Analysts set price targets with XRP at $ 5, BNB at $ 2,000 and Dogecoin at $ 10 while BTC stabilizes above $ 96,000

The cryptocurrency market shows volatility, but analysts expect three specific tokens –XrpBNB and Dogecoin – will offer important gains. Fundamental support, institutional participation and technical indicators indicate strong potential growth for all projects.

With Bitcoin Stabilizing above $ 96,000 and maintaining its market domination at 61%, altcoins are growing.

Bitcoin (BTC) maintains a force greater than $ 96,000, broken down for $ 120,000 overvoltage

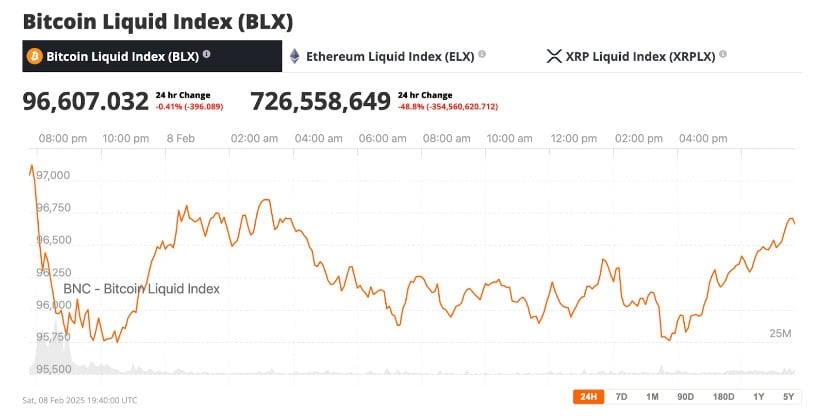

The price of Bitcoin was maintained above the bar of $ 96,000 despite a daily drop of 1.11%. The market capitalization amounts to 1.905 dollars, maintaining domination at 61.01%. The negotiation volume remains robust, increasing by 5.75% to 54.38 billion dollars within 24 hours, reflecting the supported interests of traders and institutions.

Bitcoin Liquid Index (BLX). Source: Brave new room

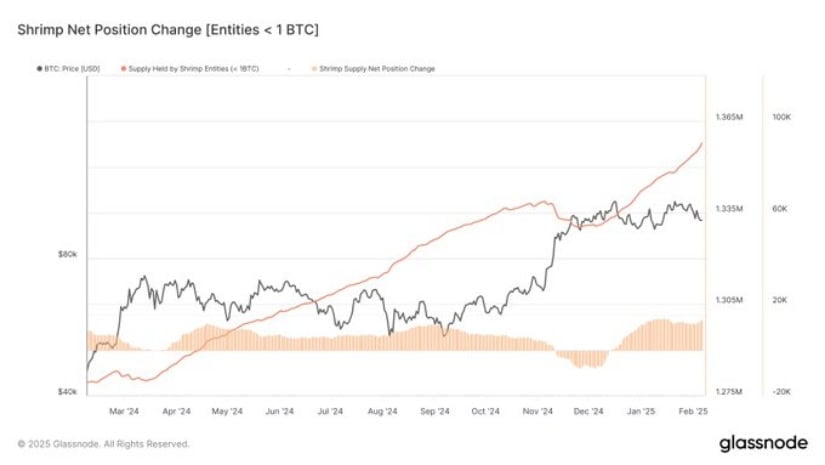

The Bitcoin network shows accumulation trends via data which indicate that more portfolios now contain at least 10,000 bitcoins. According to Glassnode dataBitcoin Wallet Numbership Numbers with a large BTC economy increased by 3.2% since last month. The growing trend in institutional investments demonstrates strategic planning for a price increase.

Significant BTC savings have increased by 3.2% since last month. Source: Glass nose

Based on the technical analysis, the main level of support of the BTC amounts to $ 95,500 while the resistance emerges at $ 100,000. Experts forecast that the BTC price will increase to $ 120,000 after crossing the resistance of $ 100,000 during its next market cycle.

