Warning: The opinions expressed by our writers are theirs and do not represent the views of U.TODAY. The financial and market information provided on U.TODAY is intended for information purposes only. U.TODAY is not responsible for the financial losses suffered during the exchange of cryptocurrencies. Perform your own research by contacting financial experts before making investment decisions. We believe that all the content is correct on the date of publication, but certain offers mentioned may no longer be available.

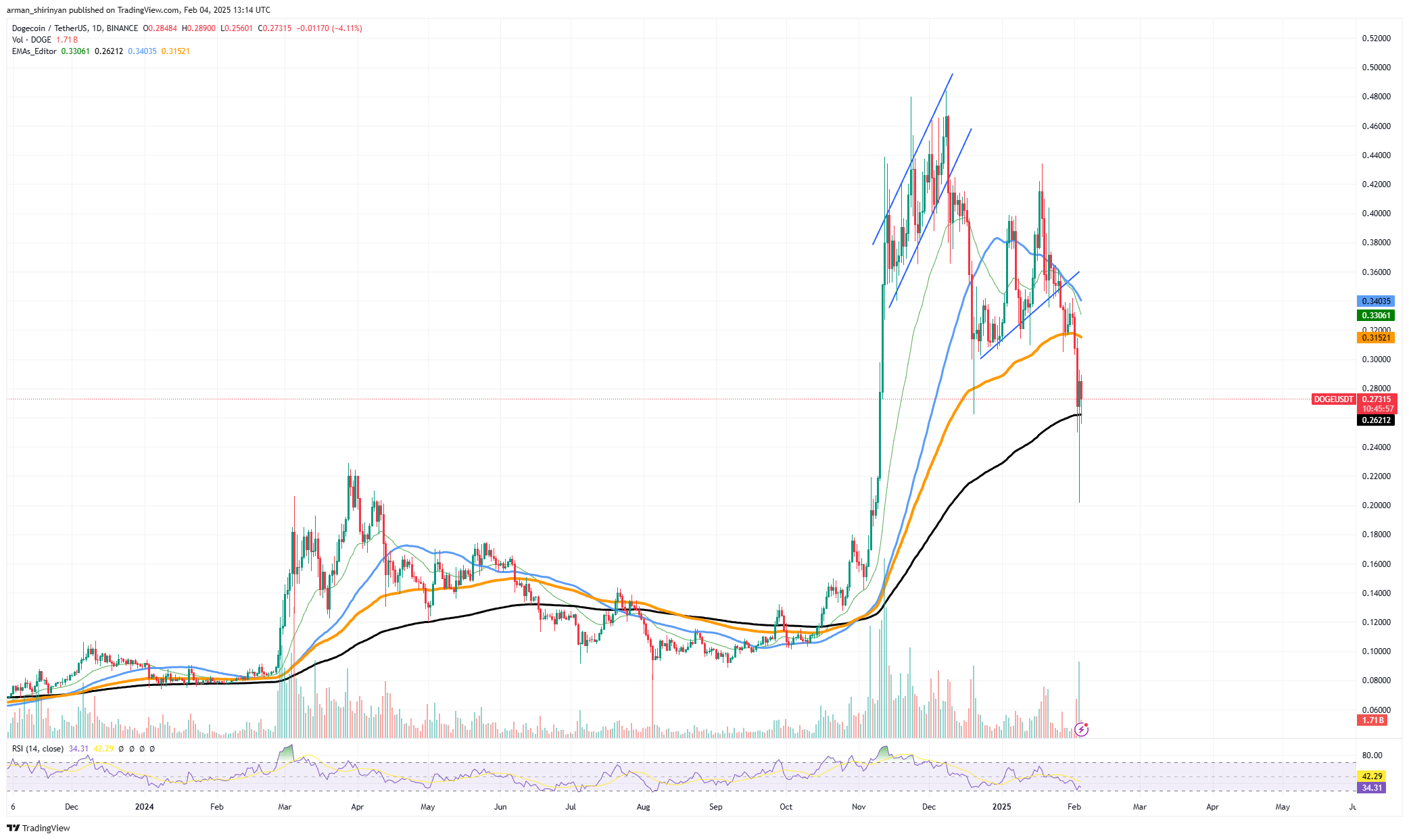

Mastiff is currently at 200 EMA, a historically significant area for trend reversals, having reached a level of critical support following a prolonged decline. Dogecoin previously used this level as a crucial turning point, making it a critical area where a significant rebound or additional ventilation can occur.

