- The price of Dogecoin earns more than 4% to exceed $ 0.26 Tuesday, supported by bullish tail needles in the wider sector of the same.

- Pepe Price increases almost 8% during the day, reaching the market capitalization milestone of $ 4 billion.

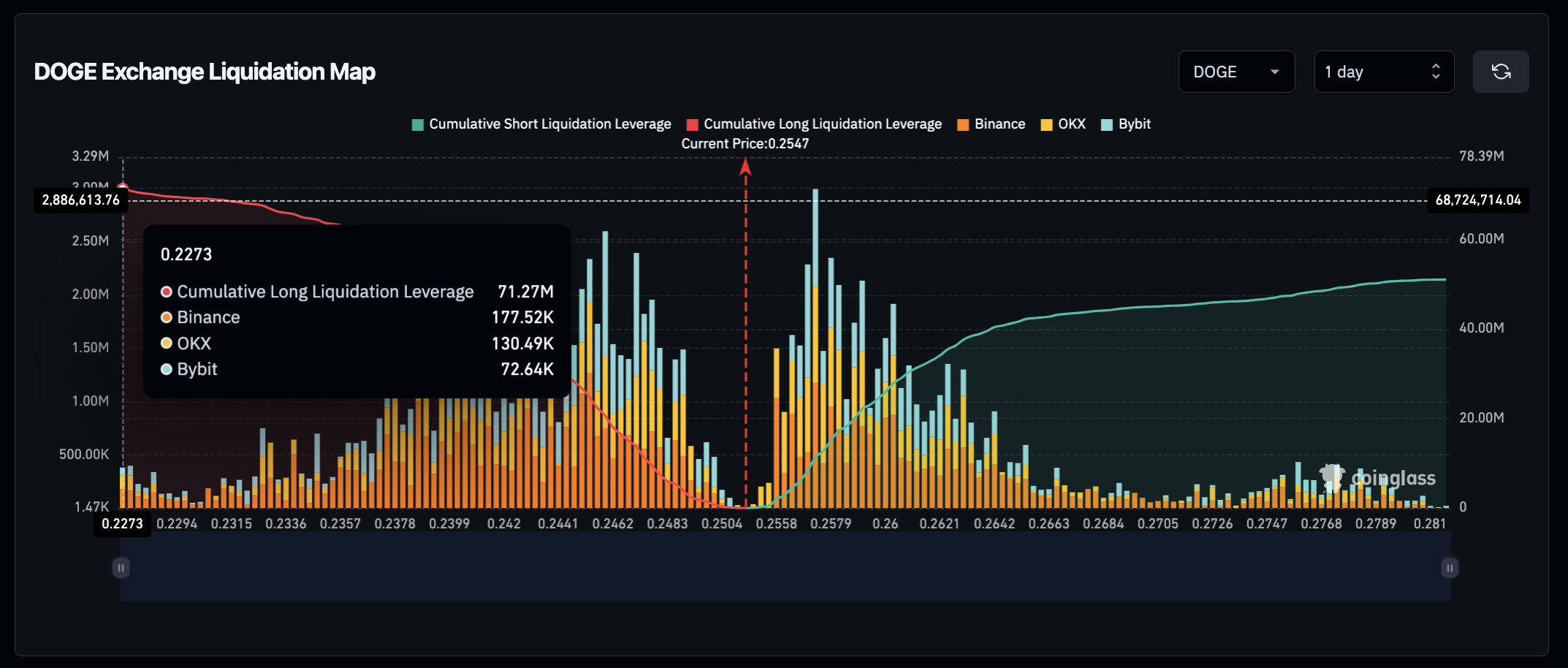

- The $ 72 million in Doge in long -term positions exceeded $ 51 million in shorts by 30%, signaling the intention to capitalize on the bullish momentum.

The price of Dogecoin earns 3% to exceed $ 0.26 on Monday, supported by bullish tail winds in the wider sector of the same. With the PEPE price publishing higher gains, data on the derivative markets suggest that DOGE could also progress more in the coming days.

DOGECOIN (DOGE) exceeds $ 0.26 while prospects for feeding the United States raise the same markets

DOGECOIN (DOGE) has recorded 9% of gains in the last four days, exceeding $ 0.27 Tuesday after ending a four -day defeats observed the previous week. Price recovery of three days of Doge since Friday has been linked to positive speculation in front of the American consumer Price index (CPI) Data, which will be published on Wednesday.

The markets anticipate that inflation will remain persistent in the United States (United States), which leads to a continuation of the break in interest rate reductions by the Federal reserve (Fed).

Dogecoin price action, February 11, 2025 | Source: tradingView

Market feeling Improved while the United States avoided a feared tariff war with its neighbors, Canada and Mexico. This development caused a feeling of risk, raising not only dogecoin, but the whole sector of the same.

Despite its 9% earnings in the last three days, Dogecoin is not the same efficient Tuesday. While DOGE increases 4% over the day, PEPE increases by more than 8%, recovering the market capitalization milestone of $ 4 billion. The larger market capitalization of the same increases 0.9%, pushing the overall assessment to $ 76.8 billion.

This wide rally suggests a deep hassier feeling, which could persist and provide a rear wind at the price of Dogecoin.

Global same Market Performance, February 11, 2025 | Source: Coingecko

Historically, strong movements on the scale of the sector indicate a sustained praise and the latest Dogecoin rally aligns with this trend.

If the positive momentum continues, Doge could move forward more and challenge higher resistance levels.

Taurus merchants bet on the price of Doges to advance more

Derivative market trends indicate that Dogecoin bull traders are positioned to capitalize on the current haus feeling in the wider sector of the same.

Dogecoin liquidation card, February 11 | Source: Coringlass

Coinglass’s liquidation card data reveals that the $ 71.2 million in Doge in long -term positions are currently exceeding $ 51 million in 30%shorts, reporting a strong optimistic intention.

The increase in long positions in the middle of a price rebound generally suggests that most traders expect the gathering to extend to higher levels of resistance.

If this trend persists, Dogecoin could rely on its current momentum and try an escape beyond the bar of $ 0.27.

The increase in the long exposure with leverage suggests that institutional and detail traders are betting on more than the increase. However, in the event of unexpected withdrawal, a solid support around $ 0.24 could absorb any sales pressure, limiting the risk of the downward.

Dogecoin price forecasts: $ 0.35 in advance if this key resistance cave

The action of Dogecoin prices shows a clear rebound within the lower limit of the Keltner canal, indicating the potential of a sustained rally.

If the bullish momentum persists, DOGE could pass the resistance of $ 0.28 and set the next key to $ 0.30.

A decisive break above this area could open the door to an extended rally around $ 0.35.

Technical indicators Support this perspective. The MacD histogram goes from red to green, signaling a potential bullish crossing.

In addition, the RSI approaches neutral territory, leaving room upwards before hitting the conditions of overchat.

Dogecoin price forecasts | Dogeusdt

On the lower side, non-compliance with $ 0.26 could invite increased sales pressure, with a potential retirement at $ 0.24.

However, with strong derivative market support and a wider sector, the probability of a continuous rally remains high.

With less macroeconomic shock, the Dogecoin price seems ready to extend its earnings, with a possible escape greater than $ 0.30 by opening the way to a test of $ 0.35 in the coming days.

-638748602492736040.png)