The Dogecoin price (DOGE) has shown little movement in the last 24 hours, down approximately 3%. Its negotiation volume fell 36% to $ 1.65 billion despite Neptune digital assets buying $ 370,000 DOGE. The price has been blocked below $ 0.33 for almost a week, has trouble taking a bullish dynamic.

Technical indicators continue to show a lower configuration, the Ichimoku Cloud and EMA lines strengthening the risks down. Unless Doge can break the levels of resistance of the keys, the trend remains low, leaving room for additional drops.

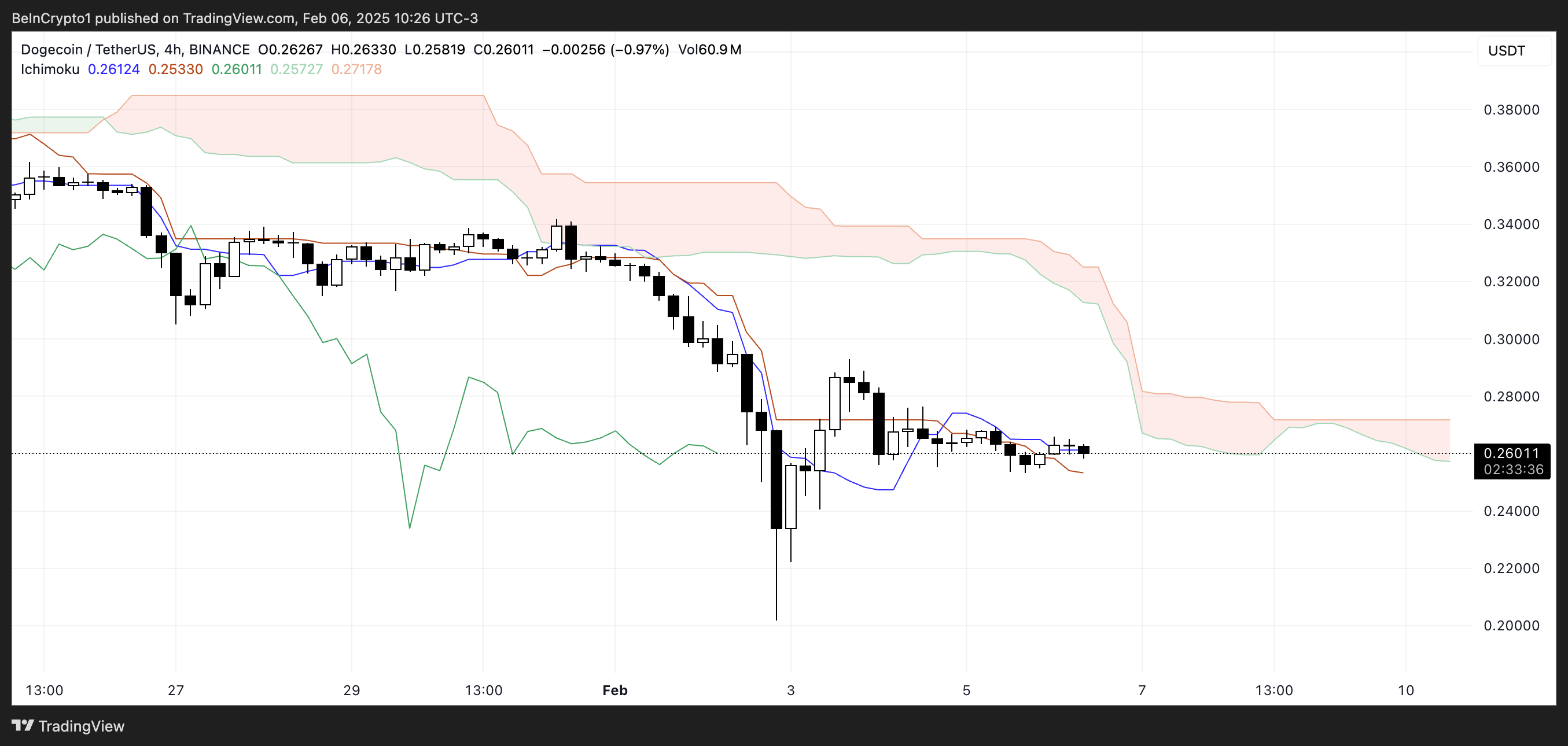

The Ichimoku cloud shows a downward perspective for Doge

Cloud Dogecoin Ichimoku The graph has a downward perspective, the price merchanting below the cloud. The future cloud remains red, signaling continuous decrease pressure and indicating that the resistance levels could remain high in the short term.

