Bitcoin, the main digital asset, fell below key support levels, to erase recent gains and rallying of lowering concerns. The slowdown occurs in the middle of a broader weakness of the market, macroeconomic uncertainties and the change of feeling of investors.

The cryptography market crash has led to more than $ 1.48 billion in liquidations, with $ 1.37 billion from long positions, according to Corglass data. This suggests that leverage traders have been caught by the sudden change in feeling.

The Bitcoin price flows below $ 90,000, reaches a three -month hollow

The price of bitcoin has decreased sharply below the $ 90,000 brandIt has been the lowest since three months ago. The cryptocurrency dropped $ 87,220, a 7% drop in previous levels, and even dived at $ 85,899.99, the lowest since November 2024. This net drop has occurred when the cryptography market sales pressure of the actions of actions and general macroeconomic uncertainty.

Bitcoin lost around 20% of its record, set to the inauguration day President Donald Trump, according to money measures. Analysts point out that the recent collapse of Bitcoin is correlated with greater volatility on the market.

Bitcoin (BTC) was negotiated at around $ 88,899, down 5.89% in the last 24 hours at the time of the press. Source: Bitcoin Liquid Index (BLX) via Brave new room

“Actions had a few difficult sessions during last week, the best interpreters lower than the index, while the markets are struggling with increasing uncertainty under the new regime,” said Steven Lubka, head of private customers of Swan Bitcoin. “This tension has infiltrated the Bitcoin and Cryptography markets.”

In addition, the fall in Bitcoin was powered by a powerful liquidation of $ 760 million, which confirmed a loss of confidence in the $ 90,000 support area. Although Bitcoin negotiated funds (ETF) are seen, experts always debate temporary correction or the start of a prolonged trend.

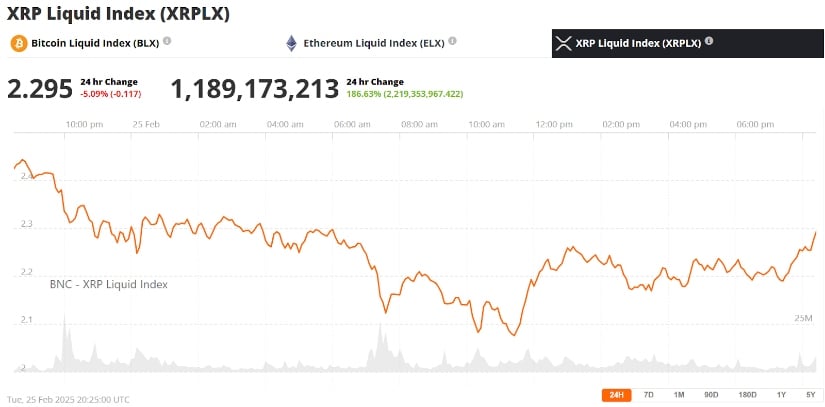

XRP faces a strong sales pressure

Ripple’s XRP token has also strongly plunged, falling below the crucial level of support of $ 2.50. XRP is Trading currently At $ 2.29, down 6.6% compared to the previous fence. This fall follows a broader drop in the cryptography market due to macroeconomic uncertainty and recent security violations such as piracy of $ 1.5 billion on the relay based in Dubai.

Ripple (XRP) was negotiated at around $ 2.29, down 5.09% in the last 24 hours at the time of the press. Source: XRP liquid index (XRPLX) via Brave new room

Technical analysis points to XRP break Under the $ 2.50 support like a downward momentum. A critical downward trend line has been established, where resistance reaches $ 2,4880, which should facilitate additional sales. If the downward trend continues, XRP must test the support level at $ 2.10.

Investors are closely monitoring, because the exchanges supported below $ 2.50 would generate additional sales pressure and a possible retest of the lower support levels. Alternately, a Bounce above this level would trigger a reversal and an upward freshness.

Watch – XRP price analysis video

https://www.youtube.com/watch?v=RD2ltMabrlo

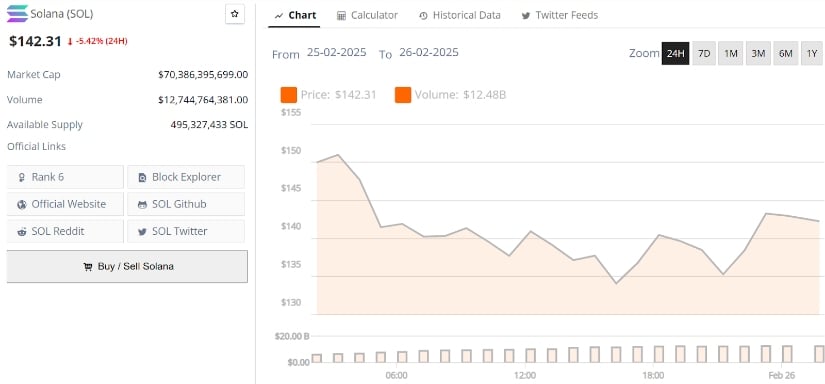

Solana’s decline raises questions about network activity

Solana, a cycle favorite with its high -speed blockchain and its solid community of developers, was not spared the collapse of the market. The token denied About 7%, the price movement reflecting increased volatility.

