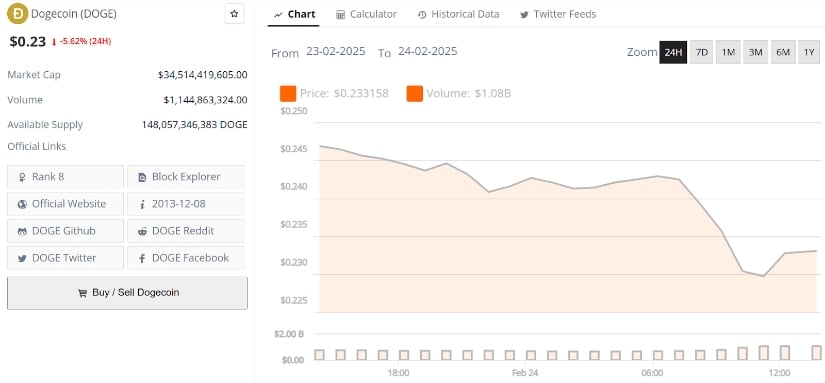

DOGECOIN (DOGE) is again at the center of market turbulence, its price down to $ 0.23 after a drop of 8.55% in last week.

As the lower momentum is built, the merchants look closely at the level of psychological support at $ 0.20. Despite its original currency status, Dogecoin is in difficulty To find a bullish traction, with multiple technical indicators suggesting more downward.

The lowering feeling grows as Doge struggles

Dogine’s recent drop is part of a wider sale on the cryptocurrency market and in particular the meme parts sector. Co -quais statistics indicate that the long -standing ratio is less than one, indicating that more traders provide that the Dogecoin price falls lower than to return up. This change of feeling made the fears deeper that Doge could be in the process of testing the level of $ 0.20 in the near future, central support which, if it were violated, would lead to a stronger correction.

Dogecoin decreases at the bottom of November 2024 in the midst of market volatility, regulatory concerns and slower slowness. Source: Fatratkiller via x

Adding to the scholarship, Dogecoin was recently able to overcome the resistance level of $ 0.27. His inability to do so served to increase the pressure further, with technical experts warning that Doge could continue to refuse Unless buyers work with high volumes.

Technical indicators indicate a new weakness

The relative force index (RSI), one of the most important Momentum indicators, evolves towards levels of occurrence. At almost 32, the RSI indicates that the lowering feeling dominates any possible bounced bounce. If this will continue, Dogecoin may undergo an additional drop in the coming days.

Dogecoin (DOGE) should retest critical support nearly $ 0.20. Source: Soshmayi on tradingView

Meanwhile, technical analysts refer to a potential “death cross” training on the Dogecoin graph, because the 23 -day mobile average should fall below the 200 -day mobile average. Such a crossing in the past has reported an extended downward momentum, which would lead to a support level of $ 0.18. The worst case, if things turn to the south, analysts warn that Dogecoin can drop as low as $ 0.13, a sharp decline compared to its recent summit.

The collapse of the scale tokens and wider market pressures

Aside from technical indices, fundamental market pressures are also against Dogecoin. THE Recent collapse of the balance Token, a piece of memes linked to the Argentinian president Javier Milei, sent the cryptocurrency space in panic. The balance reached a market capitalization of $ 4.5 billion before collapsing more than 90% on the costs of withdrawal and withdrawal of initiate liquidation. This created a widespread pressure on the universe of the piece, without any exception.

Javier Milei offered Elon Musk a chainsaw on the theme of the Doge, while his $ Balancing piece faces a complete slowdown. Source: North blockchain via x

In addition, macroeconomic problems such as the increase in bond yields of the Treasury and the new potential trade rates have also contributed to perpetuating the feeling of moderation of investors. Such wider financial models have helped push the cryptography market to greater volatility, making risky assets such as Dogecoin extremely vulnerable to price variations.

What is the next step for Dogecoin?

While short -term perspectives remain uncertain, long -term perspectives Stay a point of debate between analysts. Some models suggest that a reversal is likely if Doge can Recover the resistance from $ 0.30 level. Others, however, warn that additional weakness can extend the downward trend.

DOGECOIN (DOGE) was negotiated at around $ 0.23, down 5.62% in the last 24 hours at the time of the press. Source: Brave new room

Even with the dominant downward trend, Dogecoin always has a strong position In the territory of the same corner due to a robust support base and continuous popularity. The fact that the room bounces or continues to fall will be determined by the way in which general market trends are progressing and if buyers get Back with confidence in the asset.

For the moment, traders remain cautious, closely monitoring the level of critical support of $ 0.20 while Doge sails in this volatile phase.