The conversion line (blue) is currently moving laterally near the basic line (red), suggesting a period of consolidation rather than an immediate trend reversal.

However, with the price that cannot gain momentum above these lines, the lowering feeling remains dominant, despite the Canadian cryptography company Neptune digital assets announcing that he had bought $ 350,000 from Doge in December.

In addition, the duration of delay (green) is positioned below the price of the prices, confirming that Mediating prices is still in a downward trend. The upcoming cloud is sloping downwards, strengthening the possibility that the bearish momentum can persist.

If the basic line is similar while the conversion line moves upwards, it could indicate a change in potential trend, but for the moment, DOGE Remains in a weak position without a clear sign of recovery.

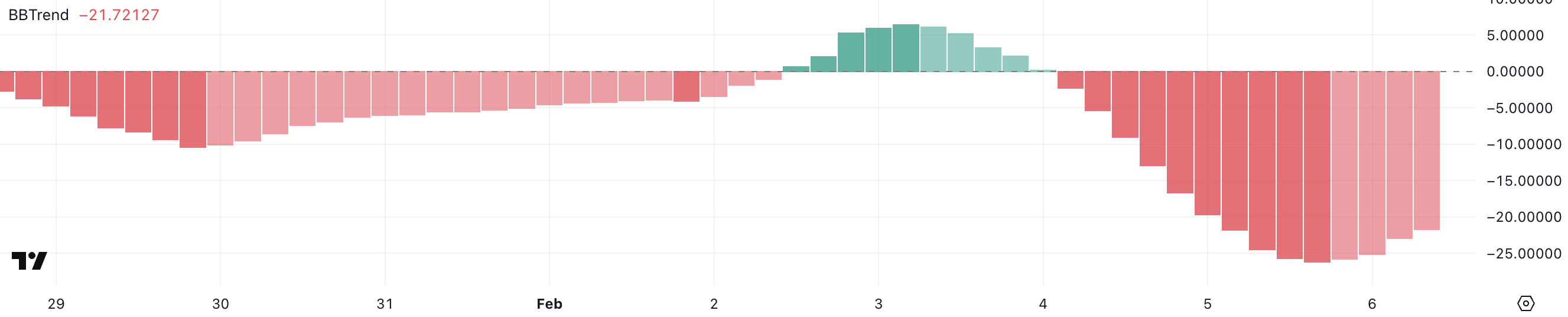

Dogecoin Bbtrend is always negative, but goes up

Mastiff Bbtrend is currently at -21.7, having remained negative in the last two days. He culminated at -26.1 yesterday before starting to lose strength, indicating that the bearish momentum is still present but weakens slightly.

Bbtrend is an indicator that measures the trend force based on Bollinger strips. Positive values indicate a bullish momentum and the negative values suggest a downward trend. The more the value is from scratch, the stronger the trend in both directions.

With Bbtrend de Doge now at -21.7, down -26.1 yesterday, this suggests that if the downward trend remains intact, the sales pressure begins to relax. Continuous movement up to Bbtrend could indicate that the lowering momentum fades, potentially resulting in a consolidation or a rebound of relief.

However, as long as the Bbtrend remains negative, the global trend is always down, which means Mediating prices could have trouble gaining a significant rise in a significant increase in a stronger momentum.

