The management of Bitwise assets has taken a significant step towards the launch of a negotiated stock market (ETF) based in Dogecoin by officially depositing an S-1 registration with the Securities and Exchange Commission (SEC) of the United States.

This depositSubmitted on January 28, 2025, marks a pivotal moment for the same market, potentially opening the doors of institutional investors to obtain regulated exposure to Dogecoin.

Bitwise movement to a Dogecoin ETF

This decision follows the previous registration by Bitwise of a Dogecoin trust in Delaware on January 22, signaling its broader ambitions In the ETF Crypto space. According to Matt Hougan, director of investments in Bitwise, the deposit is a response to the Growing demand For Dogecoin among investors.

Bitwise files for a Dogecoin Spot ETF. Source: Bscgemsalert via x

“The reality is that there are many people who want to invest in Dogecoin. It is the sixth greatest cryptographic asset in the world by market capitalization and it exchanges more than a billion dollars a day, “said Hougan.

Growing interest in ETF memecoin

Bitwise is not the only company to try to capitalize on the popularity of Dogecoin. Other asset managers, including Balbutiex funds and Rex actions, have also made requests to submit Dogecoin and other ETFs Even high level like Bonk and Trump’s theme tokens.

Same in FNB: a risky bet or financial madness while businesses are betting on Dogecoin, Bonk and more? Source: Blocker via x

The growing trend of ETF same aligns with broader market developments within the framework of the current American presidential administration. The pro-Crypto position of President Donald Trump and his Latest orders Regarding the regulation of digital assets, enthusiastic ETF issuers. Even the recent creation of DOGE – Abbreviation for Government Department of Effectiveness – With the Dogecoin logo, has given way to additional speculation that a Dogecoin ETF can see less obstacles to regulatory approval.

Despite this enthusiasm, the concerns about the speculative nature of the coins still persist. With their very volatile nature, some analysts have compared the investment in the same way to the game because they do not represent any fundamental financial logic. However, there are views that with the large piece of the market and the liquidity characterizing Dogecoin, it can in fact correspond to the invoice of an ETF.

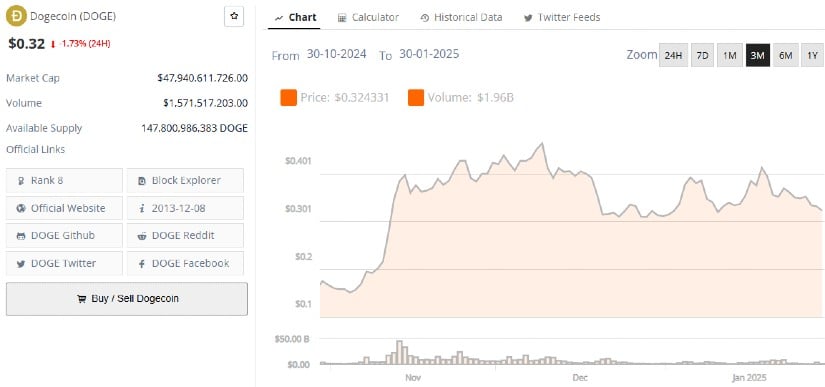

Dogecoin market performance and risks

After the news of the Bitwise ETF deposit, Dogecoin experienced a 4% drop in its price, reflecting mixed development market reactions. Technical analysis suggests that DOGE is currently negotiating in a descending triangle model, training which often signals potential risks.

DOGUE (DOGE) Price. Source:Brave new room

If Dogecoin strikes the lower limit of this scheme, analysts predict a sharp drop by approximately 37%, lowering the price to around $ 0.1905. However, if the price is higher than its support levels, a recovery could be possible, especially if a broader feeling of feelings moves positively.

Doge Price is currently testing the key support at $ 0.32. Source: Fincaesar on tradingView

Indicators such as the relative resistance index (RSI) and the divergence of Mobile average convergence (MacD) are currently showing a bearish momentum, while the Stochastic oscillator suggests that the dogecoin can be occurred, potentially preparing for a short -term rebound.

