DOGECOIN (DOGE), the Origin of Origin, is again at the center of investors’ speculation because it flashes up bull.

Known for its net price oscillations, DOGE has a history of long consolidation phases followed by explosive rallies. Analysts now suggest The token could be about to go up major, with fibonacci trace levels indicating a potential increase of 50%.

The recent bullish configuration has been reinforced by gray levels launch of a DOGECOIN TRUSTThis has aroused increased institutional interest in the medal. The launch of this trust is considered by many as a catalyst for a new traditional Doge’s adoption, adding another layer of optimism to its technical perspectives. Investors are now considering a potential escape, the 50% overvoltage target considered as a key step to watch.

If Dogecoin can erase key resistance levels, the 50% movement can become a reality, creating significant momentum for the same to recover its old summits.

Dogecoin’s historic price cycles indicate potential overvoltage

While DOGE tests the level of critical support of 0.382 FIBONACCI, historical data suggest a high probability of a rebound. If Momentum raises, the price could rally at key resistance levels at $ 0.52, $ 0.59 and potentially $ 0.65. However, non-compliance with the support could cause prolonged slowdowns, delaying any escape.

“Dogecoin has always been unpredictable, but he follows a distinct scheme – Sharp corrections followed by parabolic movements,” noted Crypto James Carter analyst. “Timing is crucial for merchants who seek to capitalize on these oscillations.”

Look at Dogecoin prices analysis

Institutional market feeling and optimism

Beyond technical analysis, wider market factors also shape DOGE trajectory. THE launch From Grayscale, Dogecoin Trust introduced an institutional exposure to assets, further legitimizing its position in cryptographic space. Grayscale, a main asset manager, underlined the transition from DOGE to a joke to a viable payment tool, citing its low transaction costs and its rapid processing speeds.

The announcement of Grayscale Dogecoin Trust. Source: Gray levels via x

“Grayscale thinks that Doge has evolved beyond a simple same. Its accessibility and efficiency make it a solid competitor in the digital payment space ”, the company declared.

This decision comes in the midst of increasing institutional interest in altcoins, with companies like Bitwise, osprése funds and rex actions depositing for funds negotiated in exchange for Dogecoin (ETF). If it is approved, an ETF SPOT DOGE could unlock More and more liquidity and demand, which has increased prices.

The unexpected DOGE factor of the Trump administration

Adding an unexpected touch, Dogecoin has attracted attention American decision -makers. The creation of the Department of Government Effectiveness (DOGE) under President Donald Trump, with the CEO of Tesla and long -standing supporter, Elon Musk, has aroused new speculations.

Source: X

The reports suggest that the White House explores the integration of blockchain into federal systems, potentially using Doge for transactions related to public spending and infrastructure management. While the discussions remain in the beginning, the association itself between the initiatives of Dogecoin and the government Anigration of confidence Among investors.

Could an ETF of Dadecoin trigger the next price rally?

The potential approval of an ETF Spot Dogecoin is A major point interesting for merchants. Historical precedents show that the regulatory approval of ETF Bitcoin initially led to volatility before being realized at a long -term assessment of prices. If the dry grants the approval of the ETF based on DOGE, the token could see a similar trajectory.

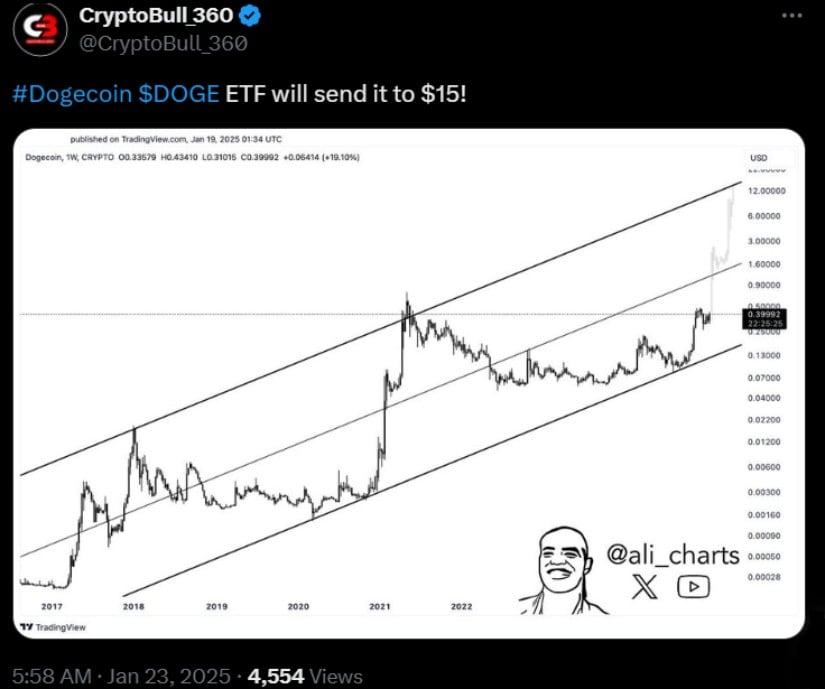

Dogecoin ETF approval could send the price of the DOGE as high as $ 15. Source: Cryptobull_360 via x

However, not all experts are convinced. “Wall Street prefers assets with fundamental solids on coins,” said Crypto Sykes analyst. “An ETF Solana is much more likely in 2025 than an ETF Doge.”

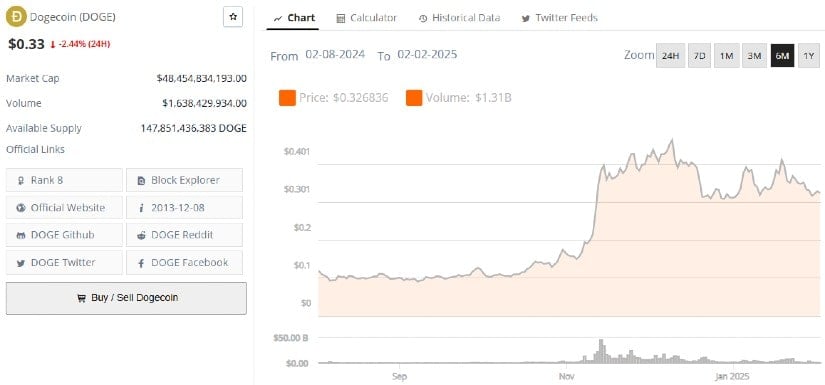

DOGUE (DOGE) Price. Source:Brave new room

Despite skepticism, the probability of DOGE ETF approval In 2025, was 56%, according to the Polymarket market prediction platform. If institutional demand continues to increase, Dogecoin could consolidate its place beyond speculation and settle as a serious financial asset.

Final reflections

The movement of Dogecoin prices remains strongly dependent on the feeling of the market and the macroeconomic conditions. While fibonacci levels point to an bullish escape, external factors such as institutional adoption, ETF approvalsand government initiatives will play a crucial role in determining its Next big movement.

For investors, the key to remember is clear – those who position themselves early could benefit significantly if Doge follows its historic model as Sudden price explosions. If she will reach new summits Stay uncertain, but one thing is clear: the story of Dogecoin is far from over.