The cryptography market was in tatters Sunday evening after the traders realized that there would be no suspended price before the opening of the world’s stock markets on Monday morning. Bitcoin (Crypto: BTC) fell below $ 100,000 and seemed to break $ 90,000 before bouncing a little. At 10:00 a.m. on Monday, Bitcoin is down 5.7% since the market fence Friday and 2.1% in the last 24 hours.

Ethereum (Crypto: ETH) was the big mover, lowering more than 20% in an hour on Sunday evening. As I write, the token is down 21.3% compared to the end of Friday and 14.8% in the last 24 hours. Mastiff (Crypto: Doge) was another large loser, lowering 21.4% since Friday and 12.8% in the last day.

The sompto move was triggered by price On goods imported from Mexico, Canada and China, President Donald Trump announced on Saturday. It started a series of reprisals from each country that could make exports more difficult.

The prices are not unexpected, but the covered prices up to 25% were a surprise, just like the pace to which they will be implemented from this week. Investors were also caught off guard which favored companies and political donors and friends could not avoid these prices.

As a single market that exchanged 24/7, Crypto was the first to abandon the news, but the stock market followed on Monday morning.

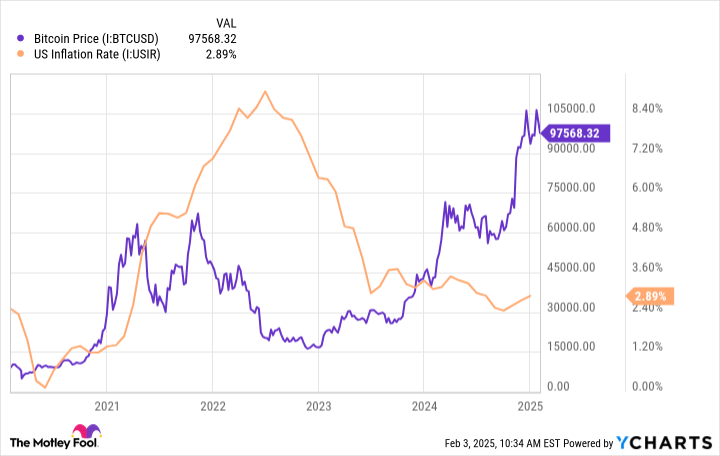

A great fear for cryptographic investors is the potential inflationary impact of prices on the market. Higher inflation generally leads to higher interest rates and higher rates stimulate growth actions and lower crypto.

Cryptocurrencies like Bitcoin and Ethereum were considered hedges of inflation, but that was not reality. In 2022, when inflation increased, cryptocurrencies crushed in value.

The best correlation for crypto has historically been growth stocks because they are higher risk assets such as cryptocurrencies. If growth actions drop, what they are today, the market will likely also reach cryptocurrencies.

The rear winds behind the cryptocurrencies have been strong since early November, but now the rubber takes the road. The promise of greater adoption of cryptography, better regulations and greater innovation must materialize.

If the crypto gain was motivated by speculation and speculation takes place, this could be a prolonged drop in the crypto for which the prices were only the catalyst.

I think that investors must recognize the risks in crypto, which are similar to growth actions, rather than considering them as coverage of the dollar, inflation or economy, that they have not been revealed to long term.