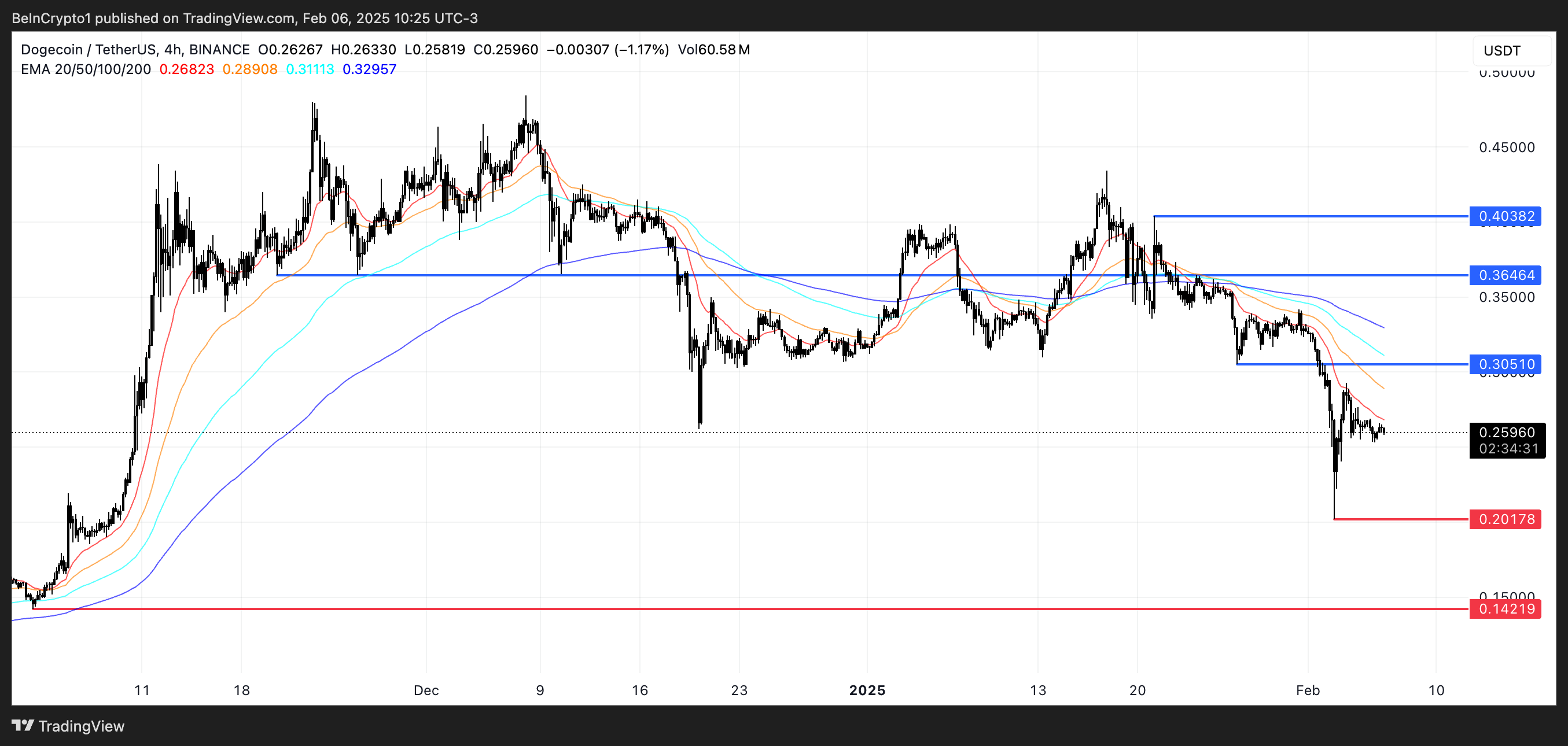

Price prediction: will Dogi will increase and break the resistance by $ 0.36 this time?

The EMA lines of Dogecoin indicate a lower perspective, with short -term EMAs positioned below those in the long term. This alignment suggests that the current downward trend remains strong, and if the negative momentum continues, Doge could test the level of $ 0.20.

Ventilation below this support could push Dogecoin price Further on $ 0.14, marking its lowest point since December 10, 2024.

On the other hand, if the trend is reversed, Doge could try to recover $ 0.30 in resistance. A successful breakthrough above this level could lead to a retest of $ 0.36, a key level that Doge did not exceed at the end of January.

If the bullish momentum is further strengthened, Mediating prices could climb up to $ 0.40, representing a potential of 54%. However, until EMA moves to more optimistic training, the global trend remains down.

Non-liability clause

Online with the Project of confidence Guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our Terms and Conditions,, Privacy PolicyAnd Warning have been updated.