- Whale activity signaled renewed confidence, as the price rebounded from the key $0.31 support zone.

- Market sentiment has aligned higher, driven by rising indicators and short-term sell-offs.

Dogecoin (DOGE) has reignited market enthusiasm as whales accumulated over $470 million DOGE in the past 48 hours.

This massive buying spree signals renewed confidence among large holders, sparking speculation about Dogecoin’s rally potential.

Furthermore, this activity comes after a prolonged consolidation phase, giving hope for a bullish breakout. Could this accumulation set the stage for Dogecoin’s next big move in the crypto market?

Whale Activity and Its Impact on DOGE Price Action

At press time, DOGE was trading at $0.3319, reflecting a 0.70% increase over the past 24 hours. Notably, the price rebounded strongly from the $0.31 support zone, which previously halted the bearish momentum.

Therefore, this rally suggests that buyers are regaining control, with immediate resistance at $0.40 and a crucial target of $0.50. If buyers continue to exert pressure, the current whale buildup could further propel the price higher.

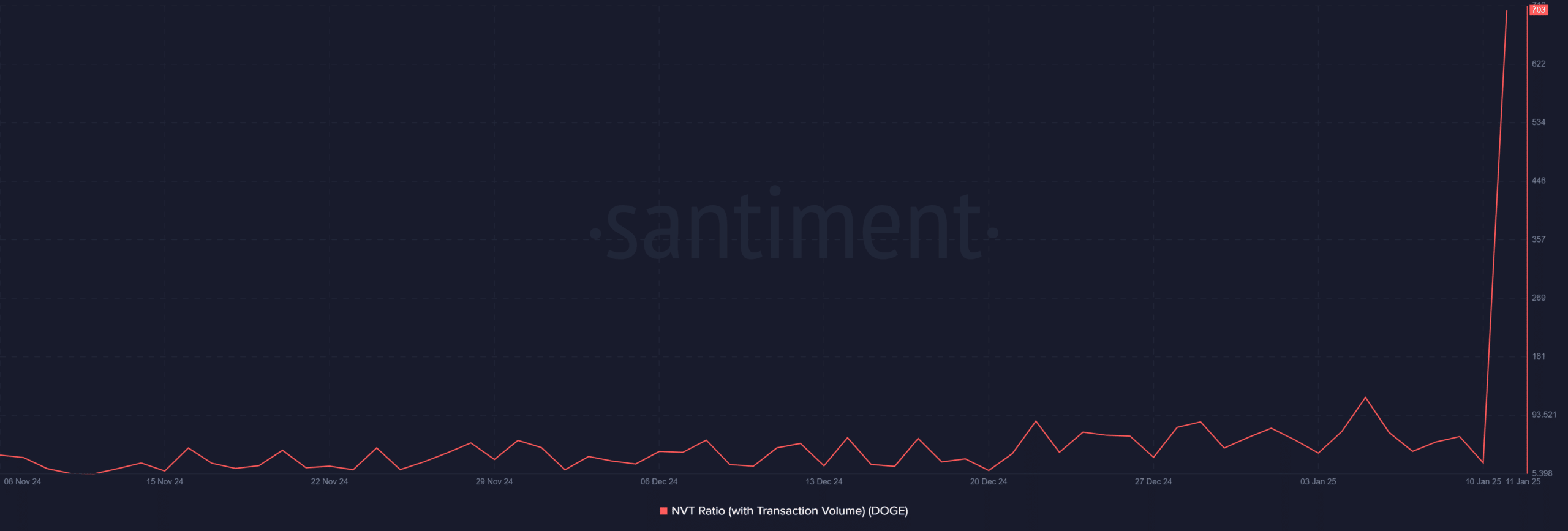

DOGE NVT Ratio Signals Renewed Network Activity

Dogecoin’s network value-to-transactions (NVT) ratio increased significantly to 703, marking a significant rise after a prolonged period of low values. This increase highlights that DOGE’s market valuation is growing faster than its trading volume, which could indicate stronger investor sentiment.

However, such a rise often reflects long-term speculation or accumulation rather than immediate utility. It therefore remains essential to monitor whether transaction volumes catch up with valuation growth.

Daily active addresses show steady growth

Daily active addresses increased steadily from 72.2K the day before to 86.6K at press time. This steady growth suggests a resurgence in network engagement, often resulting in increased trading volume and activity.

Additionally, a slight increase in the number of addresses generally indicates greater confidence among retail and institutional investors. Sustained growth in active addresses could support a broader bullish narrative for Dogecoin.

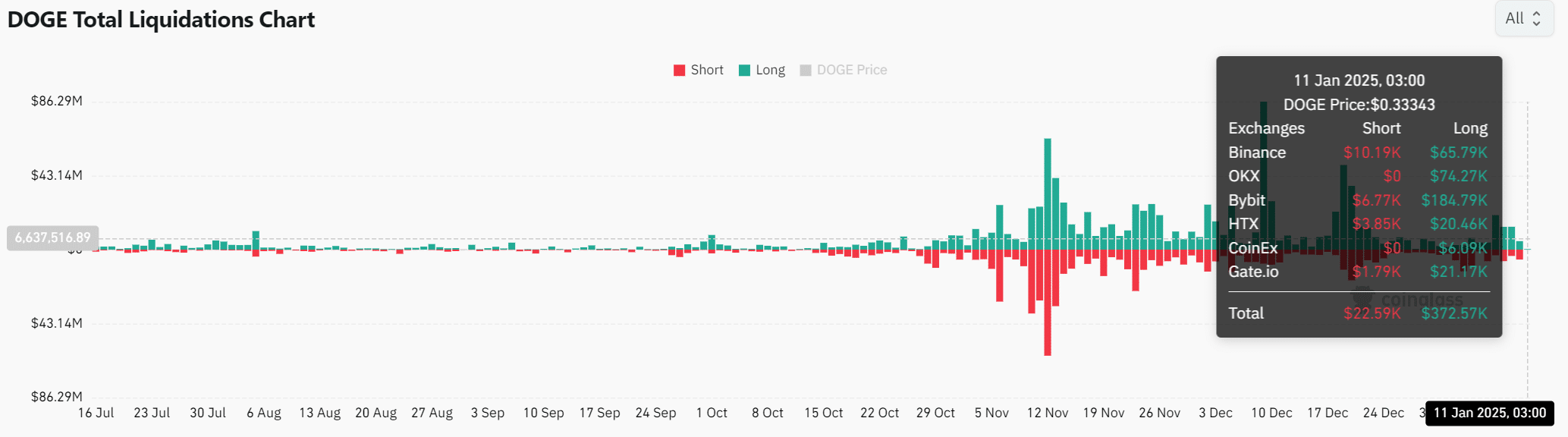

DOGE Market Sentiment Shows Bullish Trend

Market sentiment around Dogecoin reflects cautious optimism, with open interest up 5.25% to $3.49 billion. Recent liquidations reveal a higher volume of short positions ($22.59K) compared to long positions ($372.57K).

This imbalance suggests that bearish traders are being crowded out, often leading to further upward price momentum. Therefore, the market seems to be leaning towards bullish results in the short term.

Read Dogecoin (DOGE) Price Prediction 2025-2026

Conclusion: Is Dogecoin Ready for a Breakout?

Dogecoin whale activity, increasing on-chain metrics, and bullish price action paint a positive picture for the outlook. However, breaking through the $0.40 resistance remains crucial to confirm a sustainable rally.

If this level is breached, Dogecoin could aim for its next target at $0.50 and beyond. Therefore, with increasing network activity and increased market confidence, Dogecoin appears well-positioned for another major breakthrough.