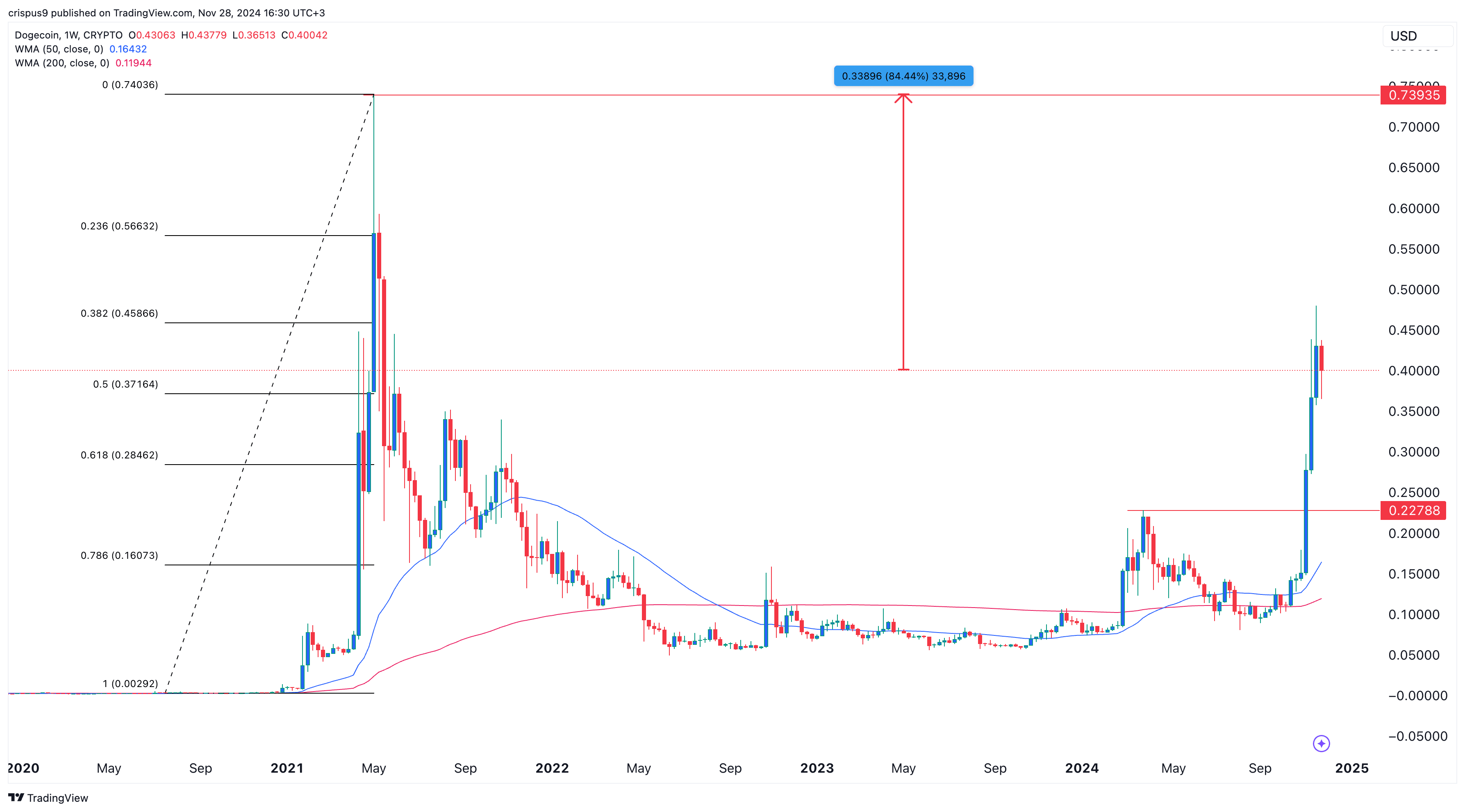

Dogecoin price performed well this month, hitting $0.4795, its highest level since May 2021, as the broader crypto rally gained momentum.

Dogecoin (DOGE) was trading at $0.40 on November 28, a 365% increase from its September low.

This price action mirrored that of Bitcoin (BTC), which came close to $100,000, setting a new record. Historically, Dogecoin and Bitcoin prices have moved in tandem. Data from In the block reveals a correlation coefficient of 0.98 between the two, indicating similar price movements.

