Shiba Inu (Salogner) was negotiated well below $ 0,000020 in the last month, experiencing a 30% drop in February. Its market capitalization is now 8.25 billion dollars. Despite this slowdown, the technical indicators of SHIB have mixed signals, suggesting the possibility of a trend reversal.

RSI Recently recovered, and Bbtrend has become positive, indicating a potential change in the purchase of interest. However, its EMA lines remain in a lower configuration, showing that Shib is still faced with challenges in the establishment of a strong upward trend.

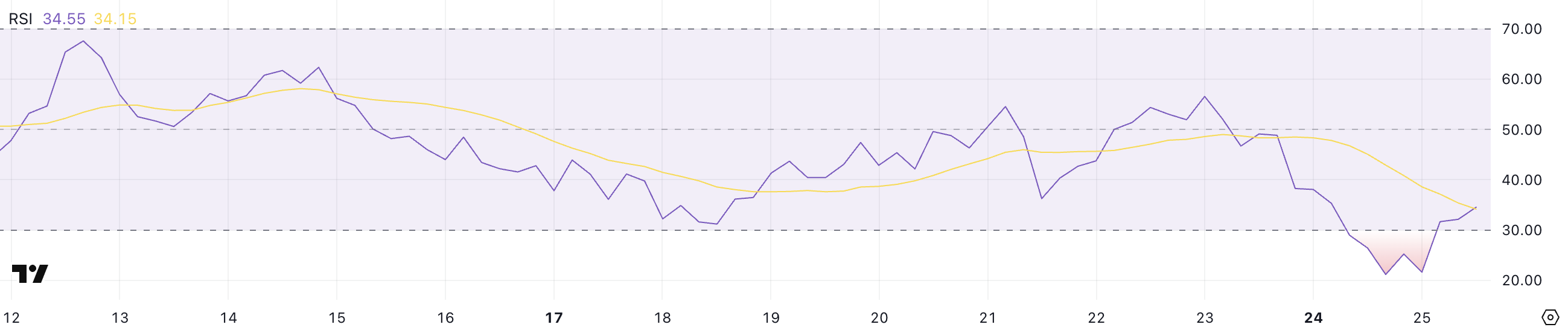

SHIB RSI is now neutral after having occurred

The SHIB RSI is currently at 34.5, after diving at 21.6 a few hours ago. This marks a sharp decline of 56.5 only two days ago.

RSI, or Relative force indexMeasures the speed and variation of price movements, helping merchants to identify the surachat or surveillance conditions.

It varies from 0 to 100, with values greater than 70 indicating surachat conditions and less than 30 suggesting occurrence levels. The recent fall of Shib in the territory of the occurrence Marked the first time that has happened since February 3, indicating intense sales pressure.

With RSI now at 34.5, Shib is recovering from surveillance conditions but remains in a fragile state. This level suggests that the sale of the momentum slows down, perhaps preparing the land for a short-term rebound.

However, the current RSI is still relatively low, indicating that the lowering feeling persists. If RSI continues to rise above 40, it could point out a change to Renewal of purchase interest.

Conversely, if it falls below 30, Shib could face another wave of sales pressure.

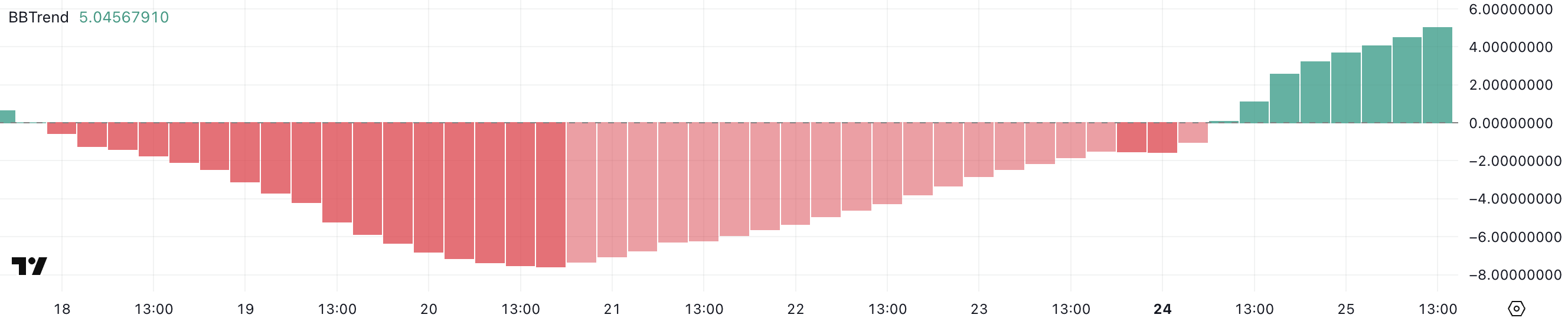

Shiba Inu Bbtrend is now positive, but not yet durable

Bbtrend de Shiba Inu became positive between yesterday and today, currently seated at 5 years after having gone from -1.55 barely one day. Bbtrend is an indicator derived from Bollinger bands which measures the strength and direction of a trend.

The positive values indicate a bullish impulse, while the negative values indicate a downward pressure.

Bbtrend de Shib had been negative for six consecutive days, reaching a hollow of -7.58 on February 20. This weak reflected strong sales pressure before this recent reversion.

With Bbtrend now at 5 years old, Shiba Inu shows signs of renewed purchase interest and a potential optimistic momentum. This positive change suggests that buyers take control, increasing the probability of a short -term trend.

