- The Dogecoin price reached $ 0.25 Tuesday, diving 10% in 48 hours.

- The drop in the market has coincided with regulatory quarrels between DOGE led by Elon Musk and the United States.

- The increase in trading volumes, a lever group of $ 21.6 million and the parabolic technical indicator line up for a rebound in early Doge prices.

The Dogecoin price reached $ 0.25 on Tuesday, diving 10% in 48 hours while the market reacted to regulatory quarrels between Doge led by Elon Musk and the United States. Despite the decline, three crucial trading indicators suggest that DOGE could be set up for an early rebound.

How the confrontation of Musk with the American sec has an impact

On Monday, the Government Ministry of Effectiveness (DOGE) led by Elon Musk announced an official investigation into the financial files of Securities and Exchange Commission (SEC) of the United States, aroused intense volatility between the cryptographic markets.

The Ministry of Government (DOGE) led by Elon Musk announced an official investigation into the American Sec, February 18, 2025

The action of Dogecoin prices has increased more and more on broader political and regulatory accounts. Elon Musk’s influence on the token intensified, especially after the Trump administration recognized the Dogecoin community during the republican electoral campaigns.

This link was further strengthened when Trump officials announced the creation of the DOGE on January 21, positioning Musk at the head of a federal surveillance agency.

The DOGE survey increased tensions, especially after the agency cited the unauthorized use of funds allocated to USAID last week.

Although the regulatory battle cannot have a direct impact on the fundamental principles of the community or the Dogecoin network, the prolonged legal dispute could delay critical administrative approvals, including the highly anticipated FNB Doge Spot.

Market participants closely follow regulatory green fires for altcoin ETFs now weigh the risk of bureaucratic roadblocks.

DOGE TRADING Signal volume increases demand after ventilation of $ 0.25

Last week, Dogecoin received a major boost when the dry recognized the depots ETF Doge and XRP.

However, the rally was short -lived, while gaining profit accelerated once Doge exceeded $ 0.30 on February 14. The sale was deepened after the Musk’s announcement that the government’s Ministry of Efficiency had launched an investigation into the financial transactions of the SEC.

Dogecoin price analysis | Dogeusdt | February 18, 2025

The DOGE / USDT daily graphic reflects a sharp drop, with DOGECOIN below $ 0.25 for the first time in eight days.

This decrease of 10% highlights the nervousness of investors concerning the current regulatory tensions.

However, the increase in trading volumes suggest that speculative traders buy the decline.

Historical trends indicate that high -level events such as Musk’s regulatory battles tend to trigger intense market volatility, attracting short -term swing traders and price speculators.

If this trend persists, Dogecoin can find a strong purchasing momentum in future sessions.

The bulls ride $ 32 million lever at $ 0.24

As evidenced by the decrease of 10% in the last 48 hours, the majority of Dogecoin traders have adopted a cautious position in the middle of the current DOG probe on the dry.

However, the derivative negotiation data suggests that bullish merchants make concerted efforts to defend the level of support of $ 0.24.

