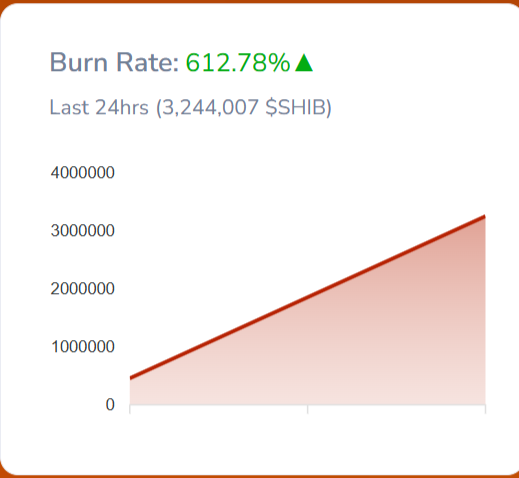

- SHIB’s burn rate soared by 600%, reducing the supply by over 3 million tokens on January 22.

- Shiba Inu Coin The price is hovering around the 200-day EMA and has struggled to regain momentum.

Shiba Inu Coin has been in a sideways trend since last month, recording a 10% decline through January 22. It fell below the 200-day EMA mark and sparked concerns among investors over whether the memecoin could reverse its course.

However, the recent Shiba Inu burn rate saw an increase of over 600%, clearing over 3 million tokens in the past few hours.

Typically, when the rate of consumption increases, it often generates short-term bullish sentiment and precedes a rise in prices.

At the time of going to press, SHIB Price was trading at $0.00001984, noting a decline of over 3.85% in the last 24 hours. Its market capitalization stood at $11.68 billion, ranking it 17th in the crypto market.

Amid a significant increase in burn rate, Shiba Inu Coin still reflects selling pressure, which raises a question: will this recent burn spark a reversal rally?

Increased burn rate: how the market reacted

Shibburn data shows that almost 3 million tokens have been burned, bringing the increase to over 612% in the last 24 hours. However, reducing supply usually results in an increase in value, but this only happens when there is a simultaneous increase in demand.

Despite the significant reduction in supply, the price action indicates a lack of demand, which means a bearish signal. According to the rule of supply and demand, when supply declines, it often precedes a rebound in prices.

However, there was no sign of a price rebound as memecoin was still trading in red and investors were panicking.

Is Shiba Inu Coin Ready to Rebound: Here Are Analyst Predictions

A recent Rose Premium Signals article on

However, investors should consider the mid-term target of $0.00002518 and $0.00003218 to book their profits.

Although a target of $0.00004018 can also be seen in subsequent sessions, a stop loss of $0.00001018 should be followed.

In addition to analyst predictions, data held by IntotheBlock sheds light on the trend. About 50% of holders were profitable at the time of publication.

This profitability data, coupled with the increased burn rate, paints an optimistic picture of the SHIB community and its potential rebound in the sessions to come.

Shiba Inu Price Analysis: Key Levels to Watch

On the daily calendar, SHIB Price is trading with a bearish bias, below key EMAs and has been rejected on the rebound. This highlights the dominance of sellers and the lack of purchasing momentum.

The Relative Strength Index (RSI) line had a reading of 40, representing weak momentum and a negative crossover, confirming the downtrend.

The immediate support zone of $0.00001500 was the make or break zone for Shiba Inu coin. Below this level, a next wave of sell-offs can be anticipated.

On the other hand, above $0.00002500, a range breakout could be in play, which could trigger a further trend reversal.

Disclaimer

In this article, the views and opinions expressed by the author or any person named are for informational purposes only and do not constitute investment, financial or other advice. Trading or investing in cryptocurrency assets carries a risk of financial loss.