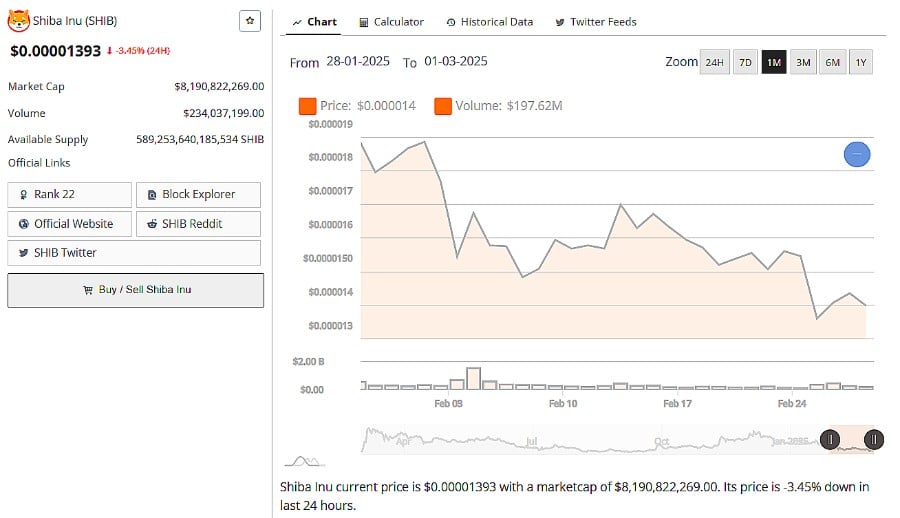

Shiba Inu (SHIB) remains in a clear decrease trend, with a dominant downtime moment both daily deadlines (1D) and four hours (4 hours). Traders and investors should closely monitor key technical levels to assess potential inversions or other drops.

Since the latest data, Shib is negotiated to 0.0000001393 and continues to expose a lower price action. The asset is currently below the exponential mobile average of 50 days (EMA) and the 200 -day EMA, strengthening the strength of the continuous decrease trend.

-

- Mobile mediums: The price of SHIB remains below the 50 EMA and 200 EMA, which indicates a sustained down momentum.

- Relative force index (RSI): The RSI oscillates around 40 years, indicating that there is room for more decline before Shib only reaches the surveillance conditions.

- Key resistance areas: Two significant blocks are formed in this structure, which can act as high levels of resistance if drying tries to rupture.

Watch the analysis of Shiba Inu prices

https://www.youtube.com/watch?

Analysis of the four -hour period

On the time 4 hours, the downward trend persists, with a contact with the 50 EMAs but not undressing above.

Shib just touches 50 EMAs

- Key technical levels:

- Shib is negotiated below the 50 EMA and 200 EMA, indicating that the sellers remain in control.

- There is a low limbs block which aligns for the 50 EMAs which could provide temporary resistance, but it may not worry about high sales pressure.

- A resistance block near the top of the current price leg could serve as a key level to look at.

The relative resistance index of the SHIB is neutral

RSI levels: Currently at 55, the RSI suggests neutral impulse. However, as Shib remains below the averages of crucial moving, optimistic confirmation is still lacking.

- Potential scenarios:

- If Shib is successfully breaking above 50 EMAs and maintains it as a support, the next level of major resistance would be 200 EMA.

- If the price does not hold above the 50 EMAs and falls below recent stockings, the next solid support area will come into play.

Final verdict: the trend remains down

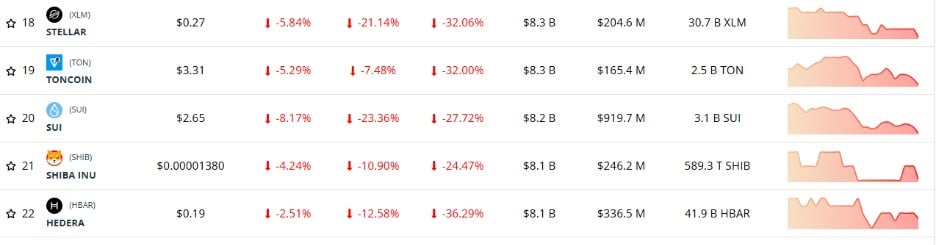

The downward trend of SHIB is currently reflecting the entire cryptography sector

Daily deadlines and four hours confirm that Shib remains in a downward trend. Until the price decomposes decisively above the 50 EMA over higher deadlines and holds it as a support, there is no confirmation of a change of momentum. At the same time, like Shib continues its burning strategyIts overall price movement is not out of step with the entire cryptography market which is currently in short -term and red downward territory at all levels.

For a potential optimistic reversal, the following conditions should be met:

- Shib must push above the EMA 50 and establish it as a level of support.

- RSI should exceed 60 on 1D and 4 hours graphics.

- The broader feeling of the market, in particular the movement of bitcoin prices, should remain favorable, because altcoins like shib are strongly influenced by the global trends in the cryptography market.

Strategic considerations

- Short -term merchants May want to wait a confirmation above the keys to resistance levels before entering the positions.

- Long -term investors could consider an average cost strategy in dollars (DCA) at historic support levels, but should remain patient given the continuous downward trend.

As always, market players should monitor Bitcoin movementsBecause it often dictates the overall orientation of the market for altcoins.