Solara (GROUND) The price has trouble below $ 200, currently down by almost 13% in the last 30 days. Despite a strong momentum in previous months, recent indicators suggest a weakening trend, the lowering signals dominating the graphics.

The Ichimoku cloud, the ADX and the price action all indicate continuous challenges because Sol fails to recover key resistance levels. However, if the purchase of pressure and floor yields can exceed $ 209, a path to $ 219 and even $ 244 could open.

Users discuss scams and the use of Solana even Coin

Solana was examined after the launch of Balance, a Even controversial even Promé Promé Promé by the president of Argentina, Javier Milei.

The consequences of this Pump-And-Dump potential has led many users to question Solana applicationslike meteors and pumps. The community is also concerned about whether the blockchain itself has culminated in terms of adoption and prices.

Some users, such as the popular artist Gino Borri, argue that Solana applications like Jupiter, Pumpfun and Meteora extract the value of users to scams. This raises concerns about the functioning of projects in the ecosystem.

“The radio silence of Solana’s management while their community is scammed several times a day at the Olympic Mass extraction Games sponsored by Jupiter, Meteora and Pumpfun”, Gino Borri poster On X (formerly Twitter).

Others, like the contributor of Defillama 0xngmi, shared data on the quantity of value taken from the trading of memes on the chain.

“Calculated the total extracted from the same on Solana. Boots trapuses and applications: $ 1.09 billion; pump.fun: $ 492 million; MEV: 1.5 to 2 billion dollars; Trump Insiders: 0.5 to 1 billion dollars; AMMS: 0 to 2 billion dollars; Total: $ 3.6 at $ 6.6 + billion ”0xngmi wrote.

However, Mert, CEO of Helius, a Solara Infrastructure provider, thwarts that the high number of scams is a by-product of the Solana scale rather than an inherent defect.

He suggests that generalized use naturally attracts bad actors, similar to what happened in other major blockchain ecosystems.

“I hope that the last one I will say on this subject: the crypto is full of speculation -> speculation leads to carpets -> Solana Scales Crypto -> There are more carpets on Solana. All chains with sufficient activity will have tons as the crypto grows and the regulations mature – and they all have it historically BTW (Icos, NFTS, etc.). This is a transitional period. The solution is better launch mechanisms, better regulation and better standards. When you do all of this, it will be better but it will never disappear as long as there are humans on the other side, ”Mert Mumtaz wrote on X.

