Shiba Inu price joined other cryptocurrencies in a strong sell-off as the recent rally took a breather and the burn rate decreased.

Shiba InuSHIB), the second-largest coin, fell to $0.000024, down 21% from its highest level this month.

Data from Shiburn shows that the coin’s burn rate dropped 30% on November 26 to 3.4 million. This brings the total number of coins burned to 410 trillion, a trend that is expected to continue in the coming years.

Shiba Inu burns occur in several ways, including Shibarium and ShibaSwap transaction fees. According to Shibarium Scan, the network has processed more than 561 transactions and the number of addresses in the ecosystem has increased to 1.93 million.

Shibarium, a layer 2 network, saw its daily fees decrease despite the increase in transactions. On November 25, the fee was 714 BONE, the equivalent of $342, with some of these coins converted to SHIB and burned.

ShibaSwap, a decentralized exchange on Shibarium, has total assets of over $23.2 million. Lama DeFi the data shows around 40 active addresses in the last 24 hours, with total annualized fees reaching $2.4 million.

Shiba Inu price also fell, with data revealing whales were selling the coin, likely making a profit after the recent rally. The biggest whale transaction on November 26, it sold tokens worth $4.8 million, while two other whales sold tokens worth $2.2 million and $1.8 million, respectively. of dollars.

Shiba Inu price could still reach its highest since the beginning of the year

Technical indicators suggest that SHIB price could rise by 90% to reach its yearly high of $0.000045.

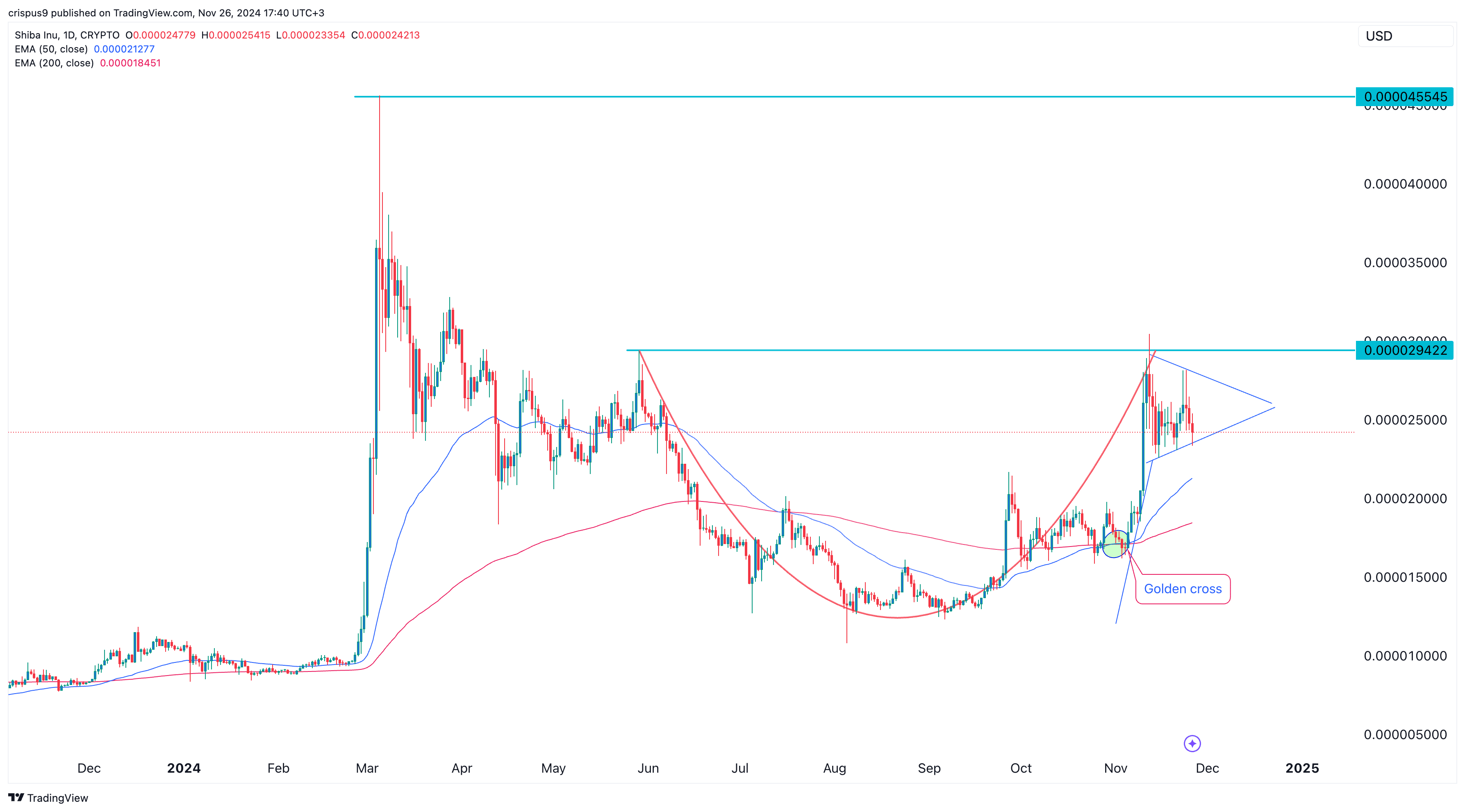

On the daily chart, the coin has formed a cup and handle pattern, a bullish indicator. The upper limit of this pattern is $0.000029. Measuring the depth of the cut, projections indicate that the coin could reach $0.000046, approximately 94% above its current level.

Shiba Inu has also developed a bullish pennant pattern, characterized by a vertical line and a symmetrical triangle. Typically, this pattern leads to a bullish breakout as the triangle approaches its confluence point.

Additionally, SHIB has recently formed a golden cross pattern, where the 200-day and 50-day moving averages cross. These indicators suggest that the uptrend remains intact and the coin could soon retest its high of the year.