Intotheblock, large transactions – those exceeding $ 100,000 – have increased considerably in the past few days. On February 23, the number of these transactions had decreased to only 26 while investors adopted a risk position. However, as the price of SHIB bounced, the activity of the whales increased to 101 transactions by February 25, marking an increase of 288% in just two days.

Shiba Inu Prix vs Shibs Large Transactions

Historically, when whale transactions increase in tandem with a two -digit price gain, it indicates that institutional buyers are the main drivers of the rally.

This suggests that rather than a short -term rebound, the action of SHIB prices can enter a more sustained bullish phase.

If the accumulation of whales continues at this rate, retail merchants can gain confidence and enter the market, which can potentially grow shib towards higher levels of resistance in the coming days.

A decisive rupture greater than 0.000015 could open the way to a movement around $ 0.000017. However, if the requests of whales slows down, the bears can try to bring the price back to the key support to $ 0.000012.

Shiba Inu Prévisions: Bears could bend after an escape of $ 0.00000020

Shiba Inu Price shows signs of a potential optimistic reversal while the Shib bounced 11.36% compared to its recent lower $ 0.000013.

The daily candlestick The structure suggests that buyers intervene near the lower limit of the Keltner canal, signaling the exhaustion of trends in the signaling potential for bears.

A decisive closure greater than 0.0000150 could validate this recovery with another increase in the middle line of the Keltner canal at $ 0.000016.

Shiba Inu price forecasts

Momentum indicators Strengthen this prudence prospects. The MacD histogram begins to move upwards, which suggests that the sales pressure was available.

In addition, the MacD signal line attempts a bullish crossing which, if confirmed, could indicate the start of a larger rally towards resistance at $ 0.000018.

However, non-compliance with the current rebound could lead to another support for $ 0.00001341, with an exposed ventilation of $ 0.000010 as the next bearish target.

If the purchase of the continuous pressure to build, Shib could establish a solid base for an overtaking of $ 0.00000020, where the uncovered sellers could fall back.

However, bulls must defend $ 0.000014 to maintain control and prevent a deeper correction.