The action of the Dogecoin prices remained silent following the announcement of the Canadian Cryptine Digital Assets Cryptine Company according to which it bought 1 million DOGE in December.

Despite the news, the market reaction has been dull, DOGE registering only a slight increase of 1% in the last 24 hours.

Dogecoin is struggling to gain ground

In a update Shared on Tuesday, the Canadian Canadian Crypto Company was listed on the stock market, Neptune Digital Assets, announced that it had acquired 1,000,000 DOGE on December 27. The digital asset company has confirmed that the purchase had been made thanks to a strategic derivative trade at an average price of $ 0.37 per token.

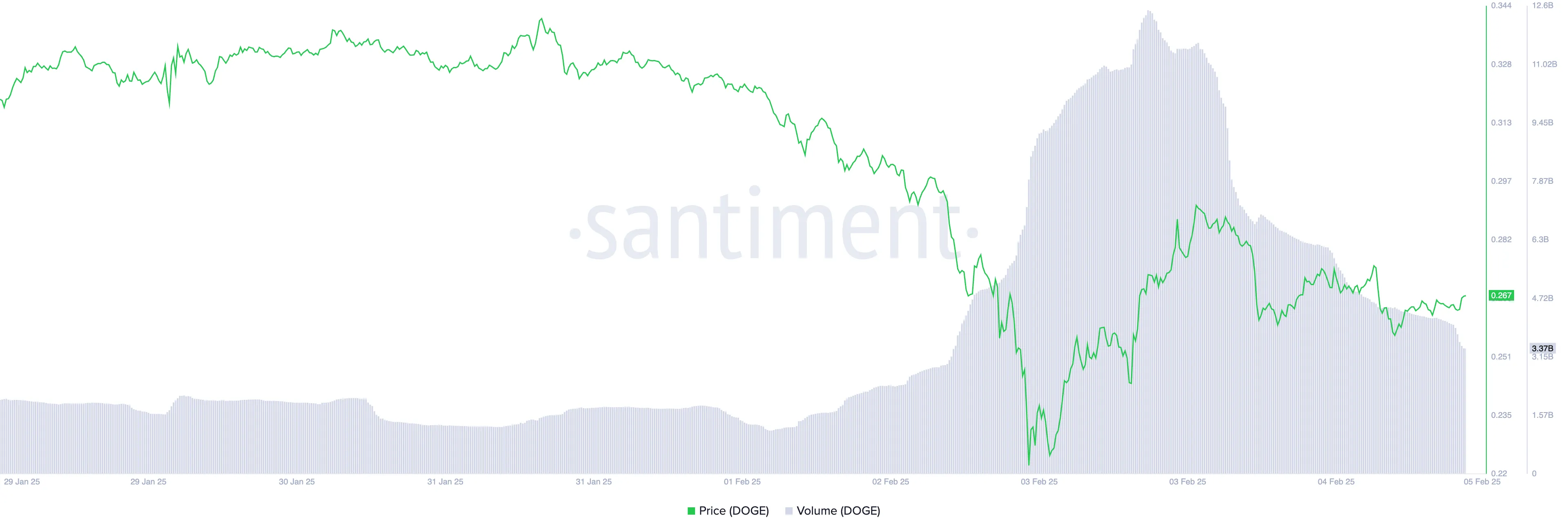

However, the announcement failed to stimulate a significant dynamic on the market. Doge is negotiated at $ 0.26 At the time of the press, noting a slight 1% rally in the last 24 hours. During the same period, trading volumes remain low, indicating that the price rally is driven by short -term speculative trades rather than a high purchase pressure.

DOGE’s negotiation volume totaled $ 3.37 billion in the last 24 hours, lowering 50% during this period.

When the price of an asset increases while the negotiation volume decreases, it suggests low purchase pressure. Fewer participants increase the price, indicating a lack of high demand for money, which makes the rally unusual and increases the risk of reversal.

