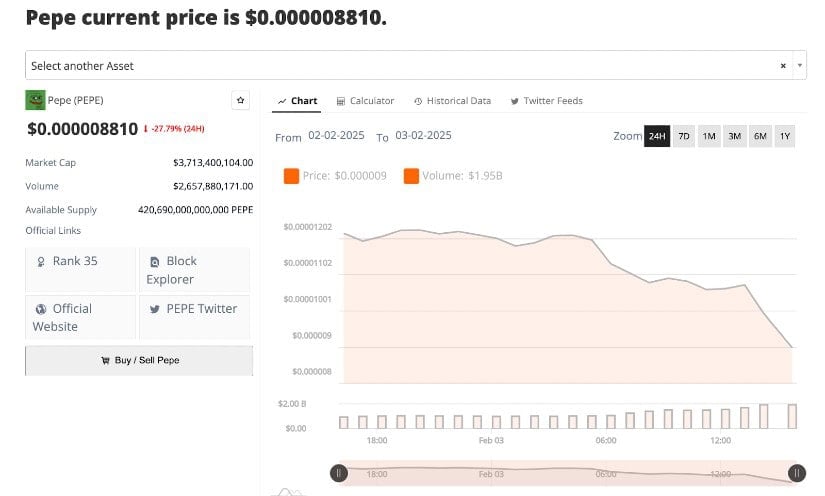

By currently negotiating at around $ 0.00,000,88,80, the token has dropped by 27% in the last 24 hours, triggering the concerns of investors.

Pepe Coin, one of the most popular cryptocurrencies, experienced an astounding drop, loss 80% of its value since its summit of $ 0.00002825 in December 2024.

The steep sale is driven by the Trump prices and the activity of the whales, which flooded the massive tokens deposit market, Increase in sales pressure.

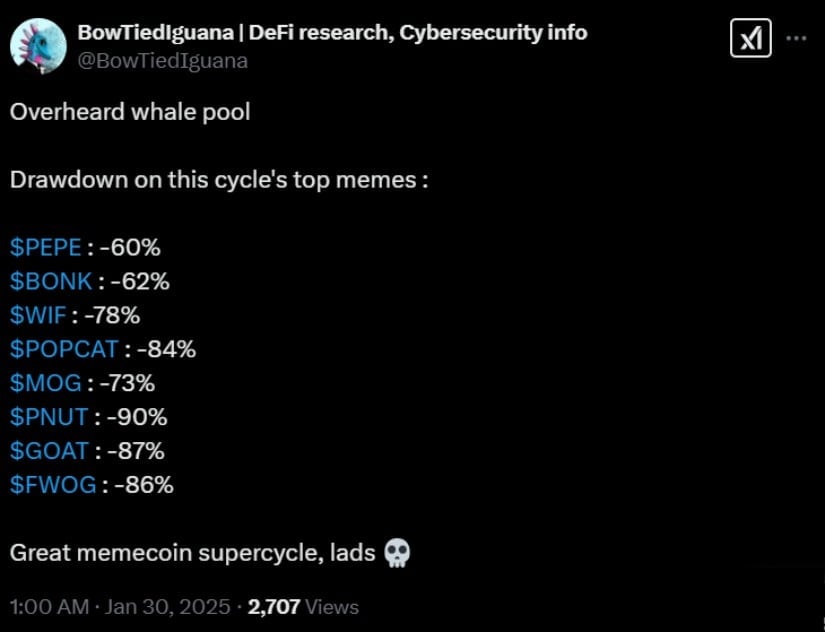

Pepe Coin recently underwent a price correction of 60%. Source: Bowtiediguana via x

The chain data indicates that more than 1.1 billion of Pepe tokens have been liquidated in recent days. An crypto analysis company said that a single portfolio had deposited 430 billion PEPE, valued at $ 6.39 million, in binance in the space of nine hours. Another whale discharged 325.5 billion PEPE, worth $ 4.9 million, while additional additional holders transferred millions more to trade. This influx of supply has considerably weakened the quantity of pepe price, resulting in a sharp decline.