Holding above 200 EMA: a recovery route is scenario 1. The downward trend can end and a rescue gathering can be triggered if Doge is capable of maintaining its position above EMA 200, which is currently $ 0.26. If this level is successfully defended, buyers will intervene to stop additional losses.

The next resistance area in this scenario is $ 0.34, and a recovery to $ 0.30 to $ 0.32 is possible. A return to the range from 0.36 to 0.38 $ can occur if the momentum accelerates. For a trend reversal to be confirmed, DOGE must have a higher volume and a purchase force.

Scenario 2: downward continuation with a break below the EMA 200. An important bearish signal that would open the way to a more in -depth correction would be generated if Dogecoin had fallen below EMA 200. A rapid drop to 0.22 $, the next significant level of support, could result from a break below $ 0.26.

At worst, Doge could even go back to $ 0.18, destroying a large part of its recent earnings. The same part would be risky, and traders would closely monitor the possible signs of recovery. This is a situation of doing or breaking for DOGE. Although EMA 200 maintenance could lead to a brief rally, a breakdown would increase the sale pressure and bring the asset into a more severe correction phase. The next few days will determine whether the bulls can defend this crucial level or if Doge will enter another leg.

Dxy pushes bitcoin

After a recent rally, the US dollar index (DXY), a crucial dollar force gauge compared to other important currencies, is currently negotiated at 108.60, indicating volatility. Bitcoin (BTC) and DXY has historically had an opposite relationship; When the dollar increases, BTC usually has trouble and when it falls, Bitcoin goes up frequently.

With the help of its 50 and 200 EMA, which both indicate a continuous force, Doxy was on a strong upward trend. Bitcoin can however resume the momentum, as the recent rejection at 109.50 suggests potential weakness. Another decrease to 106.40 or less could occur if Doxy is unable to maintain support at 107.70, providing an upper configuration for bitcoin.

Bitcoin could become stronger and try to move around $ 100,000 if Dxy begins to fall, assuming that it remains at its current levels. However, BTC Can undergo short -term pressure and drop to $ 92,000 to $ 90,000 if Dxy recovers and exceeds 109.50. The federal reserve policies and future economic data will be key factors to determine how the DXY moves.

The dollar can weaken and open the door to the next bitcoin bitcoin movement if inflation slows down and assesses hikes. However, if the economy is more resilient than expected, Dxy can increase while the BTC is struggling.

Ethereum’s worst performance

Ethereum has suffered a lot, obtaining fewer losses than the other 10 most popular cryptocurrencies. While XRP and Bitcoin have demonstrated signs of stability and recovery, the ETH is still diving and finds it difficult to find support. It is currently the least efficient major digital assets, with a recent drop less than $ 3,000, which means critical ventilation.

In a few days, ETH fell by almost 30% and broken below a number of important levels of support. Normally, serving powerful dynamic supports, the 50 EMA ($ 3328) and 200 EMA ($ 3192) were broken. If buyers do not intervene, EthereumWhich is currently negotiated at around $ 2,796, could lose more money.

ETH has trouble getting back in contrast to Bitcoin, which is still negotiated above $ 95,000, and XRP, which experienced a spectacular recovery after a significant drop. The lack of momentum suggests a low purchase interest, leaving Ethereum vulnerable to new downward pressure.

The following significant support, which corresponds to the previous request zones, is located around $ 2,600 if Ethereum is not able to recover $ 3,000. Ethereum could reach $ 2,300, a level that we do not see in months, if it breaks below. ETH may experience a brief rescue rally, however, if it recovers $ 3,000 and exceeds $ 3,200. To confirm a bullish reversal, he still needed to exceed $ 3,328.