Net whale flows increase by 16%

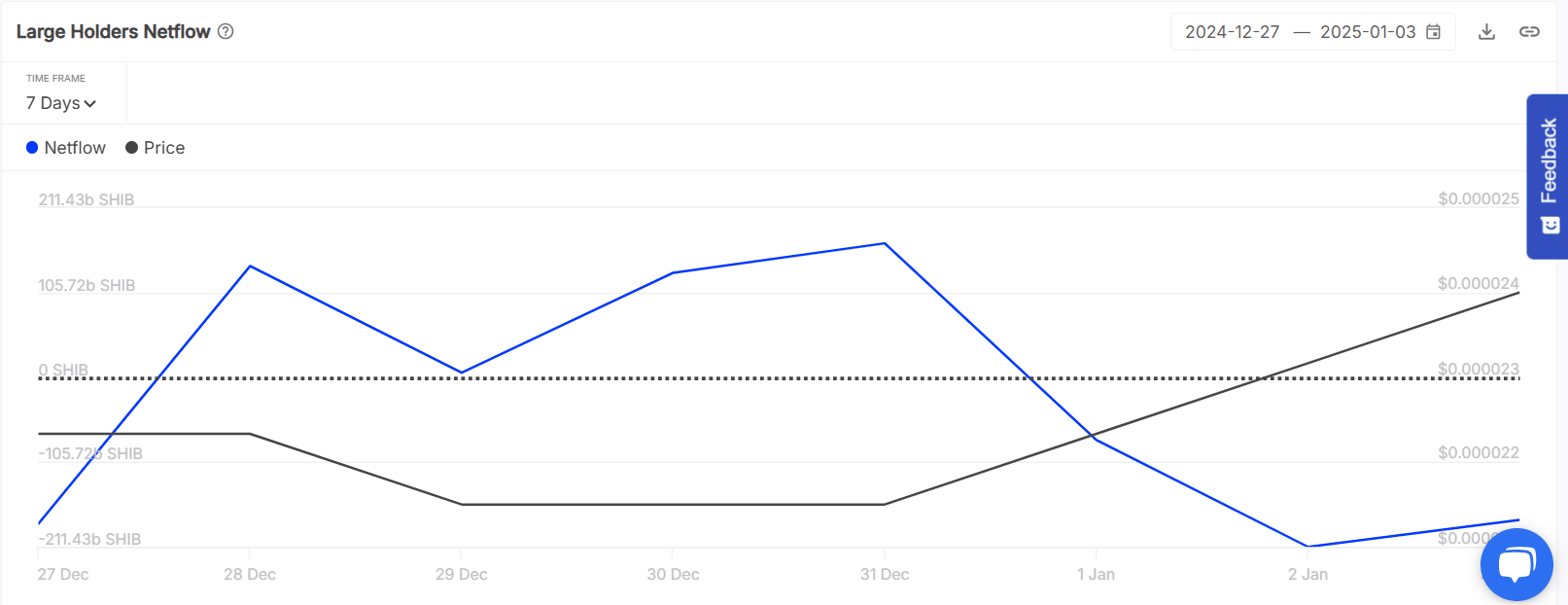

Over the past week, net flows from large Shiba Inu holders saw a 16% increase, according to data from In the block. This metric tracks the balance of coins entering and exiting wallets that hold more than 0.1% of the circulating supply of SHIB, primarily whale addresses.

The chart highlighted significant net inflows early in the week as these whale investors actively accumulated SHIB. However, a sharp drop in net flows towards the end of the week coincided with a gradual recovery of SHIB price.

Steady accumulation by large holders is a bullish indicator, often signifying confidence in the token’s long-term prospects. This trend not only strengthens SHIB’s price momentum, but also sets the stage for a potential upward movement, supported by the continued commitment of its whale investors.

Traders refrain from selling, contributing to rising SHIB prices

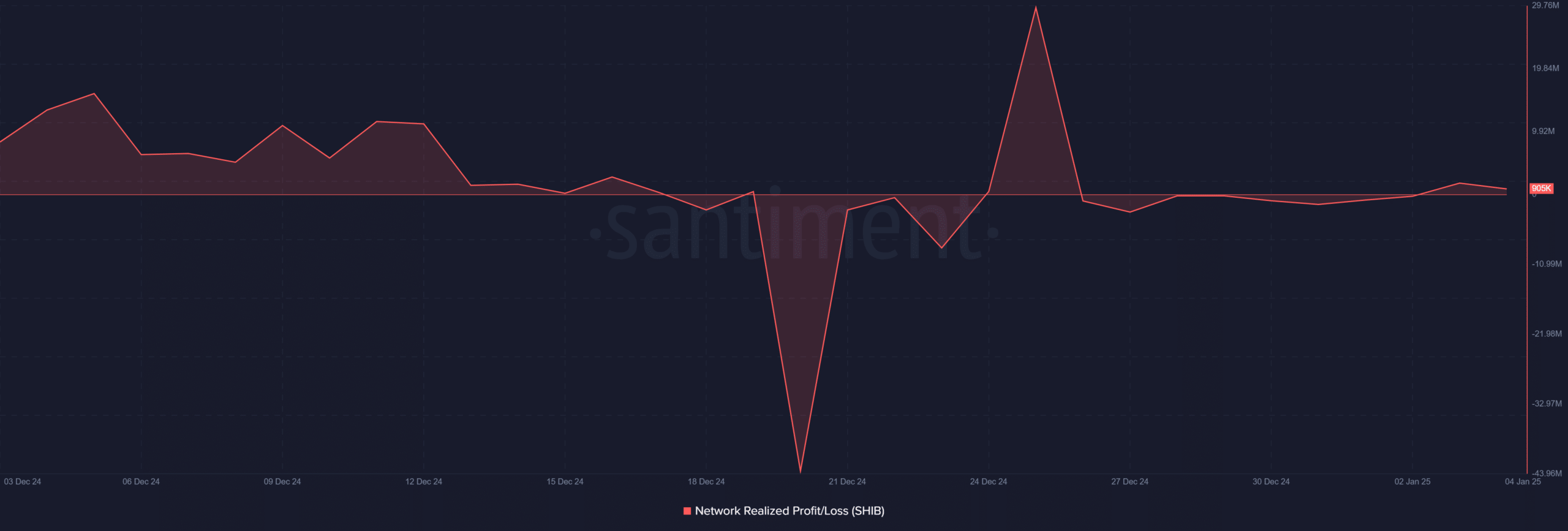

The profit/loss chart on SHIB’s network highlighted a mostly negative trend over the past week, suggesting that many traders who sold their holdings did so at a loss. This behavior, as Santiment data shows, indicates reduced selling activity, driven by holders’ reluctance to lock in their losses.

Therefore, this decline in selling pressure has played a central role in supporting SHIB’s recent price rally. By holding on to their tokens, investors demonstrated their confidence in SHIB’s recovery potential, further fueling its bullish momentum.

Is your wallet green? Discover the SHIB Profit Calculator