Shiba Inu (SHIB), the second largest piece of cryptographic memes in the world, is underway for the upward momentum because it has formed a bruise price model after having experienced a significant price drop in recent days . This bullish trend in the coin follows a passage from the feeling of the negative to the positive.

SHIB PRICE BREAKOUT? Key levels to monitor

In recent days, due to the feeling of the lowering market and a fight to take momentum, Shib was found in consolidating. However, as the feeling moves and begins to recover, the meme piece has reached the level of escape of a triangular ascending price action model formed over the four -hour period.

Based on historical price models, the memes piece has tested this level several times, undergoing sales pressure each time. However, the feeling now seems to be recovering and the price of the medal is close to the level of escape.

If SHIB successfully lost the model and closes a four-hour candle above the level of $ 0.000017, there is a high possibility that it can rise by 20% to reach $ 0.00000020 in the near future.

Mixed feeling of traders and investors

Looking at the upward perspectives, traders and investors showed a strong interest in the memes play. In addition, while some are betting on Shib, others throw their assets on exchanges, according to Rinsing data.

The Flow / Overtle spot data reveal that exchanges experienced a significant influx of 1.65 million dollars of Shib. This seems to coincide with prices overvoltage, indicating a potential sale or dumping ground. These exchanges inputs have the potential to create sales pressure and reduce price reductions.

Meanwhile, intraday traders seem optimistic because they have increased their open positions. Shib’s open interest has increased by 12% in the last 24 hours, indicating the training and accumulation of new positions.

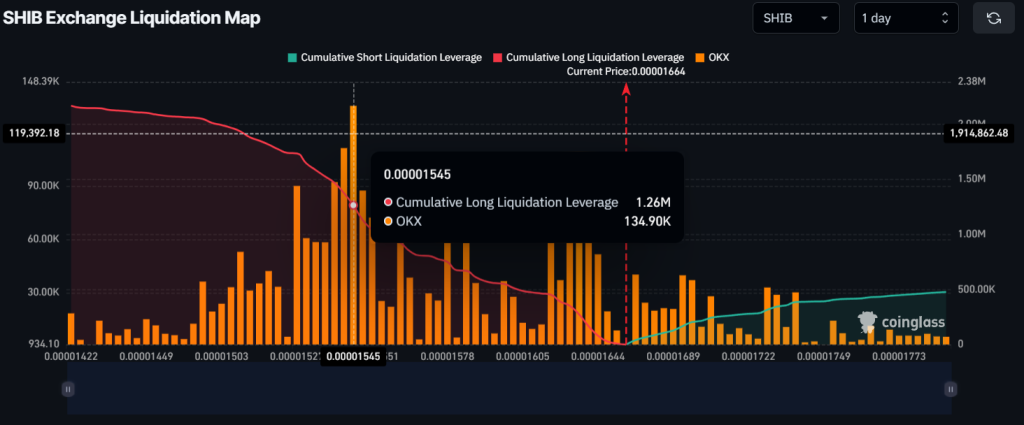

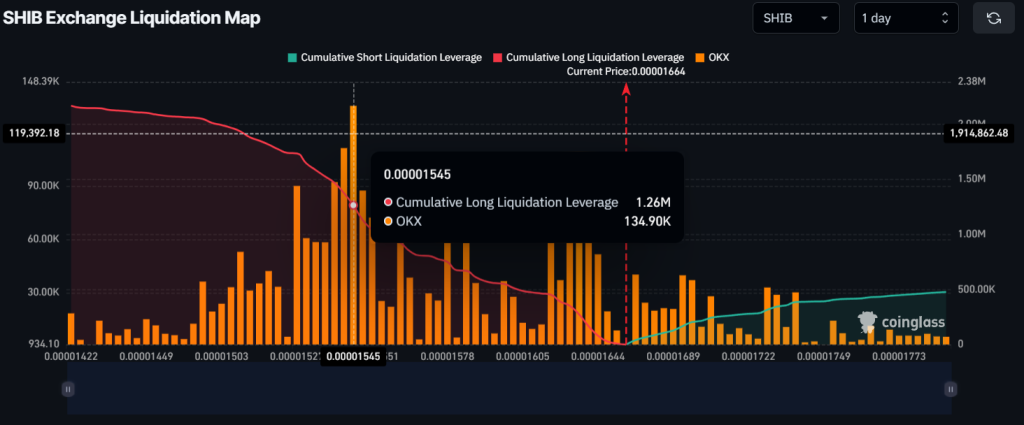

Major liquidation level

At the time of the press, the main levels of liquidation, where traders are overvalued, are $ 0.0000,1545 on the lower side and $ 0.00001695 on the upper side. Traders hold $ 1.26 million in long positions and $ 166,369 in short positions at these levels.

Channel metrics support Shib’s optimistic short -term configuration, but traders must monitor a decisive break greater than 0.000017 to confirm the upward trend.