The chain data show that large dogens transactions have seen a sharp decline recently, a sign that whales are no longer active on the network.

The activity of the Dogecoin whale has plunged since mid-November

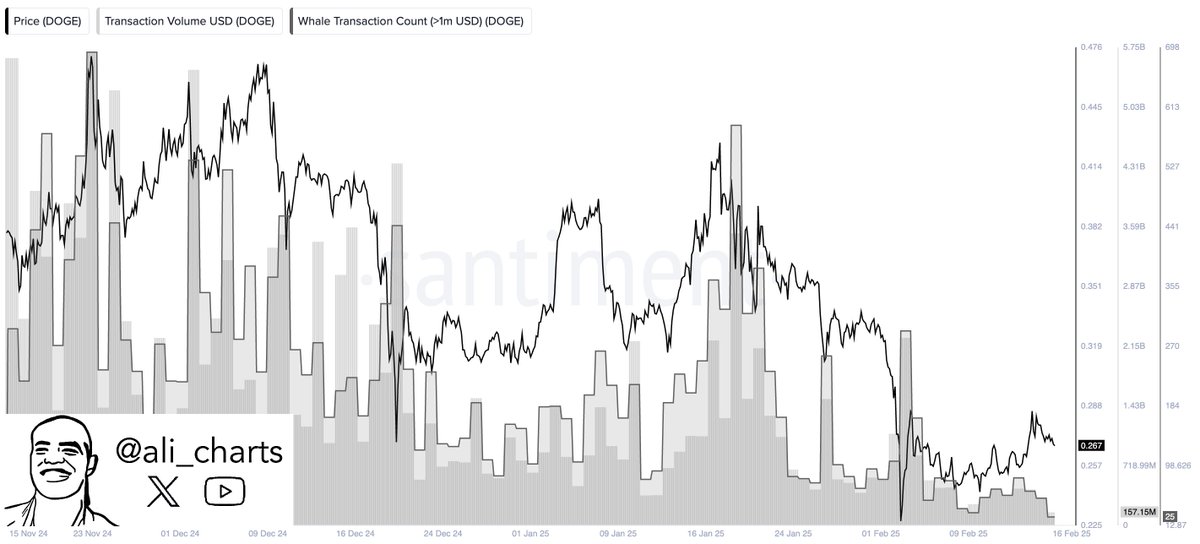

As analyst Ali Martinez pointed out in a new job On X, the number of whale transactions recently decreased for Dogecoin. THE “Number of whale transactionsReference here to an indicator created by the Santiment Chain Analysis Company which maintains the total number of DOGE transfers with more than a million dollars.

Generally, only the whale Entities are capable of making single transaction trips of this large, so that the value of metric is supposed to be correlated with the activity of this cohort.

When the value of the number of whales transactions is high, this means that whales make a large number of transfers. Such a trend suggests that these enormous investors have an active interest in negotiating the assets. On the other hand, the indicator being low implies that this group does not pay much attention to the memes part because its members do not participate in any significant transaction activity.

Now here is a table that shows the trend in the number of whale transactions for Dogecoin in recent months:

Looks like the value of the metric has been heading down since a while now | Source: @ali_charts on X

As it is visible in the graph above, the number of Dogecoin whale transactions reached a high level in November, which means that the network received a large activity of whales.

Since the peak in mid-November, however, the indicator follows a trajectory down global. Today, blockchain knows only 25 daily whale transactions, which represents a drop of almost 88% compared to the summit.

Obviously, the recent slowdown in the price of the memes play coincided with this recharge time in the interest of whales. Given this model, metrics could be to keep an eye on a near future, because any change for this could imply a new result for Doge. Naturally, prolonged inactivity of the group could signify a new downward action for the assets, while a wave could lead to a rally.

The number of low whale transactions is not the only bad sign that Dogecoin has recently seen, as Martinez explained in another X job that cryptocurrency experienced a death cross MVRV ratio and its mobile average at 200 days (MA).

The metrics appear to have seen a crossover in recent days | Source: @ali_charts on X

The market value ratio on the value achieved (MVRV) here is a chain metric that mainly talks to us about the loss of profit for Dogecoin investors. As Doge’s price recently decreased, investors’ profitability has dropped, which led to a dive into the MVRV ratio.

With this song, the indicator went under his 200 -day mastery. “The last two times this has happened, prices have dropped by 26% and 44%,” notes the analyst.

Mediating prices

At the time of writing the editorial staff, Dogecoin is negotiated at around $ 0.264, up almost 6% in the last seven days.

The price of the coin seems to have gone down over the last couple of days | Source: DOGEUSDT on TradingView

Dall-e star image, Santiment.net, TradingView.com graphic