However, although Bbtrend’s positive turn is encouraging, it is still at relatively low levels compared to previous rallies. If Bbtrend continues to increase, this would confirm the strengthening of the bullish feeling.

On the other hand, if this starts to refuse again, it could indicate that the purchase of the momentum is unleashed, which potentially leads to a decline in prices.

Shiba Inu could rally 42% if a golden cross forms

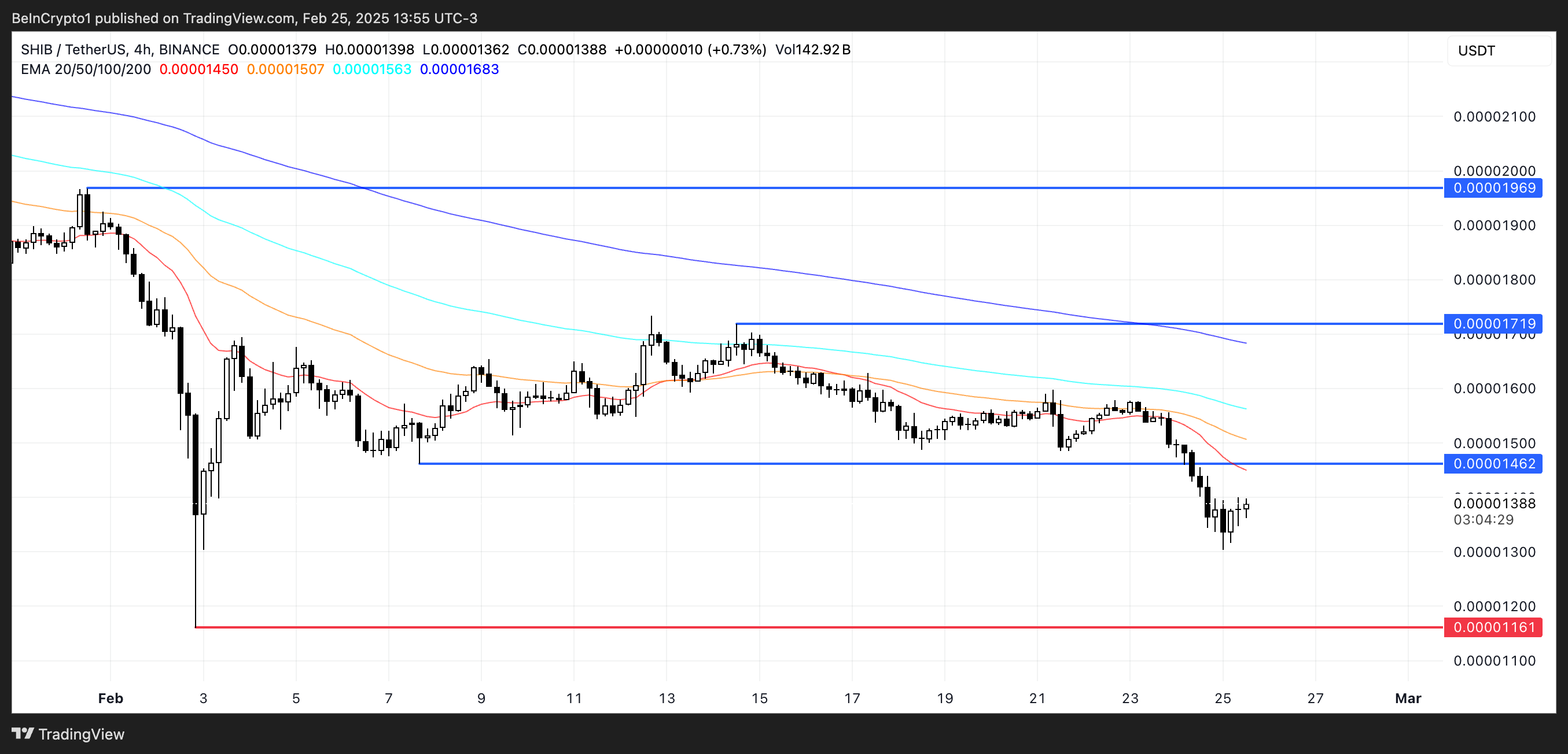

The Shiba Inu Prix has recently dropped Below $ 0.000014 for the first time since early February, reflecting a continuation of its downward trend. Its EMA lines are always in a lower configuration, with short -term EMAs positioned below those in the long term, indicating persistent sales pressure.

If this downward trend continues, Shib could test the support At $ 0.0000,000,116, potentially decreased below $ 0.000012 for the first time since August 2024. The large separation between EMA suggests a strong downward momentum, which makes it difficult for buyers to regain control.

However, if Shib managed to reverse this trend, it could test the resistance at $ 0.0000146. The rupture of this level could trigger a gathering at $ 0.000017. In addition, if this resistance is exceeded, The price of Shiba Inu could continue to increase at $ 0.0000,196.

A strong purchasing dynamic could lead the meme part to exceed $ 0,00002 for the first time since the end of January.

In order for this optimistic scenario to take place, the short-term EMA should cross the EMAs above those in the long term, confirming a trend reversal. Until then, the configuration of the EMA Bearish suggests that the downward pressure is likely to persist.

Non-liability clause

Online with the Project of confidence Guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our Terms and Conditions,, Privacy PolicyAnd Warning have been updated.