Shiba Inu main coin (SHIB) saw its prices drop by 18% in the last 24 hours. This reflects the slowdown in the broader cryptocurrency market, with global market capitalization falling 5% over the same period.

An evaluation of the on-chain and technical setup of the meme coin revealed weakening bullish momentum and increasing dominance of bearish sentiment. This indicates that SHIB could extend this downtrend. Here’s how.

Shiba Inu loses his bulls

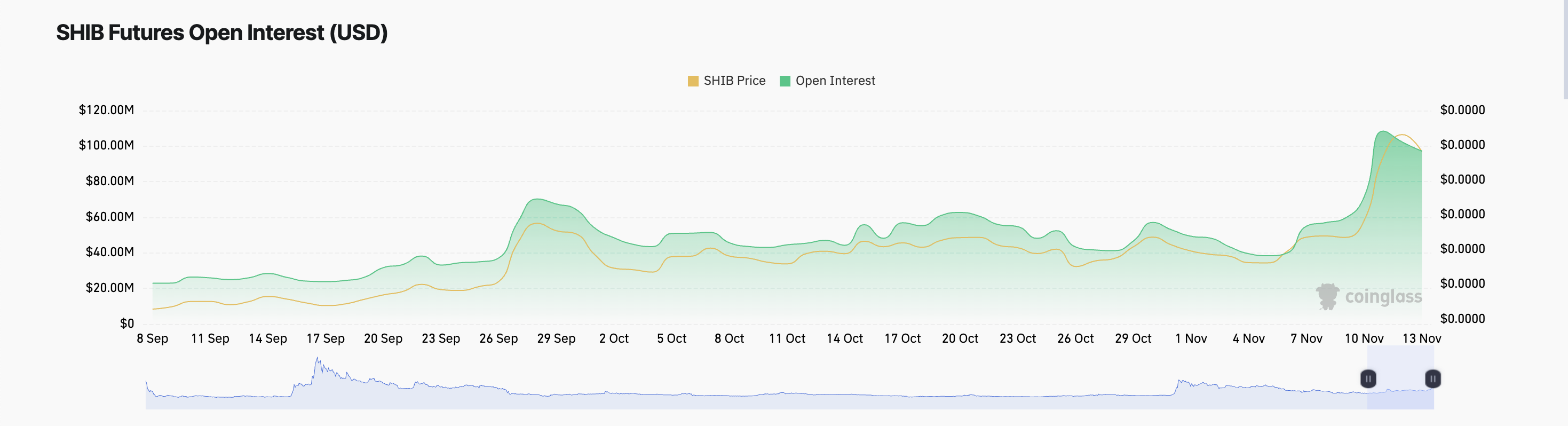

Open interest declining for Shiba Inu (OI) confirms the decrease in market activity and a decrease in bullish enthusiasm among meme coin holders. As of this writing, that amount stands at $82.49 million, a 32% drop in the last 24 hours.

OI refers to the total number of active contracts in the eventually or an options market that has not yet been settled, expired or closed. When it falls, it is a bearish signal. This suggests that traders are closing their positions, probably because they believe the value of the asset will continue to fall or because they want to limit losses.

This decline in OI amid falling prices, as in the case of SHIB, is a sign of strong bearish sentiment among market participants.

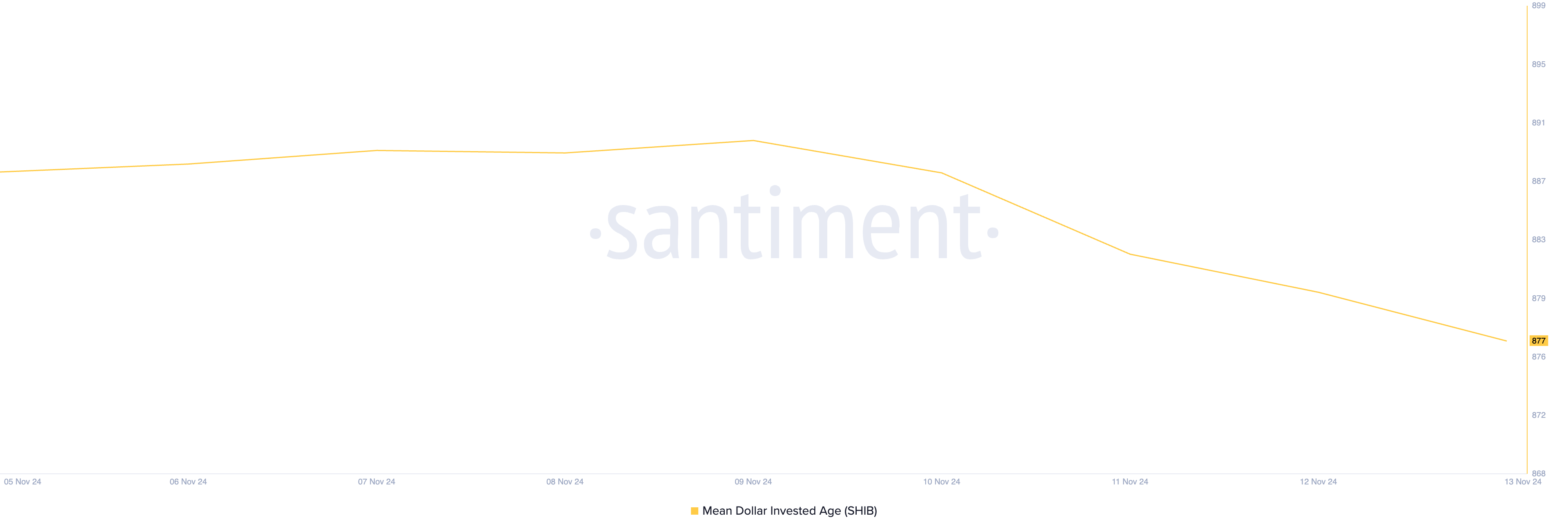

Additionally, the average dollar investment age (MDIA) of the meme coin has declined steadily since November 9, confirming rising selling pressure in the market. As of this writing, SHIB’s MDIA is 877, having declined 1.5% over the past four days.

The MDIA tracks the average age of coins based on their monetary value. It measures how long, on average, a dollar invested in a cryptocurrency has remained unused at its current price. wallet address. A higher MDIA suggests that investors have held onto their holdings for extended periods, while a lower MDIA signifies recent capital inflows or outflows.

When an asset’s MDIA drops, it suggests that older coins are being displaced, indicating increased trading activity. When this occurs during a period of falling prices, it indicates profit-taking or cutting losses.

This suggests a change in market sentiment, with investors becoming more willing to sell their holdings. This selling activity contributes to a downtrend as selling pressure outweighs buying pressure.

SHIB Price Prediction: Key Targets to Watch

At the time of writing these lines, Shiba Inu is trading at $0.000023. Its double-digit drop over the past 24 hours has caused its price to fall towards its 20-day exponential moving average (EMA), which tracks its average price over the past 20 trading days.

The 20-day EMA acts as a dynamic support level in an uptrend. A decline towards this level means a reduction in buying pressure.

However, it provides a floor of support where price corrections or pullbacks often spark buying interest. For Shiba Inuits 20-day EMA forms support $0.000020.

If the price falls below the 20-day EMA, it indicates a change in momentum, as the meme coin no longer finds support at this level. This breakout will attract further selling, as traders see it as a bearish sign, prompting them to exit or take short positions. If the $0.000020 price level fails to act as support, the SHIB price decline will continue towards $0.000016.

However, if the 20-day EMA provides assistance, the SHIB the price could resume its upward trend and try to collect $0.000028.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.