Shiba InuSHIB) price has seen a 10% decline over the past seven days, but it remains the second largest coin on the market, behind Dogecoin. Despite the recent setback, SHIB ROI has been rising steadily, indicating improving buying momentum and a potential shift in market sentiment.

Whale activity has stabilized after a brief decline, suggesting a pause in accumulation and distribution, which could lead to near-term price consolidation. With SHIB trading within a defined range, breaking key resistance could open the door to a 29.5% upside.

Shiba Inu RSI is currently neutral, but rising

Shiba Inu The Relative Strength Index (RSI) currently stands at 52.6, up significantly from 41 just two days ago. This increase reflects a notable change in market sentiment, with buying momentum gaining traction after a period of relative weakness.

The RSI is now in the neutral zone, suggesting that neither buyers nor sellers have overwhelming control. However, the upward movement indicates improving conditions for the SHIB Price in the short term.

RSI, a momentum oscillator, measures the speed and magnitude of price changes on a scale of 0 to 100. Values above 70 indicate overbought conditions, which can lead to a price correction, while values Below 30 signal oversold conditions, often preceding a rebound.

With Shiba Inu RSI at 52.6, the coin is in a balanced range, providing room for further upward movement if buying pressure continues to intensify. However, the neutral RSI also implies that the price could stabilize unless a strong catalyst drives momentum in one direction or the other.

SHIB whales now stable after 3-day decline

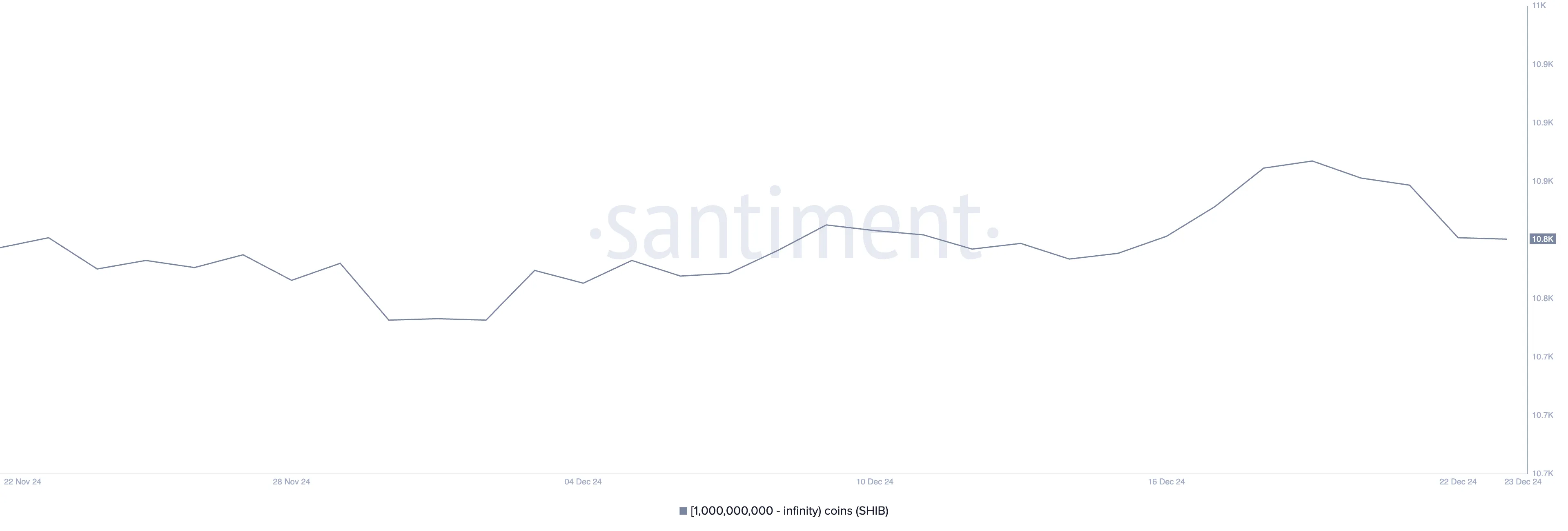

Between December 14 and 19, the number of addresses holding at least 1 billion SHIB increased from 10,861 to 10,930, signaling a notable accumulation among large holders during this period.

This growth suggests increased confidence in SHIB from major investors, or “whales”, who often play an important role in the evolution of markets due to the sheer size of their holdings. Such accumulation may indicate bullish sentiment and support price stability or bullish momentum.

However, after peaking at 10,930 on December 19, the number of SHIB whale addresses began to decline and has since stabilized at 10,875 over the past two days. This recent stabilization suggests a pause in accumulation and distribution, indicating that whales may be waiting for clearer signals from the market before taking further action.