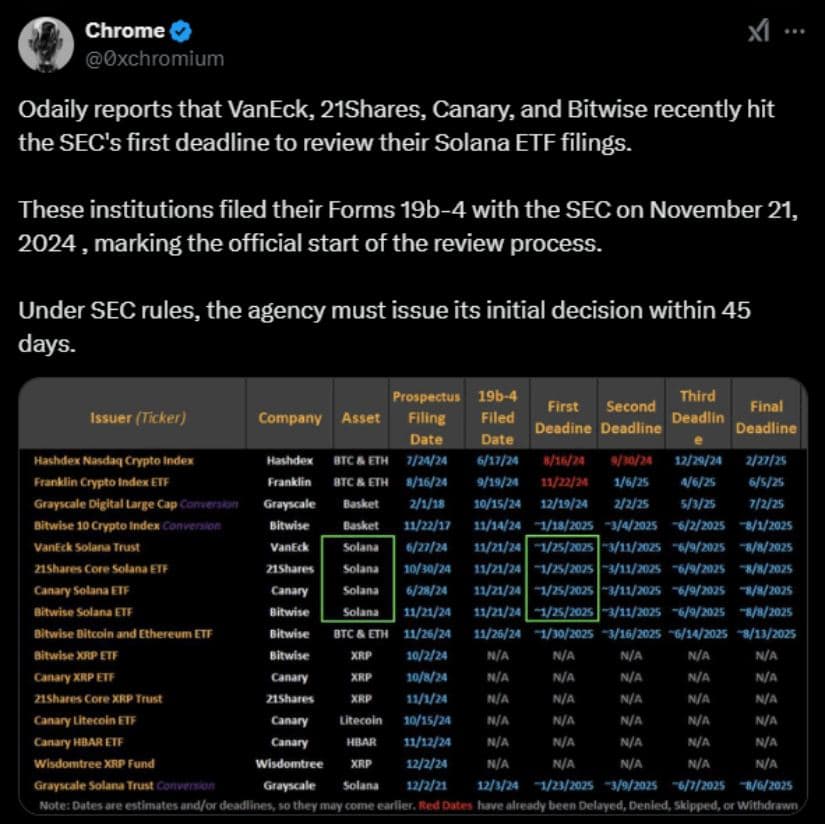

Regulatory prospects and market implications

The committee’s decision on Dogecoin Etf in the Bit direction will be closely monitored, among other deposits, for any indication of how he will address the regulation of memes. But with this administration, regulatory attitudes towards digital assets have reported a more user -friendly role than so far, given the elevation of person appointed by crypto-friendly Like Paul Atkins in important positions.

If it is approved, the FNB proposed on the Dogecoin bit would create a regulated investment vehicle for retail and institutional investors who seek to expose themselves to assets without holding it directly. This could attract more liquidity on the market and perhaps mitigate certain price swings.

Vaneck, 21Shares, Canary and Bitwise Hetways Dry Deadline for Solana ETF deposits, kick off the examination process. Source: Chromium via x

However, challenges remain. The SEC has traditionally been very cautious for the approval of FNB on very volatile and speculative assets. While Bitcoin and Ethers Ethereum have been approved, pieces of memes like Dogecoin are often treated as a different asset class because of their origins as jokes on the Internet and their sensitivity to the media of social media.

End

Despite these concerns, the growing thrust of FNB even Coin highlights the evolutionary nature of cryptocurrency investments.

Earlier in the day, we learned that Grayscale Investments filed official documents with the New York Stock Exchange, aimed at upgrading its existing XRP Trust in a full -fledged spot XRP ETF. If the regulators give the green light, it will grant traders the possibility of buying and selling stocks linked directly to the real -time price movements of XRP, all managed under the protective umbrella of a regulated exchange. This could be an important step for lovers of gray and XRP levels.

It shows growing demand for punctual crypto ETF for serious assets such as Ripple XrpAnd for coins like Dogecoin.

As the cryptography market matures, the introduction of new financial products aimed at a wider range of investors will likely continue. It remains to be seen if Dogecoin can maintain its relevance in ETF space, but for the moment, the deposit of Bitwise marks another chapter in the growing institutionalization of the cryptography market. Doge to a dollar, woof!