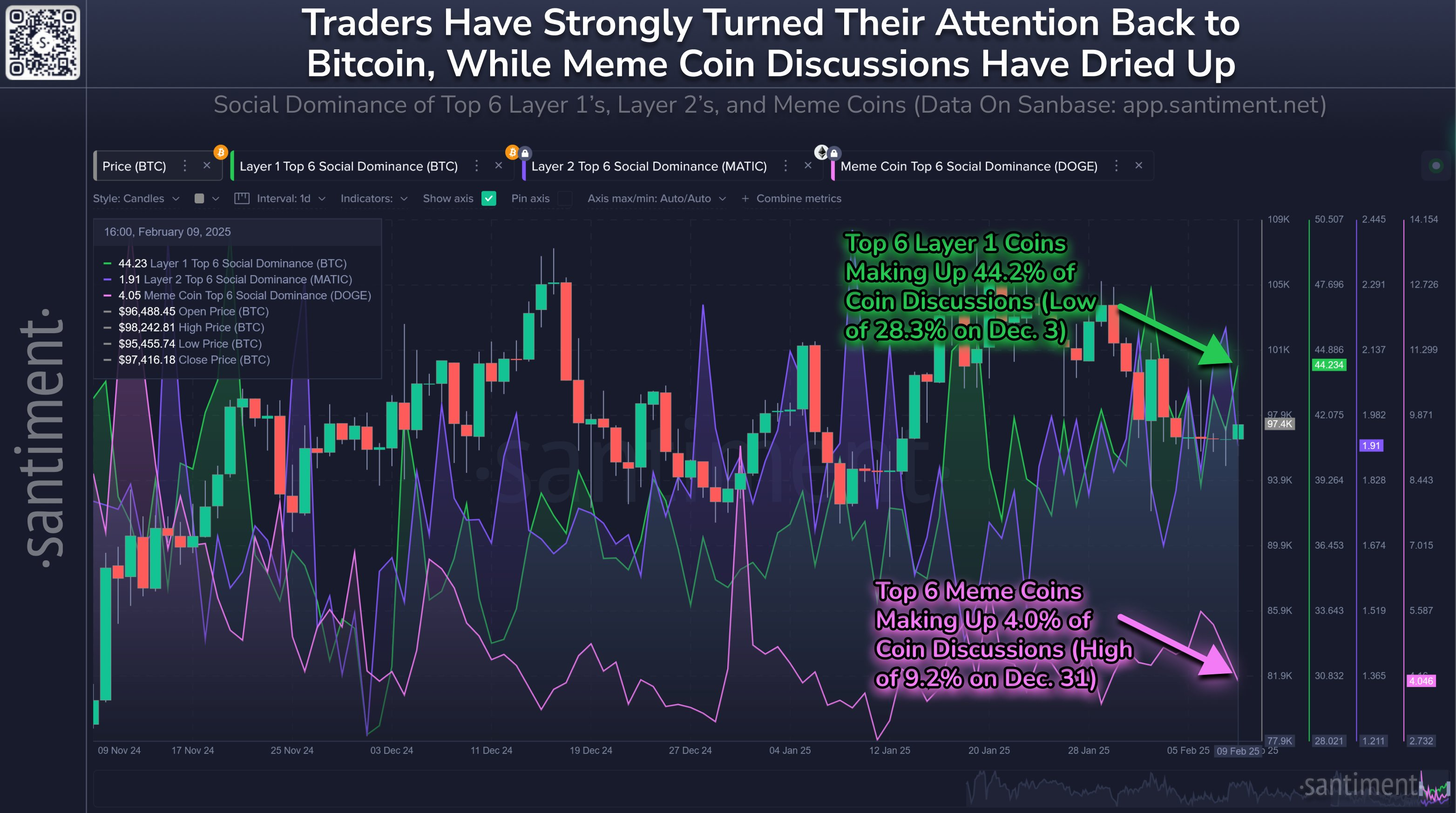

Crypto could be directed to a healthier market cycle, because the interest in the same is going BitcoinEther and other altcoins of layer 1, according to the santiment of the onchain analysis platform.

