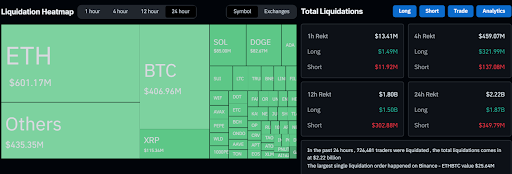

The entire cryptocurrency market has experienced a sharp decline in the last 24 hours, with its total two-digit diving after a swarm barrier of volatile price. Unsurprisingly, this strong recession has led to generalized liquidations among several assets during the past past. In particular, this wave of liquidations has led to more than $ 2,222222222222222222222 billion dollars suffered cryptocurrencies in the last 24 hours. According to Coringlass data, Dogecoin merchants were important witnessesS, with numbers placing the same part of the hardest assets of this liquidation event.

Dogecoin merchants lose more than $ 82 million in 24 hours

Co -quince data reveals that the liquidations of Dogecoin have been among the most serious on the market in the last 24 hours, as Leverage positions collapse Under the weight of quick price swings. A more in -depth examination of the data shows that the vast majority of these liquidations came from long positions, the bullish traders undergoing losses amounting to $ 69.32 million. These traders, mainly expecting a rally this week or at least a stable market, were caught off guard as a Dogecoin price took a bright turn downwards In addition to the rest of the market, forcing liquidations and cascading losses.

Related reading

Interestingly, despite the broader trend that leans towards a drop in prices, the open sellers have not been spared the liquidation frenzy. The data show that $ 13.35 million in short positions were liquidated, which suggests that brief price peaks occurred during the general decline. These momentary overvoltages may have triggered arrest losses for certain short traders, leading to forced liquidations even if the overall trajectory has remained down.

Market -scale liquidations exceed $ 2.22 billion in high volatility

The cryptocurrency market launched the new week on a lower note after a consolidation period throughout the previous week. Bitcoin, who had maintained relative stability, saw A sharp decline While the weekend was coming to an end, exceeding the $ 100,000 mark on Sunday and continued to extend the move from there.

Related reading

Bitcoin’s decline triggered a wider market sale, with several major cryptocurrencies that follow the step. At the time of the drafting of this document, the global market capitalization of cryptography has dropped approximately 11% in the last 24 hours and is now at 3 billions of dollars, its lowest level since November 15, 2024. As long as such, the wider market of cryptocurrency has grown brutal in the last 24 hours, liquidations exceeding $ 2.22 billion.

Bitcoin and Ethereum merchants made the greatest successes of this liquidation trip. Bitcoin alone recorded more than $ 406.96 million in liquidated positions, the majority being long discussions of $ 341.36 million in the last 24 hours. However, Ethereum traders have known the heaviest Liquidations, with $ 601 million in aneratic positions.

With Dogecoin knowing $ 82.67 million in liquidations, the consequences of this sale could pave the way for increased volatility alongside other cryptocurrency short -term. At the time of writing the editorial staff, Dogecoin is negotiated at $ 0.235, down 22.5% in the last 24 hours.

Adobe Stock star image, tradingView.com graphic