- DOGE regained momentum after a week of consolidation in the $0.40 range.

- To reduce volatility and reach the $1 milestone, DOGE needs a “Secret Santa” – a powerful catalyst or support.

The $1 mark is once again the center of attention, with two major altcoins reclaiming the elusive mark after years of erratic price action.

However, Dogecoin (DOGE) is lagging behind, failing to meet the benchmark despite a double-digit weekly rise. Memecoins their speculative nature tends to make them more volatile than others altcoins.

Yet, as the largest memecoin, Dogecoin has proven its resilience, leading the “supercycle” during the previous bull run, buoyed by recurring support from influential figures.

Now, with a 16% jump in the last 24 hours, outpacing its peers, and a surge in open interest, prominent analysts are speculating that DOGE could next hit $0.60. Does this put him on track to join the $1 club?

A high-risk, high-reward call could delay $1

A week ago, DOGE entered consolidation after reaching $0.40 during the post-election cycle, following daily highs of over 25%.

A correction was inevitable as trading volume surpassed 17 billion, signaling an overheated market position.

However, the pullback was brief, with DOGE rebounding with a 10% daily rise, now trading at $0.46.

This rebound reflects the continued optimism of the bulls, a key factor for a memecoin dependent on community support during bear phases.

Following this dynamic, market makers are now speculate whether further advance could push DOGE towards its all-time high of $0.73, with the $1 benchmark in sight.

Although DOGE’s nearly 30% weekly rise has positioned it at the top of the memecoin list, achieving this goal may still prove difficult.

Interestingly, spot traders have accumulated almost $180 million worth of DOGE tokens over the past week, which corresponds to its consolidation phase.

This suggests that savvy investors took advantage of the “dip,” buying DOGE at a discount and preventing bears from challenging its bullish momentum.

A post-halving Bitcoin model further fueled optimism, with projections of a massive DOGE rally by the end of the quarter and a parabolic run that could materialize by 2025.

Open interest has reached a save $3.77 billion as futures traders bet on further price increases.

Despite these bullish indicators, Dogecoin faces risks. Its RSI has entered the overbought zone, increasing the likelihood that weak hands will shake and trigger a short-term correction.

Unlike altcoins that are often held long-term despite withdrawals, memecoins like DOGE are generally favored for their “high risk, high reward” appeal.

This inherent volatility makes them vulnerable to sharp market swings, which poses the biggest challenge to DOGE’s $1 milestone.

How can DOGE overcome volatility to reach $1?

To reach $1 from its current market value of $0.46, DOGE would need to rise by approximately 117.39%. Over the past 30 days, DOGE has surged over 200%, driven by both macroeconomic trends and microeconomic factors.

While Elon Musk’s support could offer a temporary boost, lasting momentum will depend on large HODLers stepping in during volatile times to counteract market turbulence caused by traders’ rapid movements.

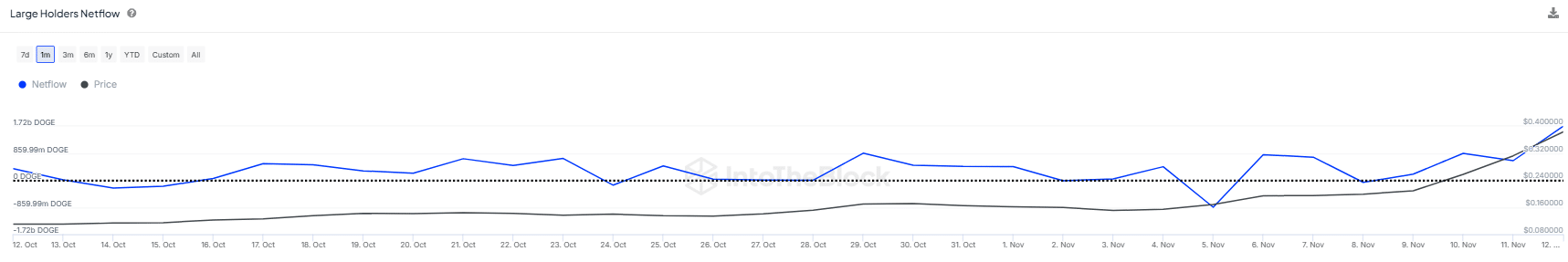

Over the past 30 days, whales have gradually removed DOGE from exchanges.

Notably, more aggressive accumulation began 10 days ago, with around 1.12 billion tokens recovered, pushing DOGE beyond the critical psychological resistance of $0.40.

This highlights how whale support is crucial for Dogecoin to surpass key price targets.

Read Dogecoin (DOGE) Price Prediction 2024-2025

Although the indicators mentioned above can propel DOGE towards $0.60, breaking the resistance and reaching the $1 mark will heavily depend on support from large HODLers.

Therefore, it is essential to regularly monitor whale activity to predict potential price movements.