The amount of Shiba Inu (SHIB) in traffic decreased again following a recent token burning event. In particular, more than 15 million shib tokens have been destroyed. This coincides with a 6.4% drop in the price of the second piece of memes.

Shiba Inu Burn increases more than 470%

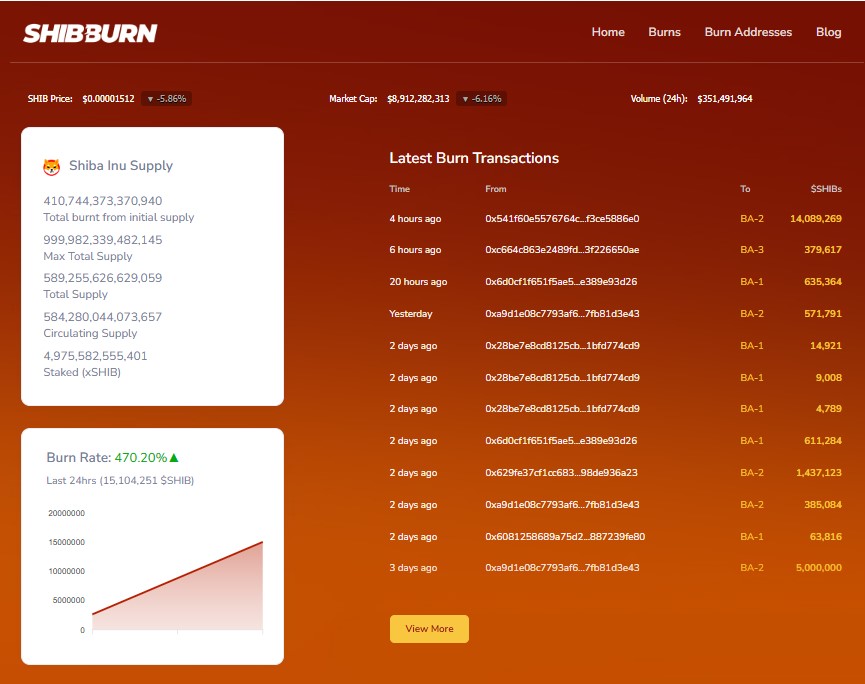

According to the Shibburn The tracker, the Shiba Inu community, has permanently allowed the protocol to destroy 15,104,251 shib tokens. Consequently, the burning rate of Shiba Inu rose more than 470% in the last 24 hours.

Depending on the details, almost the 15,104,251 tokens were burned in a single transaction. The address of the portfolio “0x541… F3CE” has burned the most immense Crypto lumps, amounting to 14,089 269 Shib. The second largest burn came from the portfolio address “0x6d0… E389E”, with 635 364 Shib burned.

The members of the community sent these tokens to dead portfolios, where they remained permanently locked up.

Until now, 410,744,373,370,940 shib tokens have been burned from the circulating power of 584,280 032 496.368.

Shib continues to bleed

The last transaction follows a precedent 577% overvoltage In the salter burning rate this week, with 8,760,236 shib burned. The Shib Inu community generally makes periodic burns to reduce the number of tokens in circulation. This mechanism contributes to prices overvoltages as demand for the memes part increases.

However, the last Shiba Inu Burn did not influence the price of the token. Shib is always negotiated below the crucial levels in the middle of the lower feeling on the larger market. The price of the same corner fell by 6.4% in the last 24 hours to 0.00001504. This lowered the weekly and monthly values by 18.9% and 30.7%, respectively.

In addition, the drop in prices coincides with an increase in the activity of Sampon whales. Like U.TODAY reportedKraken recently saw 1.24 billion of Sampon outputs from the exchange, worth around $ 20.14 million.

Despite the lowering feelings, the 24 -hour negotiation volume increased by 22.05% to 378.8 million dollars, which increased optimism on the market. As a general rule, a peak of negotiation volume indicates the will of investors to bet on an asset, which can lead to an increase in prices as market dynamics resumes.