XRP ETF deposits stretch the institutional frenzy, targeting $ 5.00

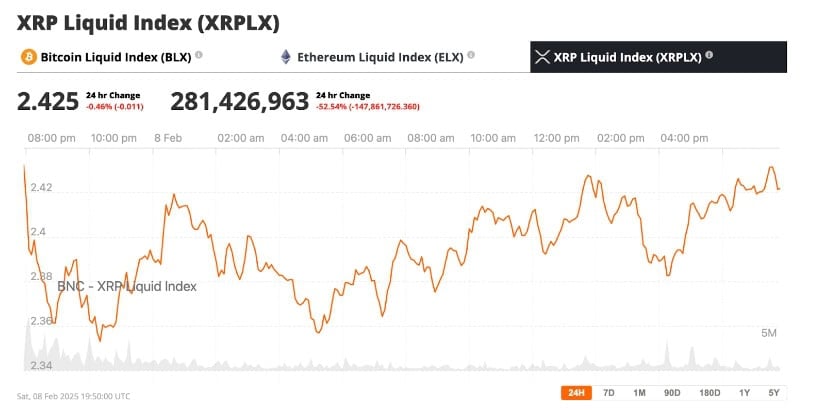

XRP made the headlines Following major institutional deposits for ETF Spot. CBOE BZX exchange subject Four 19B-4 applications distinct for ETF XRP, attracting the interest of Bitwise, Wisdomtree, 21Shares and Canari Capital. This development triggered a bullish rally, with an XRP price at a point of 7% at a summit of $ 2.53 before being at $ 2.41.

XRP liquid index (XRPLX). Source: Brave new room

XRP experienced a substantial increase of 12.23% in its negotiation volume 24 hours a day, market data demonstrated the interest of investors thanks to the figure of $ 8.97 billion. According to health data, ownership of whale whales has increased in the past two weeks. Current market trends suggest that XRP will exceed its previous maximum value before aiming for $ 5 in the coming months.

Experts predict that XRP will increase due to regulatory improvements provided for in the United States administration. The departure of the former SEC president, Gary Gensler, led investors’ expectations to increase on better regulation of cryptocurrencies in the near future.

The approval of ETF XRP by the SEC implies that XRP can reach $ 5 by 2025, according to market analysts. The new digital dollar regulations Announced by the administration of President Donald Trump to eliminate previous regulatory constraints which should increase global expansion.

The CEO of Ripple Brad Garlinghouse near the White House

The CEO of Ripple, Brad Garlinghouse, would be a leading candidate for a position on the new development of President Donald Trump Consultative advice for cryptography. This advice aims to guide the administration on blockchain and cryptocurrency innovations, marking a significant change compared to previous regulatory approaches. The recent Garlinghouse meeting with President Trump in Mar-A-Lago has increased its importance among potential names. The other notable figures taken into account for the Council are the former general lawyer of Kraken Marco Santori, the CEO of Circle Jeremy Allaire, the CEO of Coinbase Brian Armstrong and Kris Marszalek of Crypto.com. The Council will collaborate closely with the AI and the Crypto Tsar David Sacks to shape the future of the regulation of digital assets in the United States

The CEO of Ripple Brad Garlinghouse is linked To an advisory advice on the cryptography of the White House is optimistic for XRP for several reasons:

1. Favorable American regulation potential

-

If Garlinghouse joins or influences the advisory council, this increases the probability of user -friendly regulations, in particular for Xrp.

-

THE Dry vs. ripple box was a major regulatory obstacle for XRP and have Homosexual In a high -level advisory role, could help put pressure for clearer and equitable directives on cryptographic assets.

2. LEGITIMITY AND TRADITIONAL APPROVAL

-

Be connected to the White House raises Ripple’s credibility, making it more attractive for institutional investors and financial partners.

-

XRP could be considered more as a regulated and legitimate asset, reducing concerns about legal risks.

3. Integration with the American financial system

-

The liquidity solution at Ripple’s request (ODL) is already associated with banks and financial institutions worldwide. If the United States government is starting to work with Ripple, this could lead to official integrations with American banking infrastructure.

-

This could push XRP to consumer financial use – re -registration, cross -border payments and CBDC collaborations.

-

XRP could be included in a America First Nation Digital Asset Stockpile.

4. Price catalyst for XRP

-

Any change in policy in favor of Ripple / XRP could trigger a price rally, because regulatory clarity is one of the greatest overhangs for XRP investors.

-

A pro-Crypto position of the White House could lead institutional investors to buy more XRP, which increases market confidence.

5. Ripple’s influence in the United States and global policy

-

Ripple has developed worldwide, but American regulatory clarity was a major missing room.

-

If Garlinghouse is involved in the development of cryptographic policy at the highest level, Ripple could obtain preferential treatment in future regulations.

-

This would give XRP a competitive advantage over other cryptographic assets confronted with uncertainty.

End

This is great news for XRP holders. It signals regulatory progress, potential government partnerships and greater institutional adoption. If Ripple is officially recognized by the US government, XRP could increase in value and take a stronger foot in the global financial system. 🚀

Watch – Price prediction and analysis of XRP prices

https://www.youtube.com/watch?v=rzglwsohmcs

BNB Eyes $ 2,000 while the expansion of the ecosystem fuels growth

The native token of Binance Smart Chain, called BNB, continues to maintain stability while the market experiences. The market value of BNB remains Between $ 580 and $ 618, with its current price at $ 584.10. The token demonstrates an intense ascending impulse since its market extended through Defi characteristics With IA system improvements and industry -based versions that strengthen customer demand.

