DOGECOIN (DOGE), the popular and larger piece of memes and the largest in the cryptocurrency space seems to move towards an upward trend after several days in a downward trend. As of January 30, 2025, as well as other major assets, DOGE seems to be recovering, forming a Haussier price action.

Doge Price Momentum

With a positive market perspective, DOGE Currently negotiated nearly $ 0.33 and has increased prices of more than 4.05% in the last 24 hours.

Following a price reversal of the crucial level of support of $ 0.31, merchants and investors showed strong interest and confidence in the memes room, which led to an increase of 8.5% of the negotiation volume compared to the day before.

Technical Dogecoin (Dogeco) analysis and key levels

According to an expert technical analysis, DOGE seems to form a double -bottomed double -bottom price action model on the daily time. However, the upper corner price action is still in training, and it is currently at a level of support of $ 0.31, which has a history of strong Haussiers price inversions.

Based on the recent price action, if Doge holds this level of support, there is a high possibility that it can rise by 25% to reach the level of $ 0.41 in the coming days.

On the positive side, the relative resistance index of DOGE (RSI) is currently 45, which indicates a strong potential for the meme piece to join further.

Chanting uptime metrics

Looking at the Haussier price action and the feeling of the market, traders and investors have bet and accumulated the meter piece, as reported by the chain analysis company Rinsing. The Flow / OUT Spot Data Sweep revealed that the exchanges experienced a significant value of a significant value of $ 11.50 million in Doge.

In the cryptocurrency landscape, the exit refers to the movement of the assets of the exchanges to the wallets, suggesting a potential accumulation. This can create a purchase pressure and lead to another upward rally.

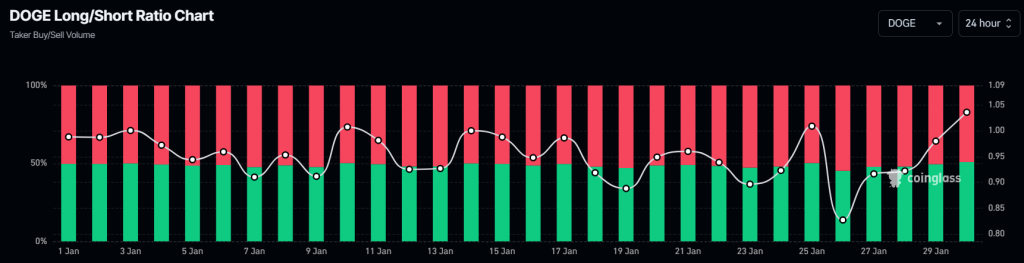

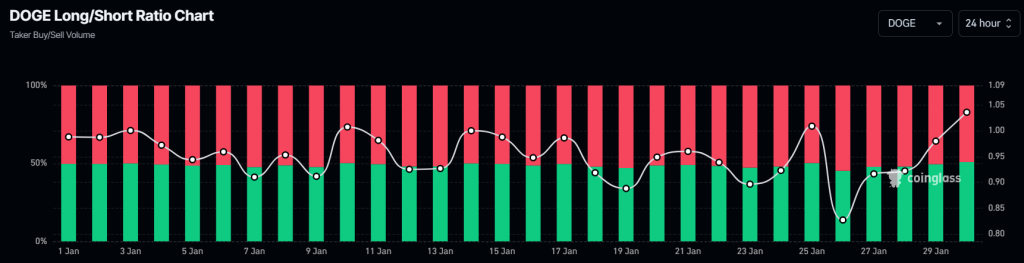

Apart from that, traders seem to be strongly strewn on the long side. Currently, the Long / Short Doge ratio is 1.056, indicating a strong bullish feeling among traders, the highest since early December 2024.

The data also revealed that 53.5% of the best traders hold long positions, while 46.5% hold short positions.

During the combination of these metrics in chain with technical analysis, it seems that the bulls support and strongly dominate the meter piece and could help it reach the level planned in the coming days.