Solara The indicators are always lowered

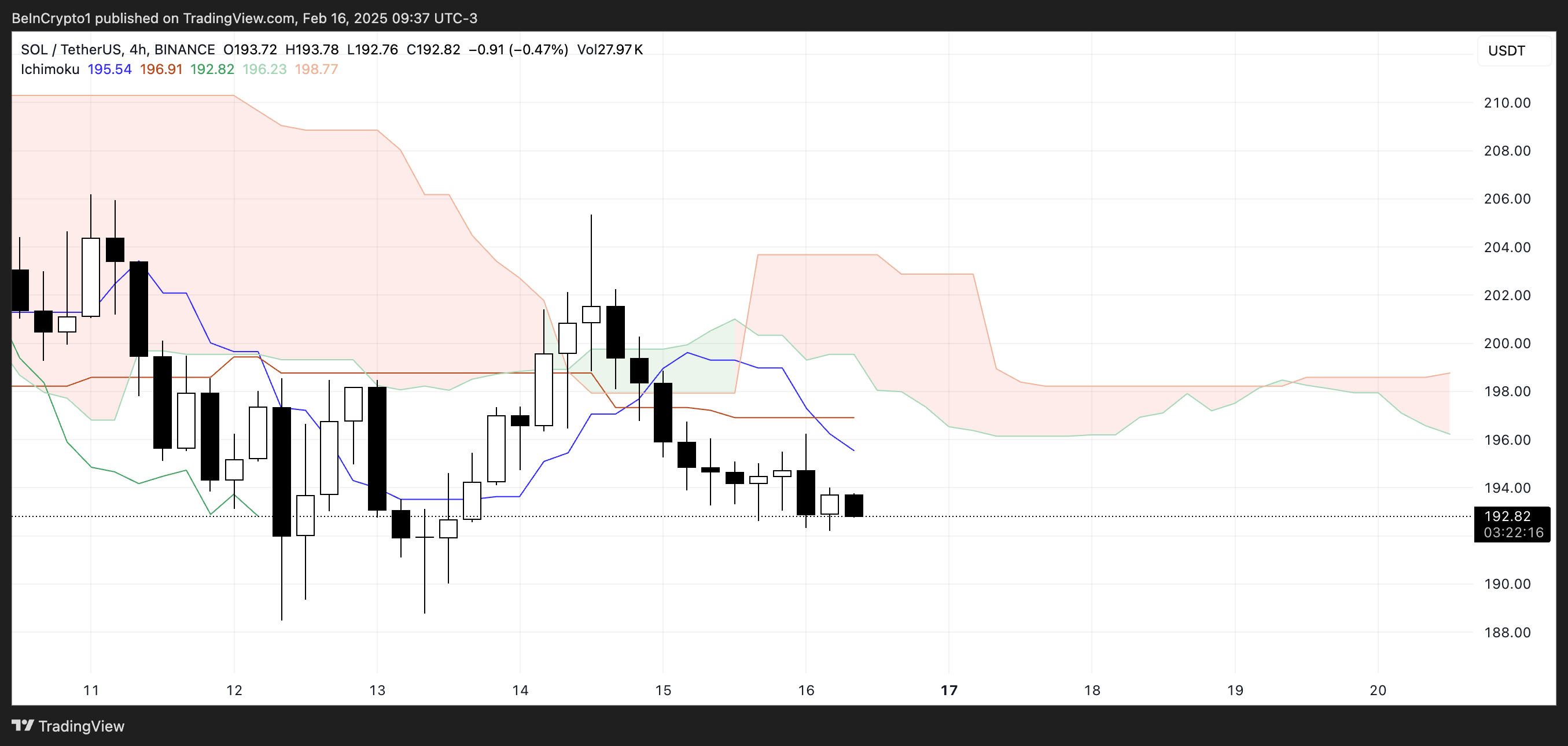

The Ichimoku cloud painting for Solana shows a Lowering perspectivesWith traditional prices below the cloud and key indicators suggesting low momentum.

The conversion line (blue) is below the basic line (brunette), indicating short -term weakness. In addition, the upcoming cloud remains red, suggesting a continuous bearish feeling.

For Soil price To resume the bullish momentum, he should surpass himself above the cloud resistance around $ 198 and maintain a step beyond $ 200.

If Sol does not manage to recover the key levels, the pressure downwards could persist.

A change of trend would require soil growing above the conversion and reference lines, in parallel with the increase in volume to confirm the bullish force. Until then, the price action remains under lower control.

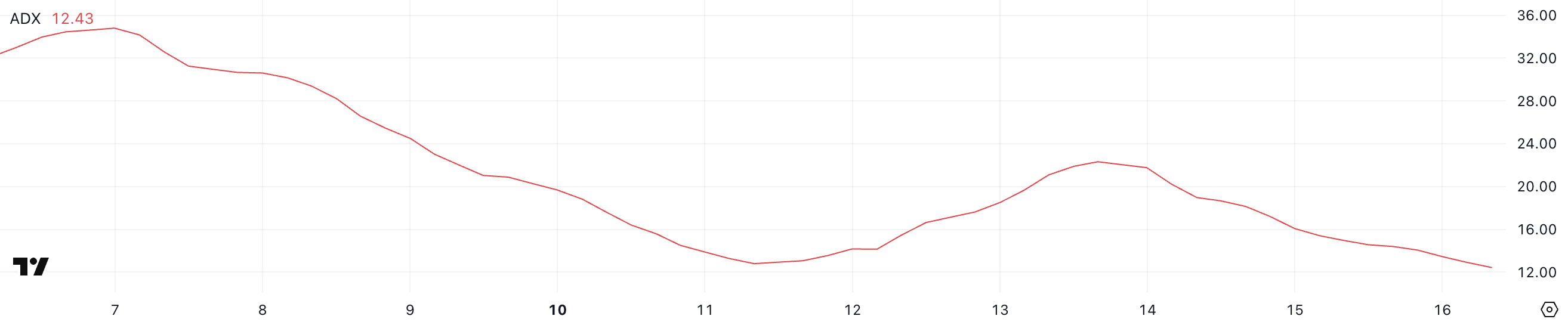

Solara Average directional index (ADX) is currently at 12:44 p.m., against 22.3 three days ago. ADX measures resistance to trend, with values above 25 indicating a strong trend lower than 20 suggesting a low trend or without trend.

The drop in ADX indicates that the current solara decreased trend loses momentum, but it has not yet reversed.

A low ADX reading like 12.4 suggests that the downward trend in progress lacks high directional pressure. Although this may mean that the sales pressure is weakening, it also indicates that Soil price lacks the strength of a significant reversal.

