Solana Marketplace Updates:

- Solana’s price fell 6% on November 12, ending a seven-day rally that saw SOL topple XRP to become the third-largest cryptocurrency by market capitalization.

- Despite the broader market’s pullback, Solana is showing signs of holding $200 support.

- On-chain data shows that SOL receivers (buyers) continue to outpace senders (sellers).

- Binance listed two newly launched Solana memecoins, ACT and PUNT, on November 11.

Solana price fell 7% from $225 to $205 on Tuesday, ending a seven-day winning streak that saw SOL become the third largest price. cryptocurrency by market capitalization.

However, on-chain data trends suggest that SOL may avoid falling below vital support of $200 following Binance’s recent listing of two newly launched memecoins hosted on the Solana network.

Solana Price Falls 6% as Post-Election Crypto Rally Halts

The global crypto market has been on an uptrend since November 5, propelled by tailwinds from Donald Trump’s election victory.

During this seven-day rally, Solana achieved two major milestones. First, SOL’s market capitalization crossed the $100 billion mark for the first time in three years.

Second, Solana became one of the best-performing mega-cap digital assets, and its market valuation quickly overtook Ripple (XRP) to become the third largest cryptocurrency network.

However, the seven-day winning streak hit a snag on Tuesday with a sharp wave of profit-taking among investors. Bitcoin traders triggered cascading liquidations in the altcoin market.

Solana Price Action, November 2024 | SOLUSD

The SOLUSD daily chart above shows how the price of Solana increased by 43.9%, from $156 on November 5 to a three-year high of $225 in the early hours of November 12.

Following the broader market pullback, Solana price is now back 6% towards the $212 level at press time.

Although Solana’s overbought status has increased the risk of a prolonged correction phase, on-chain data trends suggest that steady demand for its native memecoins could potentially absorb short-term selling pressure.

SOL maintains steady demand as Binance lists ACT and PNUT

As top altcoins like Cardano (ADA) and Shiba Inu (SHIB) succumbed to double-digit corrections during Tuesday’s daily time frame, an announcement from Binance offered a lifeline to Solana bulls.

Monday, Binance exchange announcement the listing of two newly launched Solana memecoins: The AI Prophecy (ACT) and Peanut Squirrels (PNUT).

Within 24 hours of trading on BinanceACT and PNUT saw their market capitalizations grow by more than 400%.

At the time of writing, both assets continue to see considerable demand, reaching $550 million and $450 million in market capitalization, respectively.

As traders and investors flock to purchase these meme tokens, they must acquire the native SOL coins to pay transaction fees, thereby increasing demand and absorbing selling pressure from the market-wide correction.

Additionally, this increase in meme coin trading increases Solana’s popularity, attracting both speculative interest and long-term investors.

