- Whale Accumulation and Growing Address Activity Suggest Dogecoin May Break Key Resistance Levels Soon

- Mixed Technical Signals and Low Trading Counts Underline Caution

In a significant development that has caught the attention of the crypto market, Dogecoin (DOGE) whales have acquired over 90 million DOGE in the last 48 hours. This strategic accumulation is a sign of growing confidence among large investors, potentially positioning Dogecoin for a major price breakout.

At press time, Dogecoin was trading at $0.3155, following a slight decline of 0.19% over the past 24 hours. However, the real question remains whether this momentum can trigger the next bullish phase or lead to further consolidation.

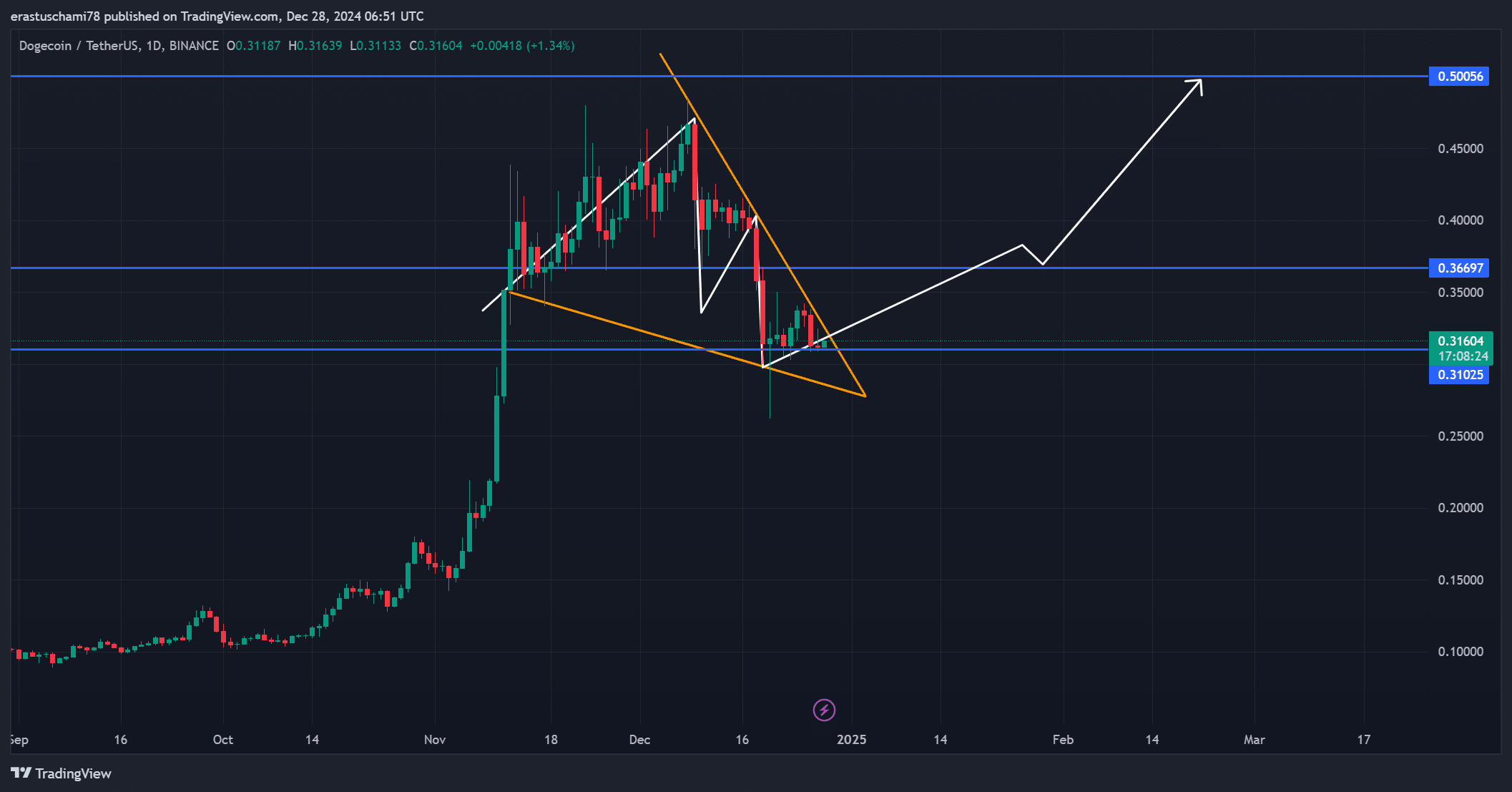

DOGE Price Action – A Breakout or Another Consolidation?

At press time, Dogecoin price action indicated a tightly coiled pattern as it traded in a bullish pennant pattern. The critical resistance level stood at $0.366, which could serve as a launching pad for a rally towards $0.50 if breached.

However, failing to break through this resistance could prolong the consolidation phase, frustrating bullish traders.

