Shiba Inu (Salogner) The price has been negotiated over the last seven days but remains down 27% in the last 30 days, reflecting a wider period of weakness. Despite recent signs of recovery, Momentum indicators such as the RSI And Bbtrend suggest that Shib is still struggling to establish a clear direction.

However, a potential golden transformation on EMA lines could point out a bullish break, with levels of resistance to the key of Shib looking at $ 0.000017 and $ 0.000019. Lower down, if the sales pressure of curriculum vitae, Shib could retain the support at $ 0,000014.

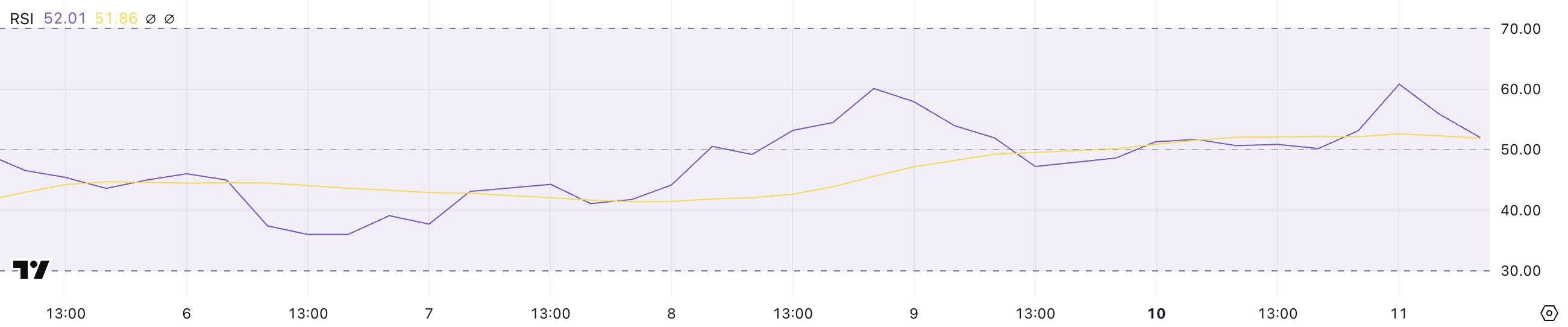

Shib RSI is currently neutral, against 60.8

Shiba Inu RSI is currently 52 years after a sharp movement yesterday which saw him go from 50 to 60.8. The relative resistance index (RSI) is a momentum indicator used to measure if an asset is exaggerated or occurred on a scale of 0 to 100.

As a rule, a RSI above 70 exaggerated signals The conditions and a potential price decline, while a RSI less than 30 indicates occurrence conditions and the possibility of a rebound.

When the RSI oscillates around the brand 50, it suggests a lack of strong momentum in both directions, which means that the asset is in a neutral area without defined trend.

With the RSI of the same part of the same at 52 years old, this indicates that the The recent bullish momentum has slightly fadedBut the price is not yet in a lower state. Although RSI above 50 can suggest a slight bullish force, it is not strong enough to confirm an escape.

If Shib can resume the momentum and repel RSI over 60, this could point out an increase in purchase pressure and a potential continuation of the upward trend.

However, if RSI continues to decrease below 50, this may indicate a weakening of demand, leaving the shib vulnerable to more in -depth consolidation or even a decline.

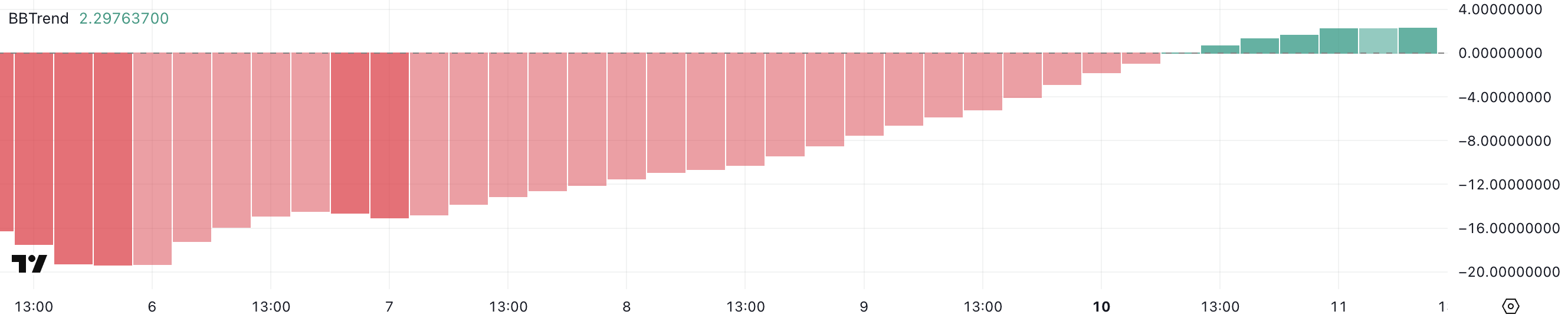

Shiba Inu Bbtrend is now positive, but always low

Shiba Inu The BBTREND indicator has become positive, currently at 2.29, after spending six consecutive days in negative territory and reached a hollow of -19.3 on February 6. The trend of Bbtrend bands, or Bollinger, is an indicator based on volatility which helps to determine the strength and direction of a trend.

A positive bbtrend value suggests a bullish momentum, while a negative value indicates a downward pressure. The greater the negative reading, the greater the sales pressure, while higher positive values indicate a growing trend.

With Bbtrend Shibrend now at 2.29, the go from a negative territory suggests that the lowering momentum has weakened and that the purchase pressure begins to build. Although this does not yet confirm a strong upward trend, this indicates a potential transition to a more optimistic structure.

If Bbtrend continues to rise, this could point out the increase volatility In favor of buyers, pushing SHIB to new gains.

However, if the indicator is struggling to move higher or becomes negative again, this suggests that the recent recovery lacks strength, leaving the shib at risk of a renewed drop pressure.

Price of Shibs Price: a potential increase of 57%

Shiba Inu The EMA lines suggest that a golden cross could be formed soon. A golden cross is a bullish signal that occurs when a short -term mobile average crosses a long -term mobile average. If this model materializes, Sancture price could gain momentum and first test resistance at $ 0.000017.

An escape above this level could push the price to $ 0,0000,19, and if the bullish momentum continues, Shib could target $ 0.0000249, representing a potential of 57%.

On the other hand, if Sancture price does not support the purchase pressure and goes into a renewed decline trend, it can test the key support at $ 0.000014.

Ventilation below this level would open the door for more drop, the price potentially falling to 0.0000116, marking a drop of 27%. This would indicate that the downward dynamics observed in recent weeks remains intact, increasing the probability of new losses.

Non-liability clause

Online with the Project of confidence Guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our Terms and Conditions,, Privacy PolicyAnd Warning have been updated.