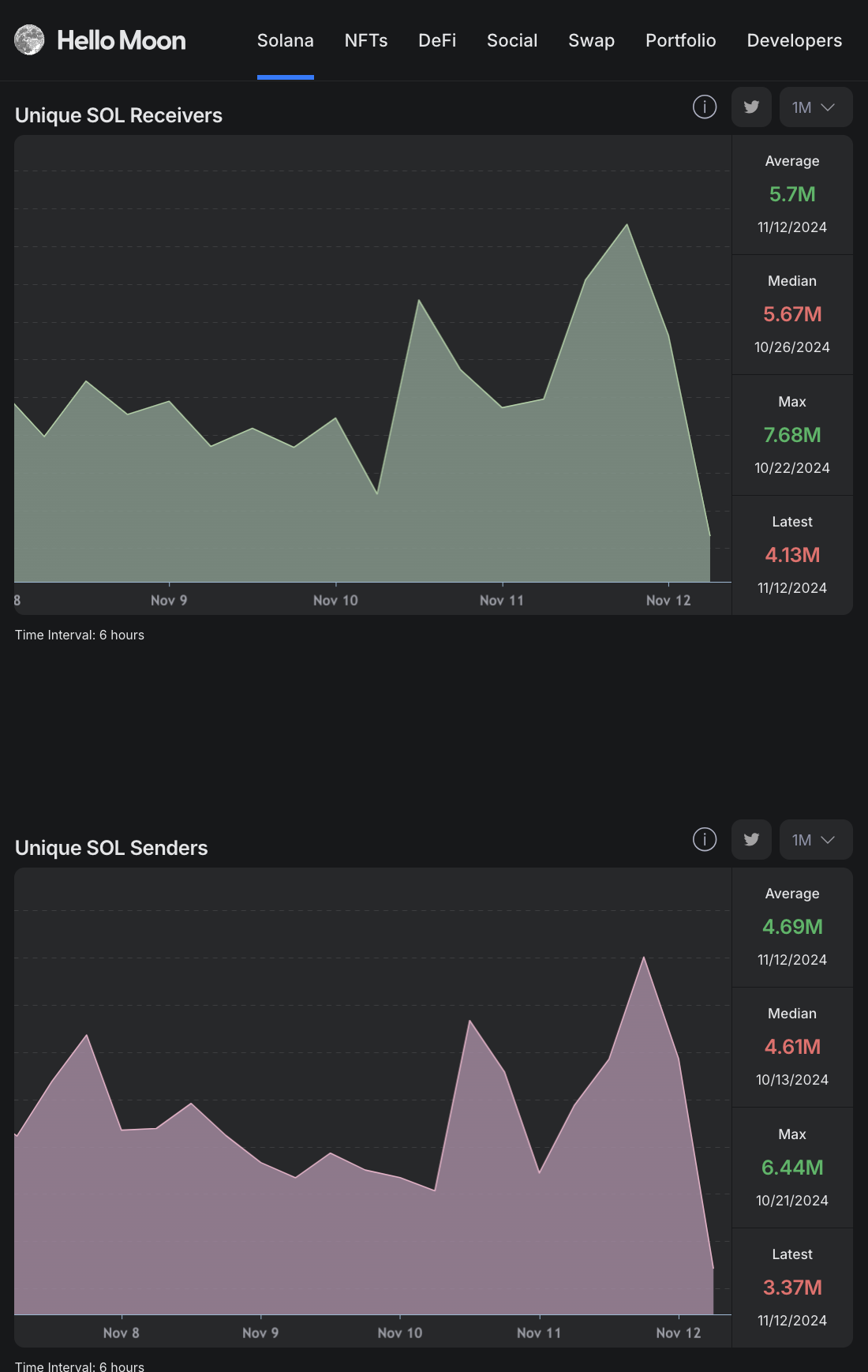

Confirming this position, real-time data pulled from Hellomoon, a Solana-native blockchain analytics platform, shows that the number of active buyers on the network continues to outpace buyers amid Tuesday’s market pullback .

Solana Unique Receivers and Unique Senders, November 2024 | Source: Hello Moon

As shown above, Solana’s unique recipients, which serve as a proxy for tracking the daily number of addresses that have purchased SOL, stand at 4.13 million as of press time on November 12. In comparison, the total number of unique SOL senders, which represent active sellers, is moving toward 3.37 million addresses.

When active buyers outnumber sellers during a market downtrend, it typically signals increased accumulation by buyers, indicating potential support for a price rebound.

In the case of Solana, it appears that demand for ACT and PNUT, which drove both memecoins to a combined market cap of $1 billion within 24 hours of trading on Binance, played a critical role in the maintaining $200 support on Tuesday.

Solana Price Prediction: Breakout of $250 in play SOL closes above $214

After briefly falling below $205 in the early hours of November 12, Solana price quickly recovered to $210, cutting its daily losses to just 5%. The increasing SOL buying pressure seen on Binance’s listing of ACT and PNUT suggests that bulls may be regrouping for another boost.

While Tuesday’s correction wiped out weak hands, the technicals indicators on the daily chart SOLUSD also confirms Solana’s potential for another advance towards $250.

Widening Bollinger bands signal the presence of intense volatility and high trading volume.

However, with Solana price currently around $212 and still trading below VWAP at $213.89, continued bullish momentum is in play.

Solana Price Forecast | SOLUSD

For SOL to regain its bullish momentum for an attempted breakout of $250, it must close above this key resistance level.

On the other hand, Solana’s daily low at $205 could act as immediate support.

But if this initial support level fails to hold, it could invalidate the bullish forecasts and open the door for a possible extension of the correction phase towards the 20-day moving average price around $182.