The price of Dogecoin (DOGE) is up 7% in the past 24 hours as it attempts to regain its $50 billion market cap. Trading volume soared to $3 billion during this period.

Key technical indicators, such as the Ichimoku cloud, are signaling strong bullish momentum. If the current trend continues, DOGE could break through key resistance levels and make significant gains in the near term.

DOGE Ichimoku Cloud Shows Bullish Pattern

The Ichimoku cloud chart for Dogecoin reveals a bullish pattern. Price broke above the red cloud, indicating a change in momentum as buyers took control, pushing the price higher.

The red cloud, formed by Senkou Span A and Senkou Span B, previously reflected bearish sentiment, but DOGE moving above suggests a change in feeling. The current green cloud further supports this bullish outlook, as it signals a potential continuation of the bullish momentum.

Additionally, the blue Tenkan-sen (conversion line) surpassed the orange Kijun-sen (baseline), further confirming the uptrend. This crossover highlights short-term price strength exceeding the long-term benchmark. The green timeframe (Chikou Span) is also positioned above the price and the cloud, signaling that the current uptrend is consistent with previous price movements.

For DOGE Price To maintain its upward trajectory, it must stay above the cloud and capitalize on this dynamic. However, any failure to maintain these levels could lead to consolidation or a return to the cloud.

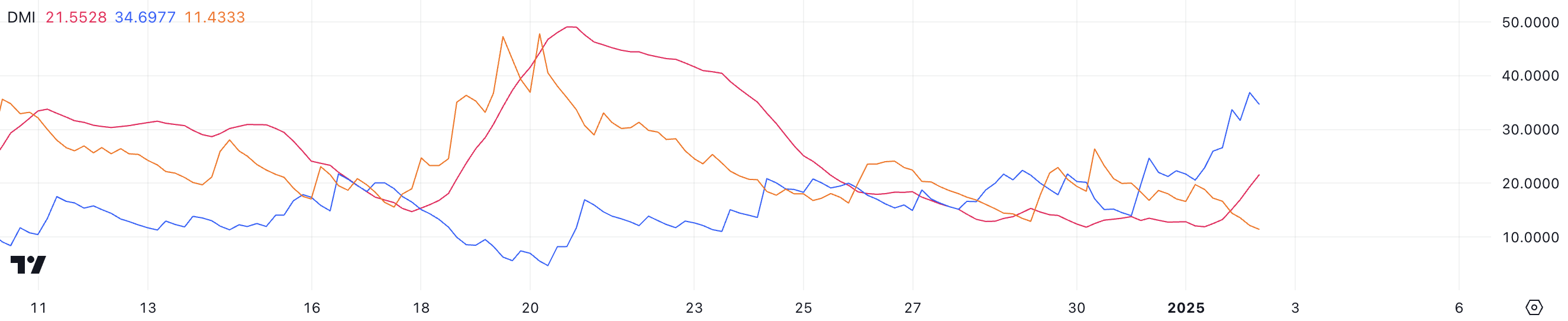

Dogecoin DMI Indicates Potential for Stronger Uptrend

Dogecoin The DMI chart shows its ADX currently at 21.5, which is up significantly from 11.9 yesterday, indicating a strengthening trend. The rise in ADX suggests that the uptrend is accelerating, reflecting growing market confidence and increased buying activity.

The +DI (directional indicator) jumped to 34.6 from 15 over the past two days, signaling strong buying pressure, while the -DI fell to 11.1 from 20, reflecting a significant reduction in selling pressure. This divergence between the +DI and the -DI reinforces the dominance of bullish momentum in the market.

The Average Directional Index (ADX) measures trend strength on a scale of 0 to 100, with values above 25 indicating a strong trend and readings below 20 suggesting weak or absent trend strength. DOGE’s ADX at 21.5 shows that the trend is about to consolidate, especially given the sharp rise in +DI and decline in -DI.

In the short term, this configuration suggests that DOGE Price is likely to continue its upward trajectory as buyers are in control. However, for the trend to continue, the ADX must continue to rise and hold above 25 to confirm a strong uptrend.

