Shiba Inu (Shib) and Stellar (XLM) drew attention due to fundamental solids.

The best crypto choices for 2025: Can Shiba Inu can provide massive yields while stellar targets a recovery of 16%?

Shiba Inu experienced an increase of 7,200% in the burning rate and stellar targets a recovery of 16%.

STELLAR EYES (XLM) $ 0.40

Stellar (XLM) is consolidated after a volatile period and is currently at $ 0.38. These are critical support and resistance levels that will determine the next movement. Holding the support of $ 0.35, which is the 100 -day EMA, is essential for the ascending momentum to continue. If the demand increases, XLM could test a psychological resistance of $ 0.40, then $ 0.44 and $ 0.45.

Daily table XLM / USD. Source: Commercial view

$ 0.44 – $ 0.45 was a resistance area in the past, so a break greater than $ 0.40 will be the trigger of more action. The techniques show that XLM is occurring, so if the volume arrives, we could see a rebound. The next resistance is $ 0.47 if the bulls continue. If XLM falls below $ 0.35, the 200 -day EMA at $ 0.33 is the following level to look at.

A break below which could see a passage to $ 0.27 which was the price before the gathering of November 2024. The wider trends in the market, in particular Bitcoin, will be the engine of the XLM movement in the coming weeks.

Altcoin increases in the fourth quarter of 2024 has propelled XLM from $ 0.075 to a maximum of $ 0.63. Despite a retracement, the token retains a substantial annual gain greater than 280%. In addition, the recent partnership The United Nations Development Program (UNDP) to improve the adoption of blockchain has strengthened the confidence of investors.

Another collaboration with OpenZeppelin should facilitate the development of sophisticated decentralized applications (DAPP) on the stellar network.

These positive progress has led to a feeling of bull community, with a recent stellar XLM predictions a potential price increase to $ 0.79.

The Shiba Inu burns increases, the optimism of the fuel market

Shiba Inu (SHIB), one of the most popular tokens, rises due to a huge increase in the burning rate, which will have an impact on the price. Shibtorch V2 The new token combustion mechanism increased the burning rate by 7200%, with more than 1.1 billion tokens burned in one day.

Since 2020, more than 410 billions of sampon tokens have been burned, so that the community is serious to reduce supply and to potentially growing value.

This increase in the combustion of tokens coincided with an increase in prices of 4%, bringing SHIB to $ 0.0000,196. The technical indicators on the four -hour graph suggest the increase in the bullish momentum. The relative resistance index (RSI) is close to 58, signaling a neutral perspective to paved among the merchants.

SPH / USD Daily that. Source: Commercial view

In addition, the divergence of mobile average convergence (MacD) shows several green histogram bars, the MacD line crossing the signal line, supporting the bullish feeling more.

If the purchase of pressure argues, Shib could exceed its current resistance at $ 0.0000,197 and aim for $ 0.00003. However, maintaining support at $ 0.000018 is crucial for continuous prices growth. If the feeling of the market is weakening, a drop less than 0.0000174 could result in additional sales pressure.

Market consent and commercial considerations

Traders monitoring these assets should assess technical indicators as well as wider market conditions. For Stellar, supporting support of $ 0.35 and exceeding $ 0.40 would confirm an upward trajectory to $ 0.44 to $ 0.45. However, non-compliance with these levels could lower the price to $ 0.33 or less.

For Shiba InuThe rapid increase in its burning rate is a promising long -term factor. Hold above $ 0.000018 could open the door for award-up to $ 0.00003. However, if Shib falls below his support, additional declines could occur.

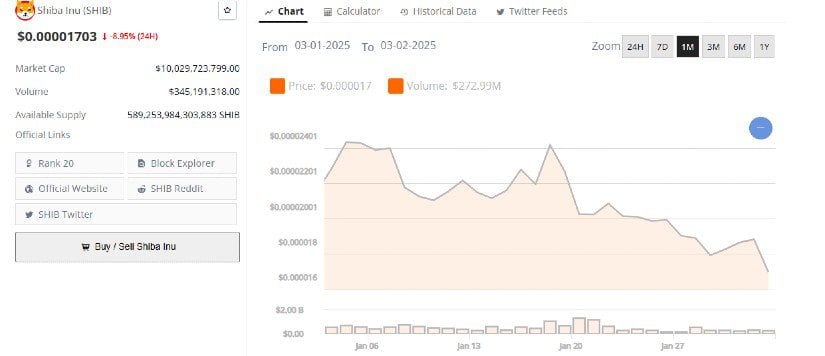

Shib / USD monthly price action. Source: Brave new room

Analysts suggest that Shib is consolidation In the range of 0.00000018 to $ 0.000020 and if it holds here, it could be a big decision.

Stellar’s real world use cases

Beyond the techniques, the reality of Stellar global use case Attract attention. With the Décaf, the stellar network allows digital payments in non -banished regions.

For example, an entrepreneur in Australia, Zac Borrowdale, now pays his USDC employees who can be converted into a local currency to Colombia. Previously, ZAC had to make dangerous trips to Medellín to withdraw money, so it is a case of real world use for Stellar blockchain for financial inclusion.

This integration puts stellar in a better position on the market, because more and more institutions explore blockchain for global transactions. As adoption increases, Stellar could see more demand and therefore more price moments.

Buy the dive?

Shiba Inu and Stellar both present opportunities for traders; This is just a question of price levels and market feelings. XLM could bounce back to $ 0.40 and increase, and its use case for financial services is good for long -term growth. The burning mechanism of Inu Shiba reduces the supply and if the demand is stable, it could be good for the price over time.

Both are opportunities, but these are price levels. Stellar’s recent work on financial inclusion via blockchain is good for the use of the real world, which could lead to more adoption and price. The community of Shiba Inu manages the offer, and it’s good for the price.