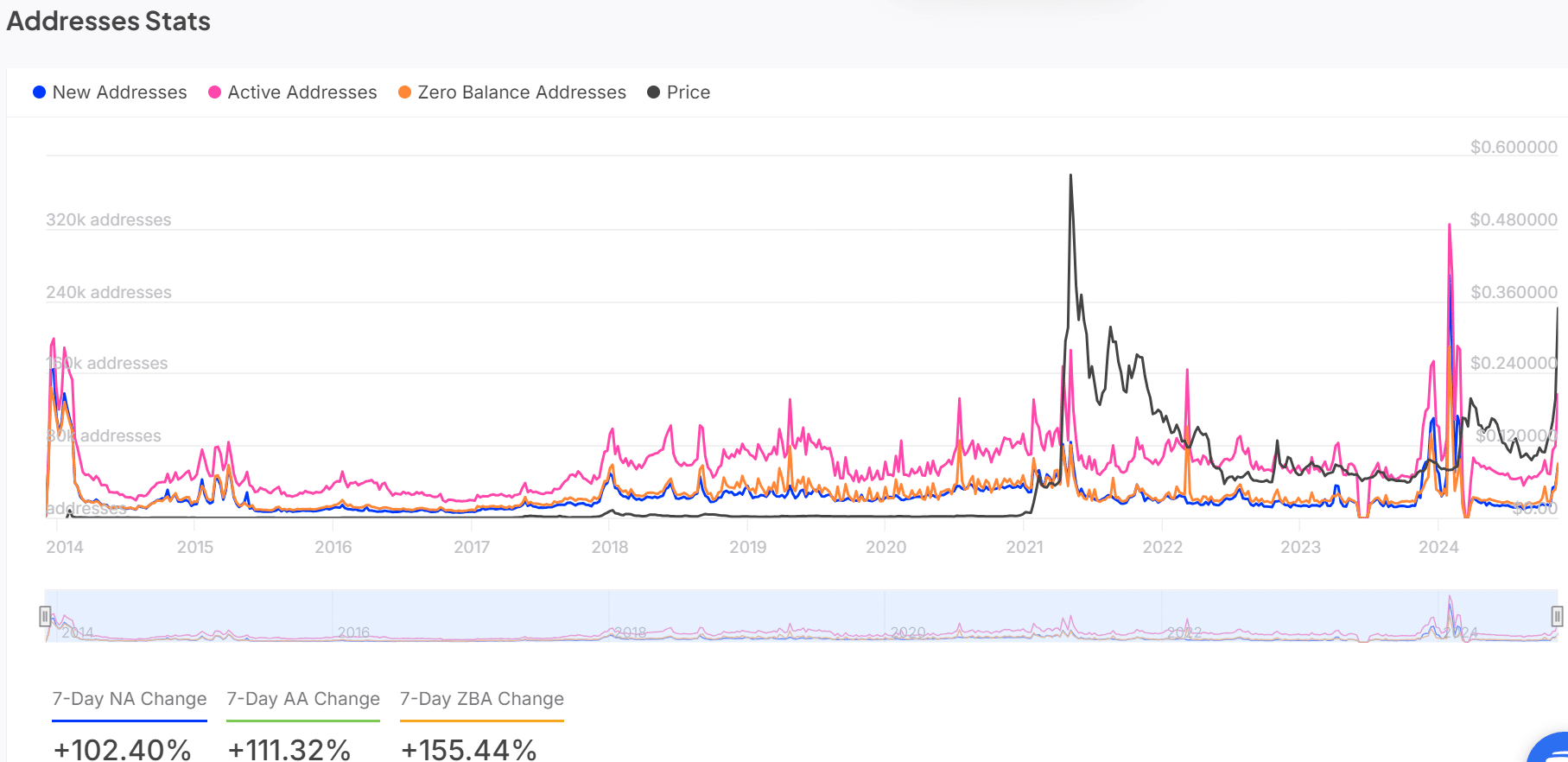

Analyze Dogecoin address activity

Examining Dogecoin address statistics revealed an encouraging trend in network activity. Last week, new addresses increased by 102.4%, while active addresses increased by 111.32%.

These numbers indicate an increase in user engagement – a metric often linked to price growth. Additionally, zero balance addresses increased by 155.44%, indicating an influx of new participants testing the ecosystem.