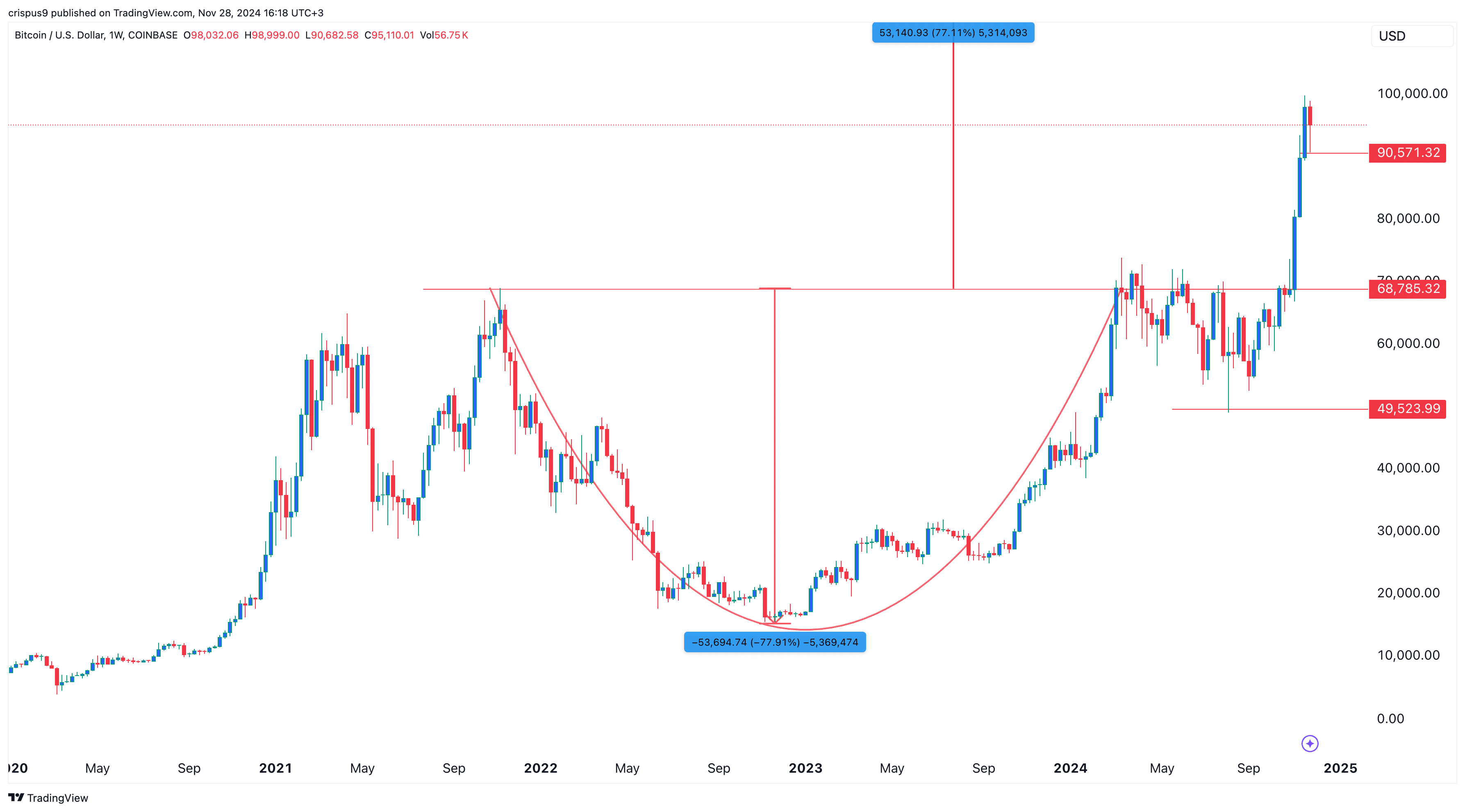

Therefore, it is likely that Dogecoin will continue its strong uptrend when Bitcoin crosses $100,000. In a recent Bitcoin analysiswe noted that technical data pointed to a possible jump to $122,000. This view is based on the coin’s cup and handle pattern on the weekly chart.

As its name suggests, this model is composed of a rounded bottom followed by a withdrawal or consolidation. Bitcoin’s hold lasted from March until the beginning of the month, when it made a bullish breakout to $99.7k.

Bitcoin also has strong seasonal fundamentals since its price often rises in November and December. In addition to this, Trump is reportedly considering Paul Atkins, who is popular in the crypto industry, to become the next head of the Securities and Exchange Commission.

Spotting Bitcoin ETFs also gained ground, with total assets surpassing $101 billion, further boosting market confidence.

Dogecoin price rise to continue

Dogecoin price looks set to advance further if Bitcoin climbs to $122,000 as expected.

On the weekly chart, Dogecoin went parabolic and broke a critical resistance level at $0.2278, its March 2023 high, invalidating a previous double top pattern.

The coin also formed a golden cross pattern, with the crossover of the 50- and 200-week moving averages, and broke above the 50% Fibonacci retracement level at $0.03715.

Dogecoin now forms a bull flag or pennant pattern, which often precedes a strong breakout. If that happens, the next target could be $0.7400, its all-time high, representing an 85% gain from current levels. However, a decline below $0.2278 would invalidate this bullish outlook.