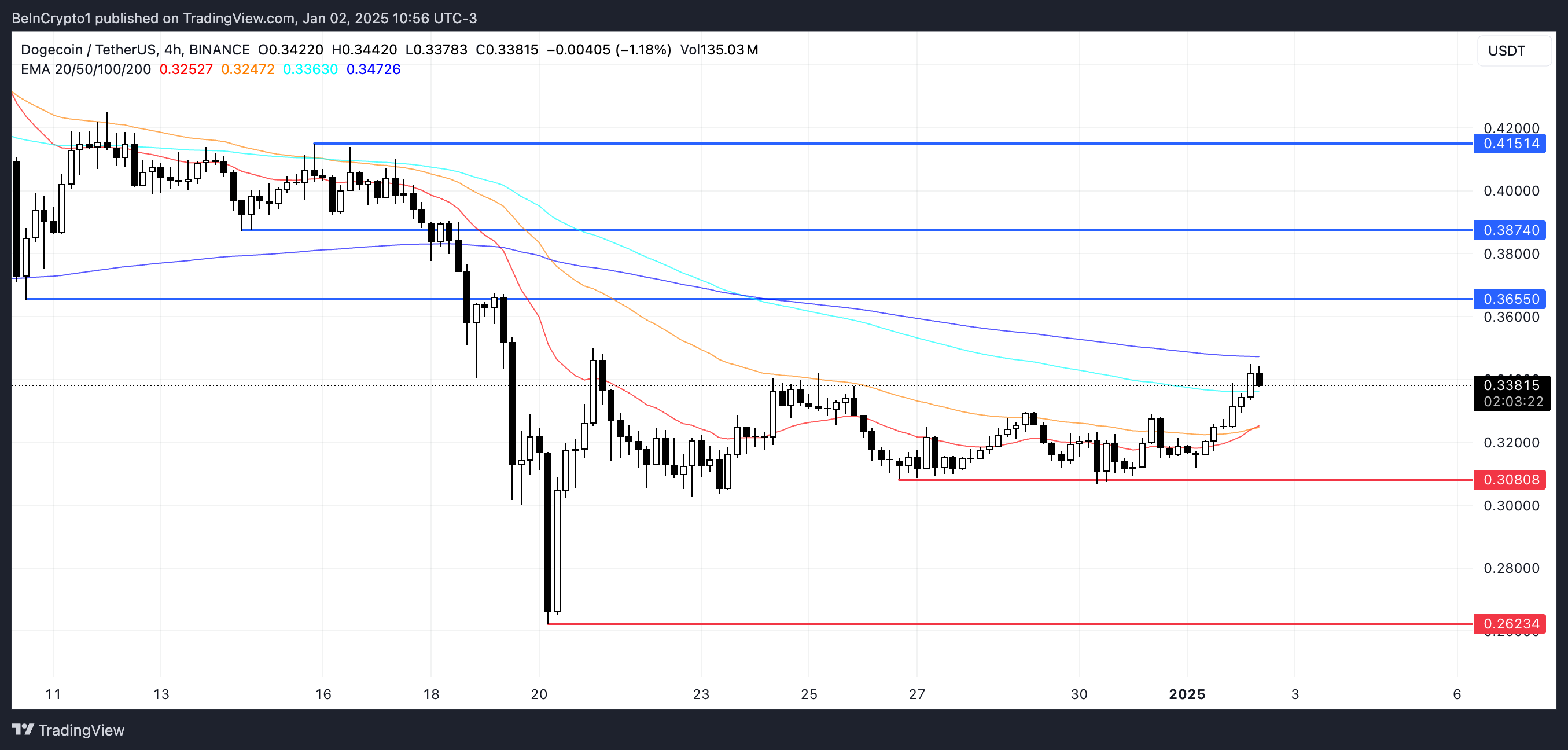

DOGE Price Prediction: Will It Rise 22% Soon?

Dogecoin Price The EMA lines suggest that a Golden Cross could form soon, a bullish indicator where the short-term EMA exceeds the long-term EMA. This potential crossover could signal a continuation of the uptrend, allowing DOGE to test resistance at $0.36.

If this level is breached, DOGE price could target higher resistance levels at $0.387 and $0.415, representing a potential price increase of 22.7%.

On the other hand, if the upward trend runs out of steam and the market reverses, DOGE Price could test its immediate support at $0.30. Failure to hold this level could lead to a steeper decline, with the next strong support at $0.26 coming into play.

For DOGE to maintain its upward trajectory, the Golden Cross would need to materialize and buyers would need to push the price through critical resistance levels.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.