Solana (soil) was negotiated at around $ 142, down 5.42% in the last 24 hours at the time of the press. Source: Brave new room

Despite the solid fundamental principles of Solana, the congestion of the network and periodic downtime was a concern among investors. In addition, the drop in the broad market had an impact on high -growth altcoins like Solana, leading to a high prices correction less than $ 150. During the bear phase, Sol can test the support level at $ 130 before stabilizing.

Watch – Solana price prediction video

Dogecoin falls as the currency rally sparkles

Dogecoin, the main piece of the same, lost more than 10% in the middle lowering feeling on the market. The token, which used to jump on social media movements and the celebrities of Elon Musk, could not take advantage of recent momentum.

DOGUE (DOGE) Price. Source: Brave new room

The parts market even, which saw speculative fever exchange at the start of the year, seems to lack steam while investors pay attention to risk -free assets. Dogecoin Journeys In terms of support of $ 0.20, reflect the general trend in taking advantage and reduced risk appetite among investors.

Watch – Dogecoin price prediction video

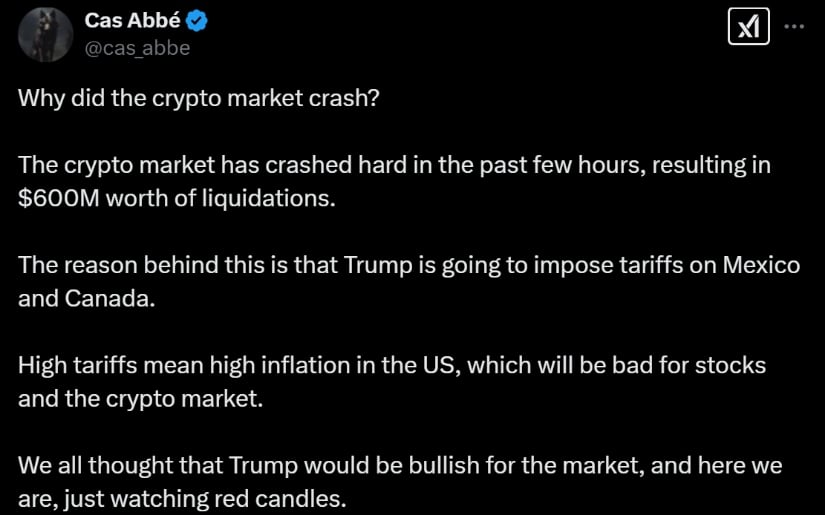

What triggered the accident?

Several factors have contributed to the sale, ranging from macroeconomic uncertainty at risk specific to industry. Analysts highlight the correlation between bitcoin and traditional markets while the recent slowdown in American actions has spread to crypto.

The cryptography market crashed after Trump announced prices on Mexico and Canada, which sparked fears of inflation. Source: Abbot via x

“The actions have been faced with a few difficult sessions, the most efficient actions seeing significant losses,” said Steven Lubka, head of private clients for Swan Bitcoin. “This pressure has spread on the bitcoin and cryptography markets.”

In addition, geopolitical concerns and economic data have weighed on the feeling of investors. The increase in yields of the American treasury, weak economic indicators and uncertainty surrounding future federal reserve policies have prompted many traders to adopt a risk approach.

Aurelie Barthere, main research analyst of Nansen, noted that Bitcoin’s decline follows a broader trend in retirement risk assets. “BTC is now lowering the drop in other tokens prices,” she said, citing recent incidents such as the Hack of Bybit and the scam that have further attenuated risk appetites.

Prices, inflation and market dips

Beyond short-term market trends, proposed prices In Canada and Mexico, aroused fears of global economic instability. Investors fear that such policies could cause disruption of the supply chain and slowdowns of economic growth that would create a training effect for cryptographic markets.

President Trump announces a 25% rate in Canada, starting March 4. Source: America to the point via x

In the meantime, inflation is also a primordial concern. The consumer price index (IPC) increased by 0.5% in January, which was more than expected and relaunched the fears that the federal reserve pushes against interest rate reductions. Traditionally, bitcoin has been considered to be coverage of inflation, but short -term uncertainty has brought generalized volatility.

“The market was very optimistic about a friendly crypto government from November to January,” said Joel Kruger, a strategist for the LMAX group market. “Now it’s a question of waiting for the next catalyst.”

Could a rebound be on the horizon?

Despite the dark image, some analysts think that the correction is temporary. Bitcoin has historically seen net withdrawals even on the bull markets, and many traders see it as a routine shaking before winning new gains.

Bitcoin (BTC) could bounce back from current support close to $ 86,000 and retest the critical resistance at $ 95,000. Source: TK2YTK2Y on tradingView

“There is room for Bitcoin to decrease to the area from $ 70,000 to $ 75,000 without compromising long -term perspectives,” noted Kruger. “We suspect that demand will emerge at these levels.”

Lubka also expects the market to stabilize, predicting that Bitcoin will resume its Ascending trajectory in mid-March. With potential catalysts such as the report on NVIDIA profits and upcoming American inflation data, traders watch closely for signs of Renewed moment.

For the moment, the market remains at the front, but long -term investors see this slowdown as an opportunity rather than a sign of misfortune. As history has shown, bitcoin and the wider market of cryptography have resisted Worse storms Before.