- The Dogecoin price continues to negotiate down $ 0.24 after dropping more than 7% the previous week.

- The technical perspectives suggest another correction because the RSI and MacD indicators report downward divergences.

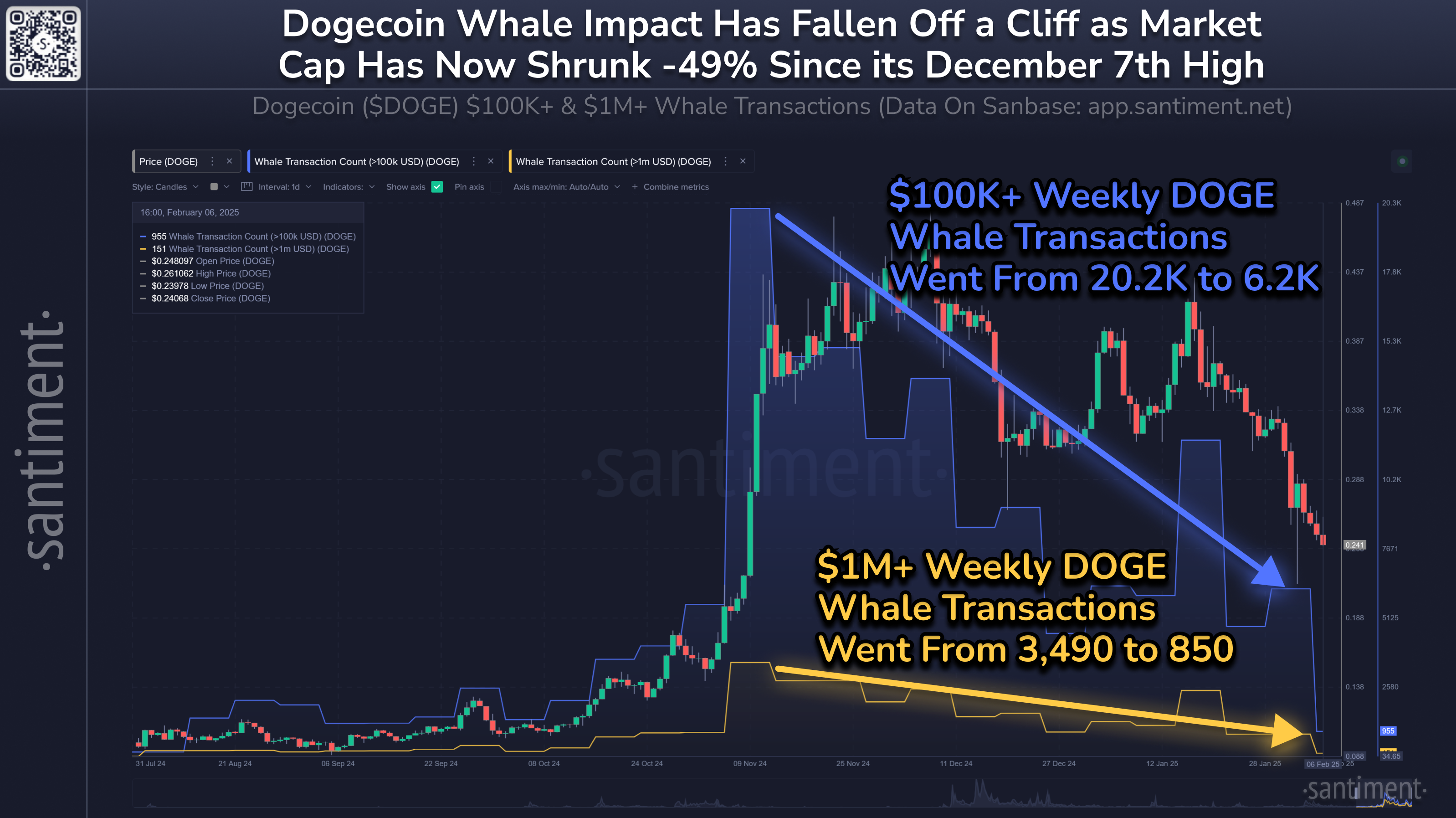

- Santiment data show that DOGE whale transactions decrease, indicating weakness.

DOGECOIN (DOGE) continues to negotiate around $ 0.24 after dropping more than 7% the previous week. The technical perspectives suggest another correction because Doge’s Momentum indicators reflect downward divergences. Santiment data show that DOGE whale transactions decrease, indicating signs of weakness.

The activity of the Dogecoin whale fell from a cliff

The Dogecoin price has dropped by more than 30% since mid-January and continues to descend. According to health data, DOGE whale transactions have also decreased with its price.

The graph below shows that the weekly whale transactions of $ 100,000 in Doge have increased from 20,200 to 6,200 since early November. In addition, more than a million dollars in weekly transactions also went from 3,490 to 850 during the same period, which indicates a weakness of the accumulation of whales.

DOGE Weekly Whale Transactions thatm. Source: Santiment

Technical perspectives of Dogecoin: Momentum indicators show a step in the advance

Dogecoin Weekly chart decreased by 7.15% last week, closing below its price level of prices of 50% (from a minimum of August 14 of $ 0.05 at a level of December 2 of $ 0.48) at $ 0.27. At the start of this week on Monday, he oscillates about $ 0.24.

If Doge continues to drop, he could extend the correction to retest his weekly support at $ 0.18.

The indicator of the relative resistance index (RSI) on the weekly graph reads 48, below its neutral level, indicating an increase in the bearish momentum. In addition, the divergence of mobile average convergence (MacD) indicators Also show a lower crossover on the weekly graphic, suggesting a continuation of the downward trend.

DOGE / USDT weekly table