In the short term, this could mean that Shiba Inu Price could consolidate, because the absence of significant whale activity could reduce volatility and momentum in both directions.

SHIB Price Prediction: A Potential Upside of 29.5%

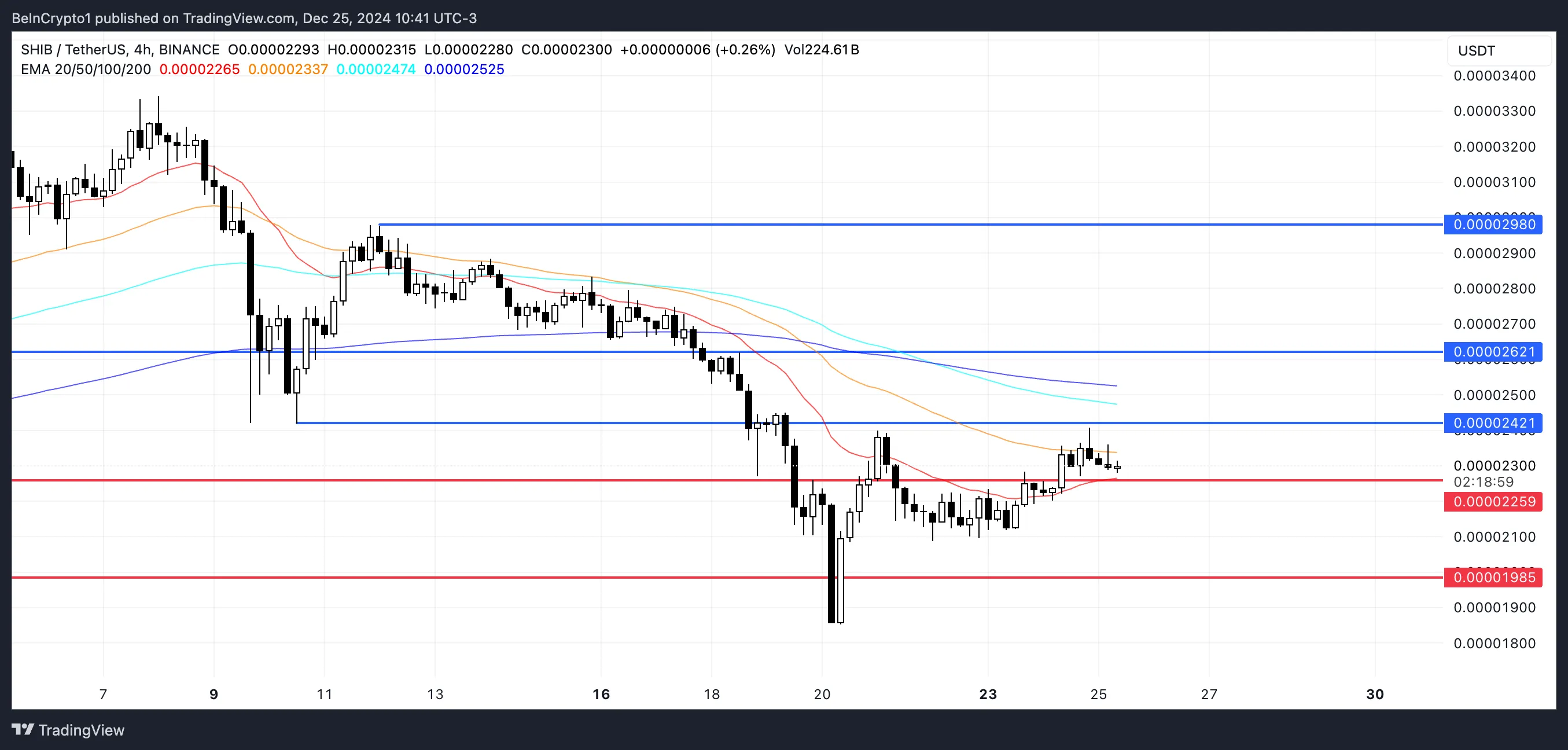

SHIB Price is currently trading in a tight range, with resistance at $0.000024 and support at $0.00002259 defining its immediate limits.

If support at $0.00002259 fails to hold, the market’s second-largest coin could face further downward pressure, potentially falling to $0.00001985.

Conversely, if SHIB Price can surpass the resistance of $0.000024, it could gain upward momentum and test the next level at $0.000026.

If this level is breached, the price could continue its rise towards $0.0000298, representing a potential upside of 29.5%.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.