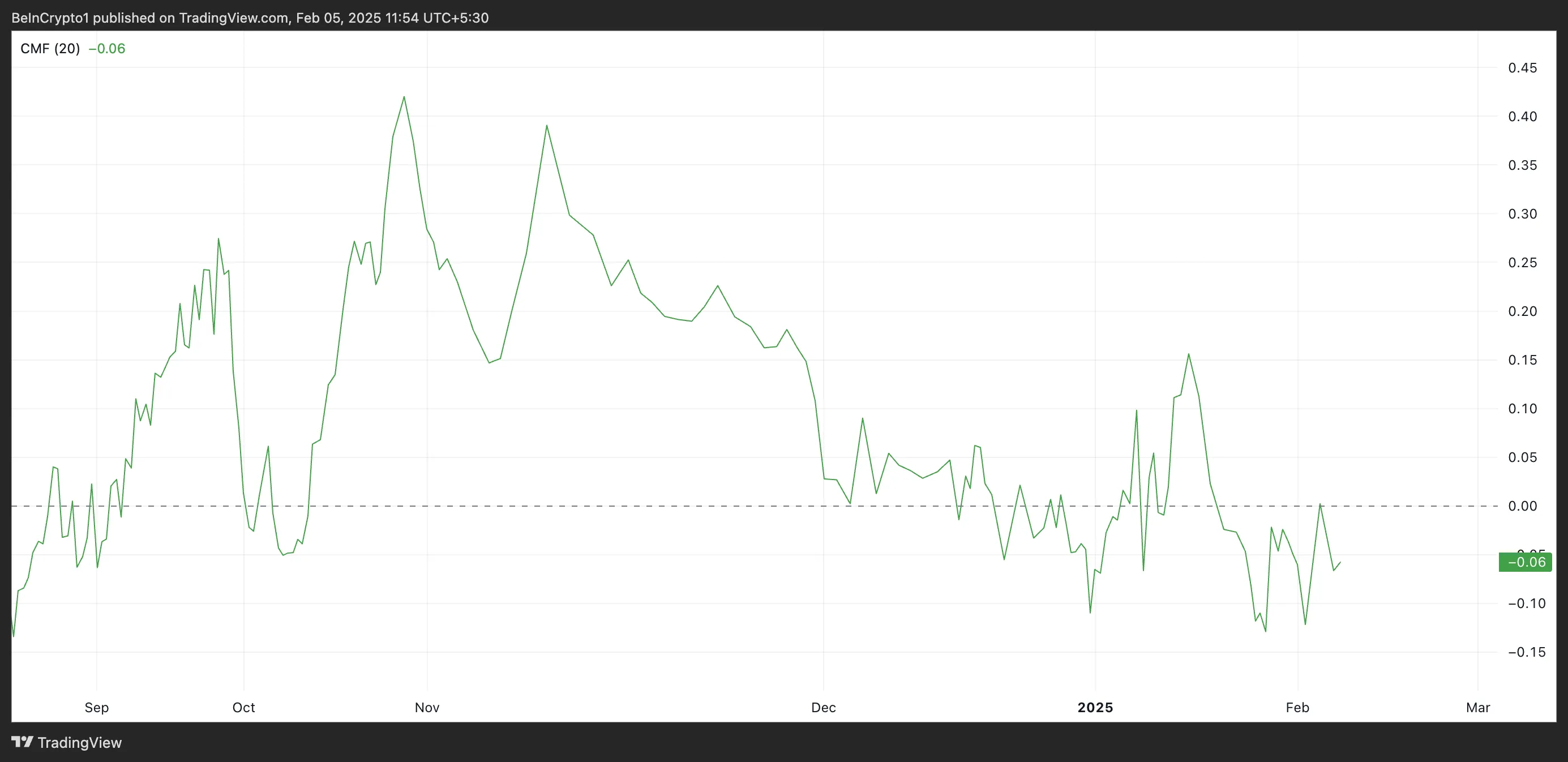

In addition, the Chaikin monetary flow of Doge (CMF) reflects the poor demand for the main part of memes among market players. To date, it is below the zero line at -0.06.

The CMF indicator measures the power purchase and sale force by analyzing the price and the volume over a specific period. When its value is lower than zero, the sale pressure prevails over the purchase pressure, which suggests a downward trend and a potential further for the assets.

Dogey prices prediction: the downward pressure persists as the downward trend holds

Since January 18, Doge has exchanged below A descending trend line and its value dropped by 33%. This model is formed when the price of an asset regularly reduces peaks over time, connecting these points to create a downward resistance line down.

When an asset is negotiated below this trend line, sellers remain in control and the overall feeling of the market is lower. The rupture above the trend line would signal a reversal of potential trend, but stay below, this suggests continuous decrease pressure.

If the demand is more weakening and the downward pressure on DOGE is strengthening, its price could drop to $ 0.24. If the Bulls fail to defend this level, the price of the medal could drop more to $ 0.19.

On the other hand, a resurgence of DOGE’s demand will invalidate this downward perspective. In this scenario, the price of the play could Go up to $ 0.32.

Non-liability clause

Online with the Project of confidence Guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our Terms and Conditions,, Privacy PolicyAnd Warning have been updated.