Signs of potential recovery

Despite recent sale, some indicators suggest that Pepe may be on the rod of a recovery When the market bounces. One of the main metrics that traders consult is the market value ratio on the value achieved (MVRV). Historically, when the Pepe MVRV enters certain levels, the price has rebounded strongly. Previous similar events have led to price increases from 51% to 72%. If this trend takes place, Pepe could see a substantial rebound in the coming weeks.

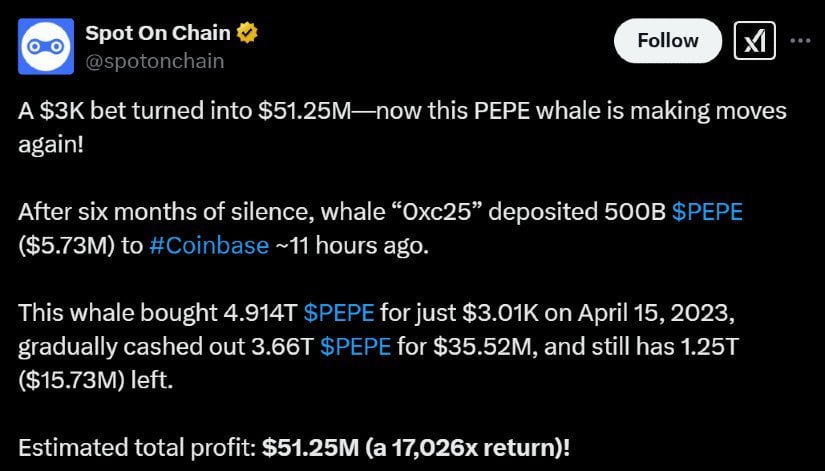

Pepe Whale “0xC25” resurfaces, placing 500B PEPE after transformed $ 3,000 into $ 51.25 million. Source: Spotonchain via x

Another encouraging sign is the decline in PEPE exchange reserves. The data on the chain show that more pepe token is moved from exchanges to private wallets. This often indicates that investors choose to hold rather than sell, which can reduce sales pressure and stabilize prices. The merchant of Crypto Chandlercharts noted: “For the first time since January 18, Pepe actually seems to grow with conviction.” If buyers regain confidence, the medal could see a reversal.

Watch – PEPE PRICE Analysis

The event in half could trigger new momentum

One of these major events in the pipeline which will influence its price is the reduction of the imminent half of Pepe, which is scheduled for February 4, 2025. Block rewards are currently at 62,500 pepe and will be reduced to 31,250 Pepe per block, reducing the rate to which new tokens flow into circulation. Historically, when this has happened in other cryptocurrencies, such as Bitcoin, this tends to increase the price due to the shock of the offer. If Pepe follows the same scheme, demand could increase as investors speculate on a Potential price increase.

PEPE PRICE (PEPE). Source:Brave new room

Analysts have different views of the potential impact of this reduction in half. Some believe it could repel pepe Towards the previous summits, while others warn that the market conditions and the feeling of investors will finally determine the result. With the part which currently oscillates almost crucial levels of support, the reduction by half could serve as a catalyst for a renewed interest.

Market prospects and investor considerations

Pepe’s future remains uncertain and very dependent on Wider market trends. If the overall cryptocurrency sector stabilizes and the media threshing of the piece even returns, Pepe could resume its momentum. However, competition from emerging coins, such as Yeti Ouro, and regulatory uncertainties in the United States could impact its trajectory.

The PEPE was rejected at $ 0.00001,450 (FIB level 0.5) and is now heading for a retest from 0.00001130 to $ 0.00001120. Source: Wizzardo on tradingView

Single coins are intrinsically volatile, and although Pepe has demonstrated strong community support, there remains a high -risk asset. Investors should closely monitor the activity of whales, exchange reserves and the main levels of support before taking negotiation decisions. For those who wish to take the risk, the potential awards could be substantial, but the losses too.

While the market accumulates for the event in half of Pepe, traders are Look closely To see if the meme piece can challenge expectations and stage a return. That Pepe bounces or continues his slide downwards will depend on the confidence of investors, wider cryptography trends and its ability to maintain critical price levels in the coming days.