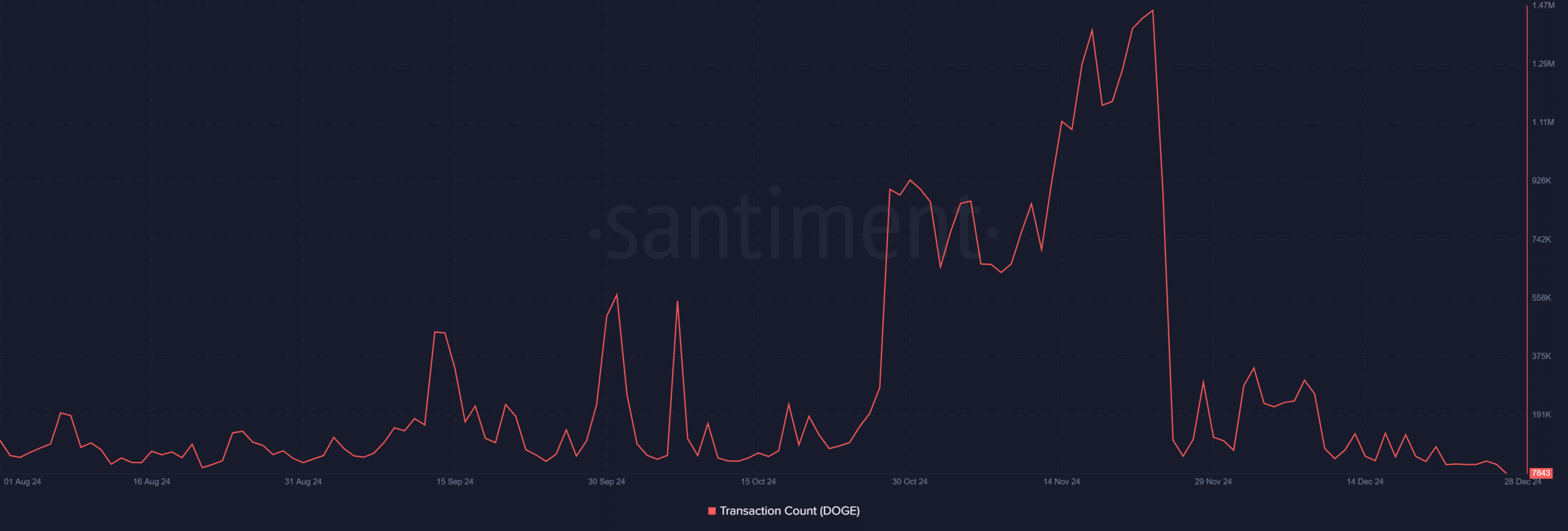

Dogecoin Transaction Count Signals Caution

Despite the growing interest in whales, Dogecoin the number of transactions has decreased significantly, with only 7,843 transactions recorded at the time of publication. This drop highlighted moderate on-chain activity, which could pose a barrier to bullish momentum.