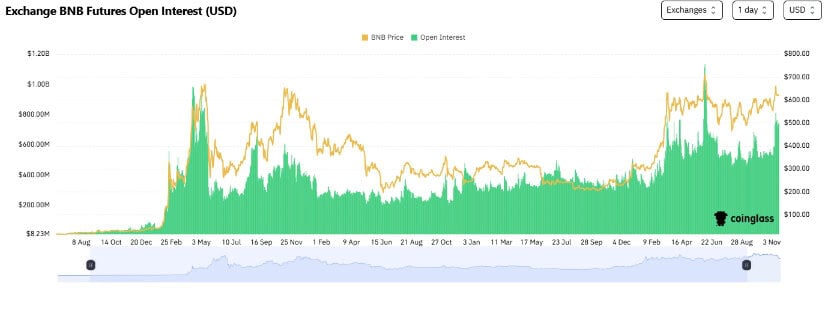

The interest open to BNB has remained over $ 700 million, highlighting a strong participation in the market. Despite a slight decrease compared to its November 2024 summit of $ 1.2 billion, analysts consider this to be a sign of profit rather than decline. A decision above $ 590 could trigger an upward wave, while a drop of $ 570 could cause temporary volatility.

Open interest for bnb.source: Rinsing

The analysis of Market Prophit’s feelings reveals a strong upward perspective, retail and institutional investors showing confidence. The intelligent monetary score is at +2.5, reflecting optimism surrounding the future performance of BNB. The Crypto Crypto Patel analyst predicts a sustained rise trend for BNB, its price reaching $ 2,000 while adoption continues to increase.

DOGECOIN EYES $ 10 while whales accumulate 750 million DOGE

DOGECOIN (DOGE) has quietly accumulated strength, data on the significant revealing chain whale activity. Large holders have acquired 750 million DOGE during the recent drop in prices, which indicates strong confidence in the future trajectory of the memes piece. Despite a 4% drop in last week, DOGE remains one of the most monitored assets due to its high price cycles and high speculative interest.

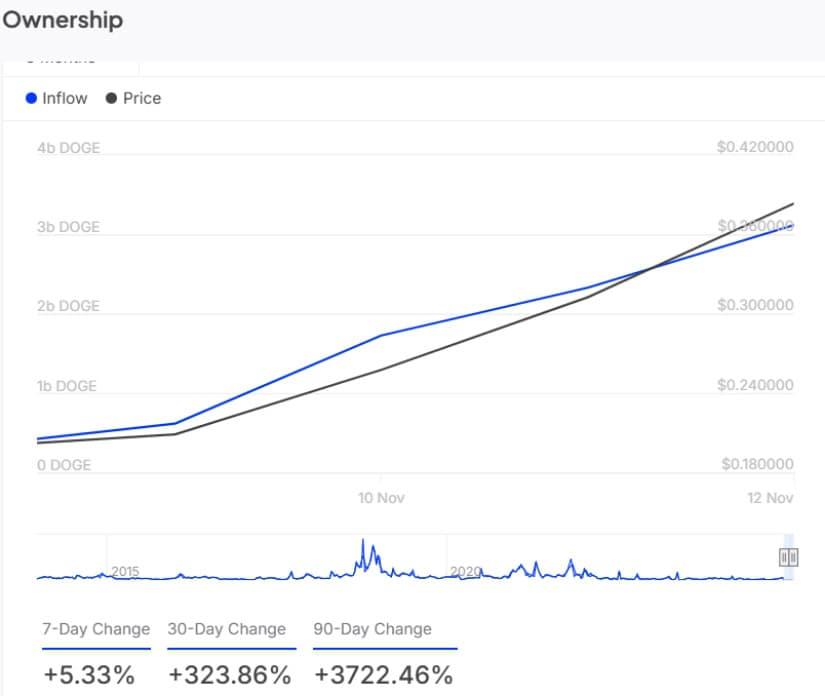

According to data from IntotheblocDogecoin carrier entries jumped 5.33% in the last seven days, with an astonishing increase of 3,722.46% of the accumulation of whales over 90 days. This suggests a high accumulation trend, often a precursor of significant price movements.

Dogecoin Large Colleurs Flow.source: Intothebloc

Technical analysts have identified an ABC corrective wave model on the DOGE / USDT graph, suggesting that the current market phase is almost finished and that a reversal is imminent. Historical price cycles indicate that Dogecoin has experienced exponent overvoltages, with cutting -edge price gains of 21,821% and 54,890% in previous market cycles.

ABC corrective wave model on the DOGE / USDT.Source graphic: Bycoinvo on x

An analyst predict This DOGE could exceed $ 10 in the next major cycle, with the potential of an even more optimistic target of $ 440 based on long -term historical models. Although such a projection may seem ambitious, Mastiff has always challenged expectations, motivated by solid community support and an accumulation of whales.