For a bullish change, ADX should exceed 20 while the action of prices shows signs of recovery, such as higher ups and higher stockings. Until then, soil remains vulnerable downward or consolidation.

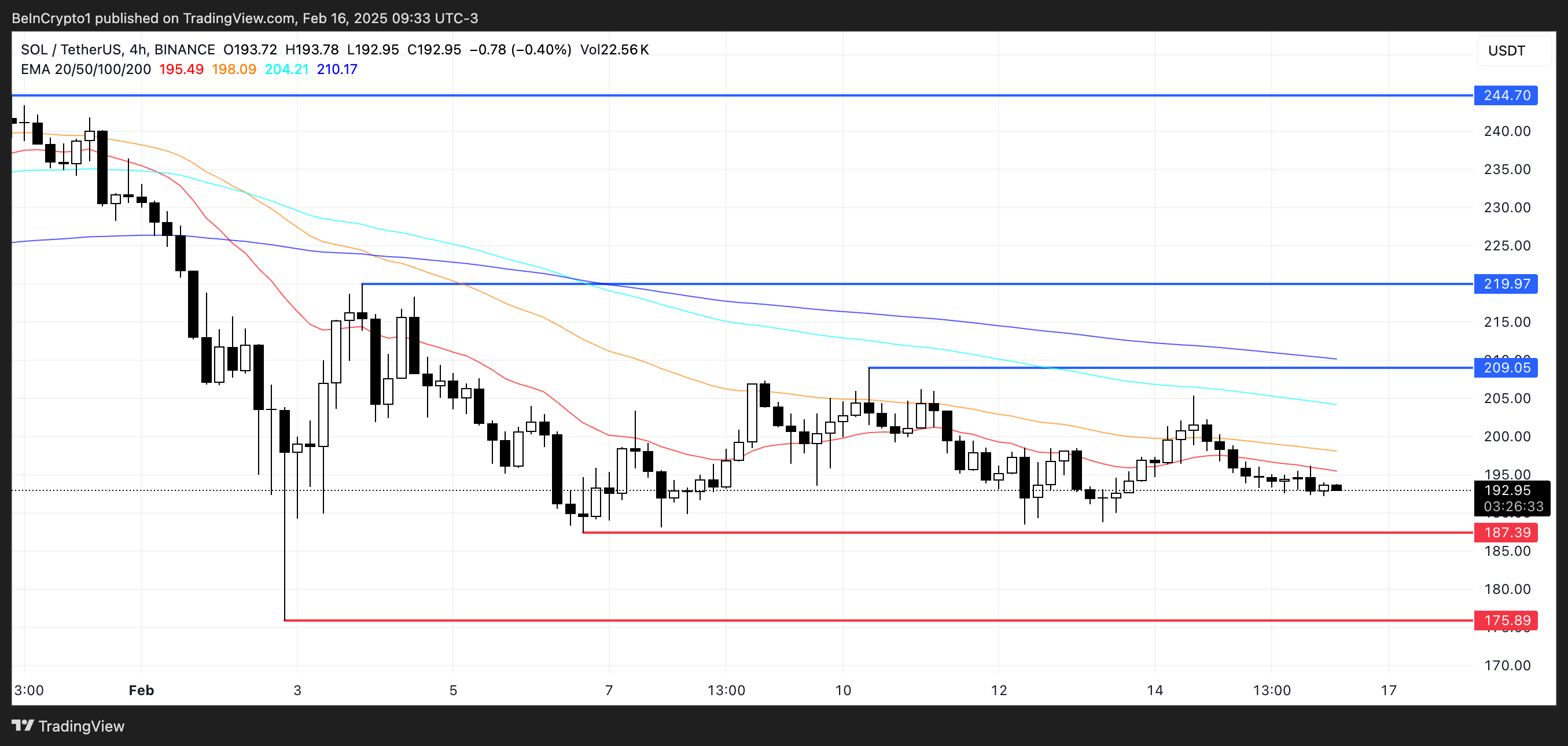

Sol price prediction: Will Sol will recover $ 209 soon?

Solana is struggling To recover levels above $ 205, constantly passing below $ 200 when it does not break this resistance.

If Sol Sol tests the support of $ 187 again and does not hold, it could extend the losses to $ 175, reporting a new weakness.

On the other hand, if Solana price Resumes the strong momentum observed in the previous months and enters a clear rise trend, it could push towards the resistance of $ 209.

An escape above this level would open the door to a rally at $ 219, and if the optimistic force continues, Sol could even review $ 244.

Non-liability clause

Online with the Project of confidence Guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our Terms and Conditions,, Privacy PolicyAnd Warning have been updated.