Bitcoin and most altcoins withdrew this week, while the index for fear of cryptography and greed has slipped into the fear area.

Ethereum (Ethn) fell to a hollow of $ 2,100, down more than 47% compared to its highest level this year. Likewise, Dogecoin (DOGE) The price has slipped to $ 0,2060, its lowest level since November 4, while Ripple (Xrp) fell to $ 1,8010, down 47% of the highest of the year.

Other altcoins, including Solana, Polkadot and Chainlink, also underwent two -digit losses on Monday. However, most of them have made certain losses and are now approaching their weekly opening levels.

The total market capitalization of the cryptocurrency, followed by CoinmarketCap, initially fell on Monday at 3 billions of dollars before going back to 3.3 billions of dollars by Friday.

The wider market of cryptography withdrew this week in the midst of increasing concerns concerning a potential trade war between the United States and its main trade partners, including China, Mexico and Canada. Former President Donald Trump announced a 25% rate on goods imported from Mexico and Canada and a 10% rate on Chinese imports.

He then Pause prices on Canadian and Mexican products For 30 days awaiting negotiations, while prices on Chinese imports remain in place. An prolonged trade war between these countries and the European nations could trigger a feeling of risk, weighing on more risky assets such as cryptocurrencies.

The FNB Bitcoin and Ethereum had a strong demand

Bitcoin and these altcoins withdrew because the demand of institutional investors remained low. Spot Bitcoin and Ethereum had nets of nets this week, while Microstrategy interrupted Bitcoin purchases Last week. The company had acquired bitcoins for twelve consecutive weeks, bringing its total assets to 471,000 pieces.

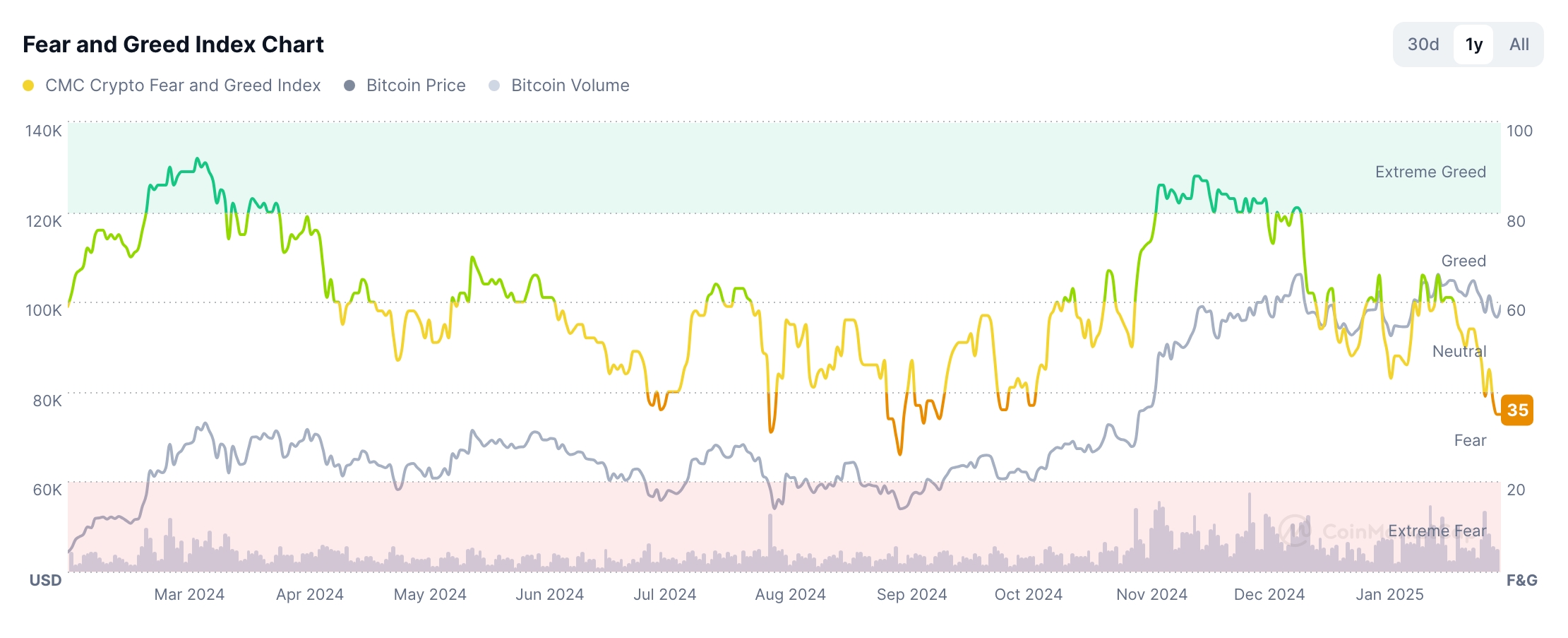

Altcoins, including Ethereum, Doge, XRP and Sol, also dropped as the feeling of investors has weakened. The index of fear and greater watched greed has fallen 35Its lowest level since October of last year. Historically, cryptocurrencies tend to decrease when fear dominates the market.

These losses occurred while the Altcoin season index continued to decrease, while Bitcoin remained stable. The index dropped to 33, down compared to its top of the year 47, indicating a stronger demand for bitcoin compared to altcoins.

A potential optimistic catalyst for altcoins is the formation of a hammer candlestick model on the weekly graph. This model, characterized by a long lower shadow and a small body, is a well -known bull’s inversion signal.

In addition, Bitcoin has formed a bull’s dowel model on the weekly graphic, which could indicate a potential rebound.