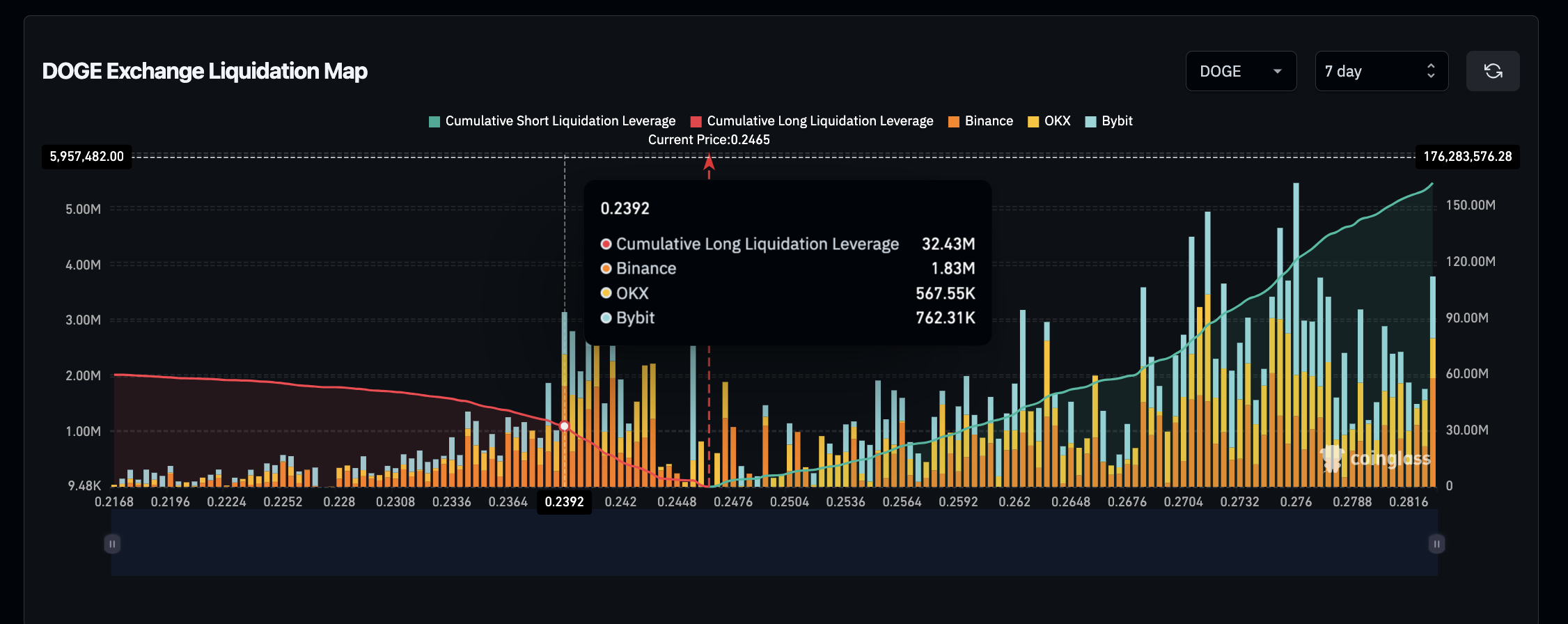

Dogecoin liquidation card | Source: Coringlass

The Coinglass liquidation graph, which follows the lever -effect Doge -effect positions during last week, provides key potential information Support and resistance Levels.

A glance at the graph reveals that the majority of term contracts on the term contracts on DOGE reasons were short positions, with total active positions exceeding $ 151.2 million.

Short exchanges are currently overshadowing long positions of $ 59.9 million, reflecting a bias of 80% in favor of the bearish feeling.

However, a more in -depth examination of the data reveals a significant lever cluster of $ 32.4 million at the price level of $ 0.24, representing more than 52% of the total of long contracts.

This suggests that bullish merchants have concentrated efforts around this critical support area.

If Doge Price performs this level, the traders occupying these posts undergo significant losses.

Consequently, support on the buyer side could be strengthened in the coming days, because traders strengthen the positions or try to cover the losses.

Dogecoin price forecasts: Bulls have $ 0.24 if market sales drop

With a volatile mixture of regulatory uncertainty, increasing speculative demand and lever -effect positioning, the short -term price trajectory of Dogecoin remains relatively neutral.

The technical indicators of Dogecoin also affirm this position, the parabolic technical indicator confirming a strong support greater than $ 0.22, because the Bollinger strip half-line indicates a major resistance to the SMA of 20 days of $ 0.27.

If the increase in the commercial volume and the bunch lever support in the cluster persist and cancel the lower feeling of the quarrel of Elon Musk with the dry,

The Dogecoin price could be set up for a prolonged consolidation phase in the middle of the two key support levels, around the psychological price level of $ 0.25.

The daily graph shows that Doge Price was negotiated at $ 0.25, displaying a decrease of 3.71%, while the Bollinger bands contract, reporting a drop in volatility to come.

Furthermore, Doge Price currently oscillates near the median support of $ 0.22, which aligns the lower Bollinger strip, strengthening this level as a critical request zone.

Dogecoin price forecast

If the bulls maintain control at $ 0.24, a passage to $ 0.27, the simple 20 -day mobile average, remains plausible.

However, the lowering signals persist. The parabolic SAR indicators continue to place resistance over current price levels, which suggests that the momentum has not yet disappeared. The RSI at 35.11 indicates Surolon conditions, referring to a potential relief rebound.

But if Doge loses the support of $ 0.24, the sellers could push prices to the lower $ 0.22 strip, which could cause new liquidations and deepen the correction.

While the shock of Musk with the dry can introduce other turbulence, the underlying technique indicators Suggest that Doge could stage a rebound if the bulls successfully defend the key support levels.

Investors will carefully monitor market conditions evolve.