However, these periods of calm have historically preceded sharp price movements, making this a situation worth monitoring closely.

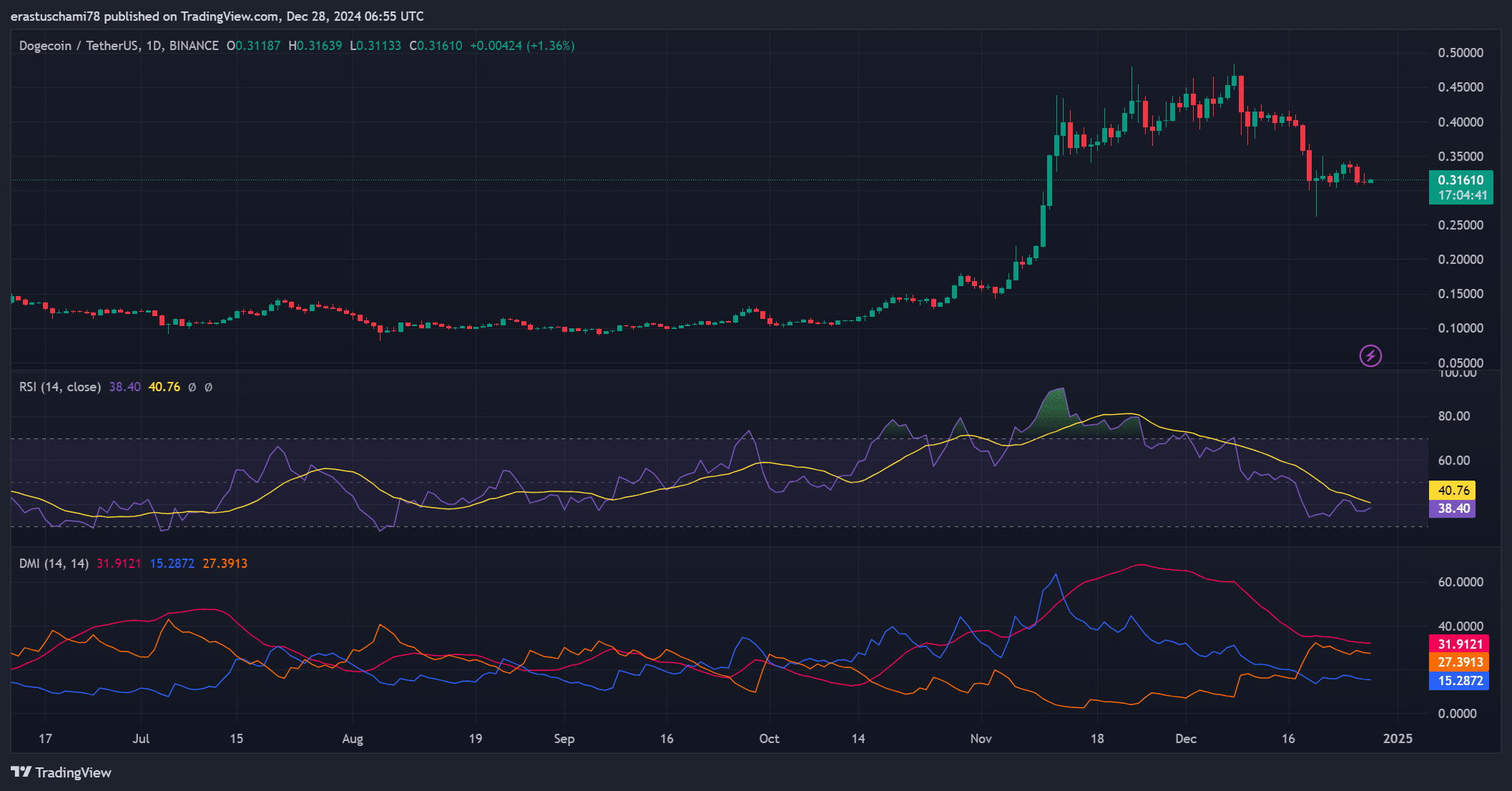

DOGE Technical Indicators

Dogecoin technical indicators have highlighted a market at a crossroads. The relative strength index (RSI) appeared to be hovering around 40.76, hinting at a market heading towards oversold conditions, but not quite yet.

Meanwhile, the Directional Movement Index (DMI) hinted at bearish dominance, with the -DI at 31.91 eclipsing the +DI at 15.28. Therefore, while the technical outlook is not overtly bearish, it highlights the importance of a strong catalyst to reverse the prevailing trend.

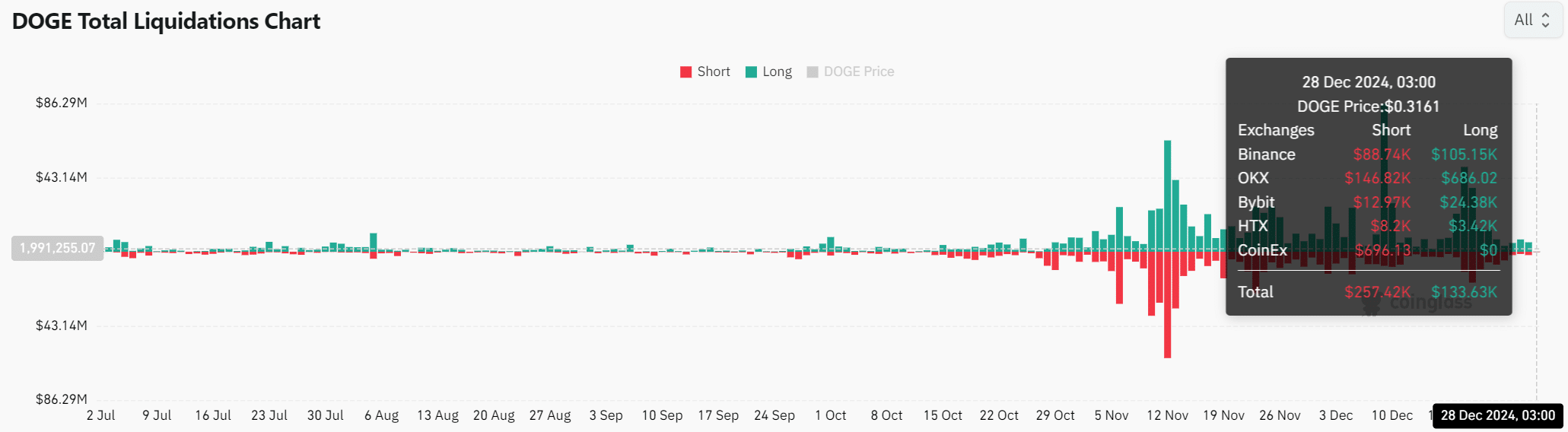

Liquidation Data – Signs of Changing Dynamics?

The liquidation numbers present a nuanced outlook, with $257,420 of short positions liquidated compared to $133,630 of long positions. This imbalance suggests that short sellers are starting to lose control, potentially setting the stage for a bullish reversal.

However, this shift will require sustained buying interest to fully reverse the trend.

Read Dogecoin (DOGE) Price Prediction 2024-2025

Dogecoin’s recent whale accumulation and growing address activity highlight its breakthrough potential.

However, with low trading numbers and mixed technical signals, the current market remains uncertain. If DOGE manages to cross $0.366, the next bullish phase could begin. For now, cautious optimism prevails.