The social feeling tracker of santly shows that the best channels of layer blocks 1 such as ether (ETH $ 2,713), Solana (soil $ 204.73), Toncoin (ton $ 3.86) and Cardano (ADA $ 0.7926) dominate 44.2% of discussions between specific parts, while the first six mecoins receive only 4% of the discussion on social networks, said the platform in an article on February 10 to X.

The change in focus could mean a “more stable and lasting market environment” because the Bitcoin networks (BTC 98 314 $) and the layers of layer 1 represent the fundamental infrastructure of cryptographic space, he declared, adding:

The increased accent on these assets generally reflects a more mature and more enlightened approach in the community, which favors security, innovation and adoption of the real world.

“Layer 1 blockchains support intelligent contracts, decentralized applications and the scalability of the network-the main engine growth engines in industry,” he said.

Traders are talking more about Bitcoin and Altcoins than even in recent times. Source: Santiment

The tracker has also found mecoins such as Dogecoin (DOGE 0.2673 $), Shiba Inu (Shib 0.00001628) and PEPE (PEPE 0.00001006) are talking about “less and less on social networks” , with speculating santly that drop could be due to recent volatility.

The monitoring of social feelings crosses social media channels specific to crypto such as X and Telegram for the first 10 words which saw the most significant increase in social media mentions compared to the previous two weeks, according to its methodology.

Santiment has said that the cycles dominated by mecoins generally signal a phase where traders pursue short -term gains and precede market corrections as the media threw.

The same, even prospered the activity of the same president Donald Trump, Pump.

Millions of bitcoins and moving ether

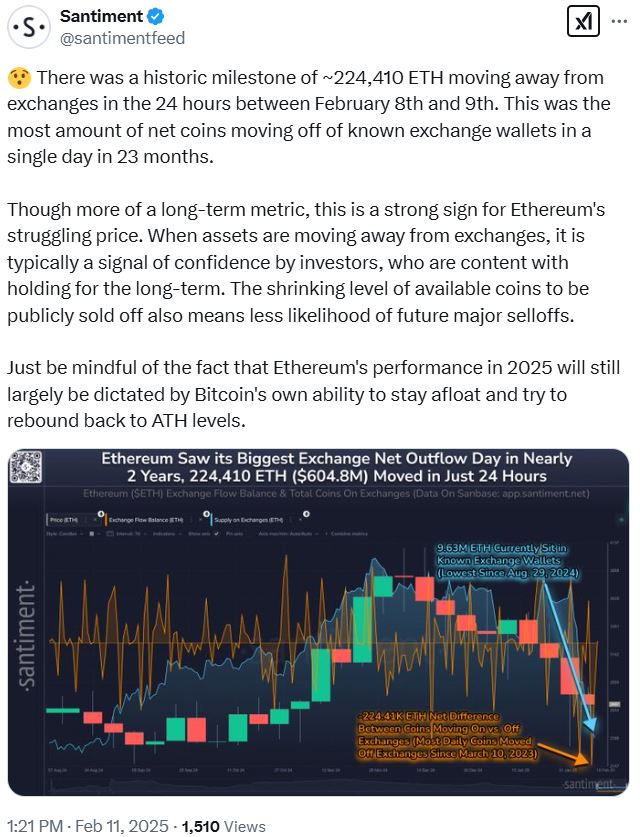

Meanwhile, in an update from February 11 to X, Santiment declared that 224,410 ether of exchanges between February 8 and February 9, the most important movement of the exchange portfolios known in one day during of the last two years.

“Although more a long -term metric, it is a strong sign for the price in difficulty of Ethereum,” said Santiment, because it signals the long -term confidence of investors.

Source: Santiment

On the other hand, Crypto Dan said in a recent Quicktake market update that 14,000 bitcoin that had been inactive for seven to 10 years had evolved throughout February 10.

“Despite the large volume, these parts have not been transferred to exchanges, which suggests that they are not intended for immediate sale,” said Crypto Dan, a contributor to the ONCHAIN analysis platform Cryptocurrency.

“This type of movement does not necessarily mean that the price of Bitcoin will drop. In the past, similar cases has occurred, but they have not always led to a drop in prices. »»

However, he noted that the average acquisition price of these parts is relatively low, which could influence “future decisions of holders concerning potential sales”.